Carnival (NYSE: CCL)(NYSE: CUK) is the leading global cruise operator. It has fully recovered after sales went to zero early in the pandemic — and yet, investors are sending its stock down this year. It trades at a dirt cheap valuation, but its growth story is far from over. Here’s why you may not see an opportunity to buy it at a price like this again.

Carnival is cruising again

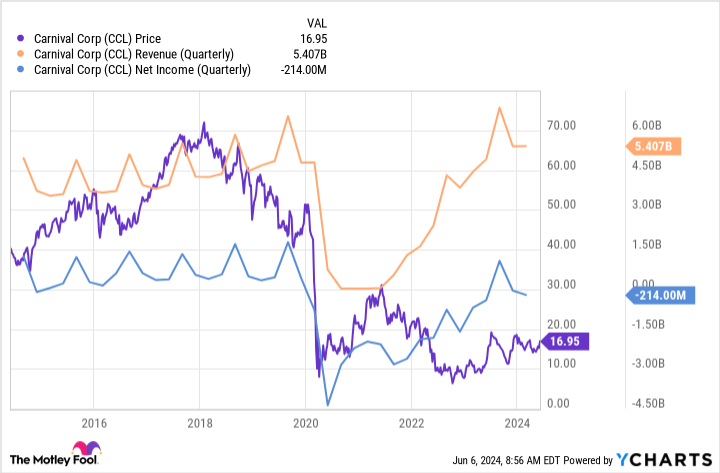

Investors sold off Carnival stock when it had to pause operations and took in no revenue during the pandemic. Those who bet on its recovery have benefited from incredible gains, but the market seems to think it overshot last year, and Carnival stock is down 9% this year.

Business is booming. Revenue is at record levels, hitting a first-quarter high of $5.4 billion in its fiscal 2024’s first quarter (ended Feb. 29). Deposits are at all-time highs, reaching $7 billion in the first quarter. Since demand is strong and inventory is limited, it has been able to take bookings at strong levels on a longer curve at higher prices.

Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) more than doubled from last year in the first quarter to $871 million, and Carnival reported its third consecutive quarter of positive operating income. Free cash flow was $1.4 billion, near historical levels.

Why Carnival stock should soar

If you look at Carnival’s stock price before the pandemic, you’ll notice that it closely mirrored the company’s growth.

However, while sales are at highs and net income is improving, the stock price remains suppressed. Net income has remained negative since the pandemic started, save for one quarter last year. But Wall Street expects it to turn positive as early as this summer, and the average analyst consensus for full-year adjusted earnings per share (EPS) is $1. Carnival’s stock price will likely jump at that point and begin to catch up with performance.

The dirt cheap price

Carnival stock trades at a price-to-sales ratio of under 1, which implies investors aren’t confident about its opportunities right now. This valuation is well below historical levels.

The main cause is Carnival’s extremely high debt, which stands at over $30 billion, even though that’s a good chunk off of its peak debt of about $35 billion last year.

Management has been working to get it into a better financial position, paying down some of its highest-interest notes and expanding its credit facility. As cash from operations and free cash flow continue to increase, management has a plan to reduce the debt efficiently without disrupting its operations.

The market won’t give Carnival a high valuation when it’s not profitable and has a high debt load. But as those things start to change, the price will rise, and the valuation will likely follow.

The long-term opportunity

Carnival was a market-beating stock before the pandemic. It has an incredible brand and assets and is the dominant player in its field. As you can see from the chart, its performance is reliably strong when there isn’t a global pandemic, which doesn’t happen too often.

The stock jumped last week on the news that it will absorb the P&O Cruises Australia brand and operations into the Carnival Cruise Line. Demand isn’t slowing, and this move will expand its inventory and create better efficiencies for the overall company. That’s a huge confidence booster for Carnival’s brand, management, and future opportunity.

Carnival is building itself back up with careful calculations, and within what could be a short time frame, it could return to full historical norms. The stock will reflect those movements, and you may not get the opportunity to buy it at these prices again.

Should you invest $1,000 in Carnival Corp. right now?

Before you buy stock in Carnival Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Carnival Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.

Once-in-a-Generation Investment Opportunity: Why You Should Buy Carnival Stock Now was originally published by The Motley Fool