- TVL hiked by almost 20% in the last 30 days alone

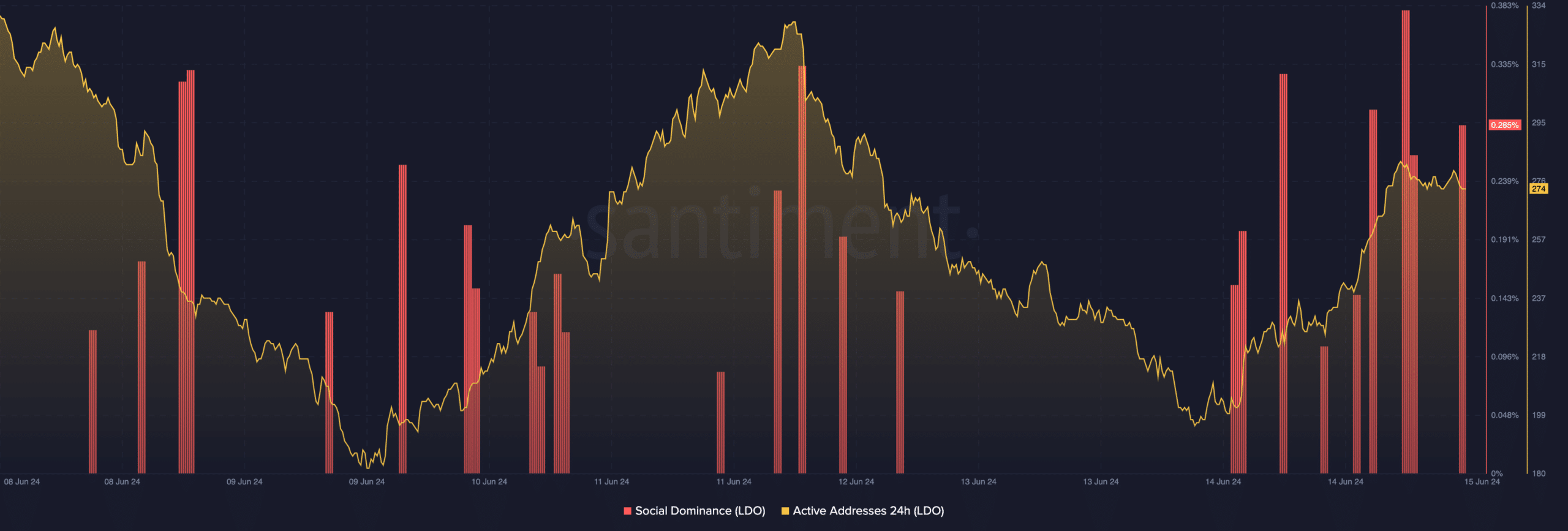

- While LDO’s price rose, online engagement with the project surged

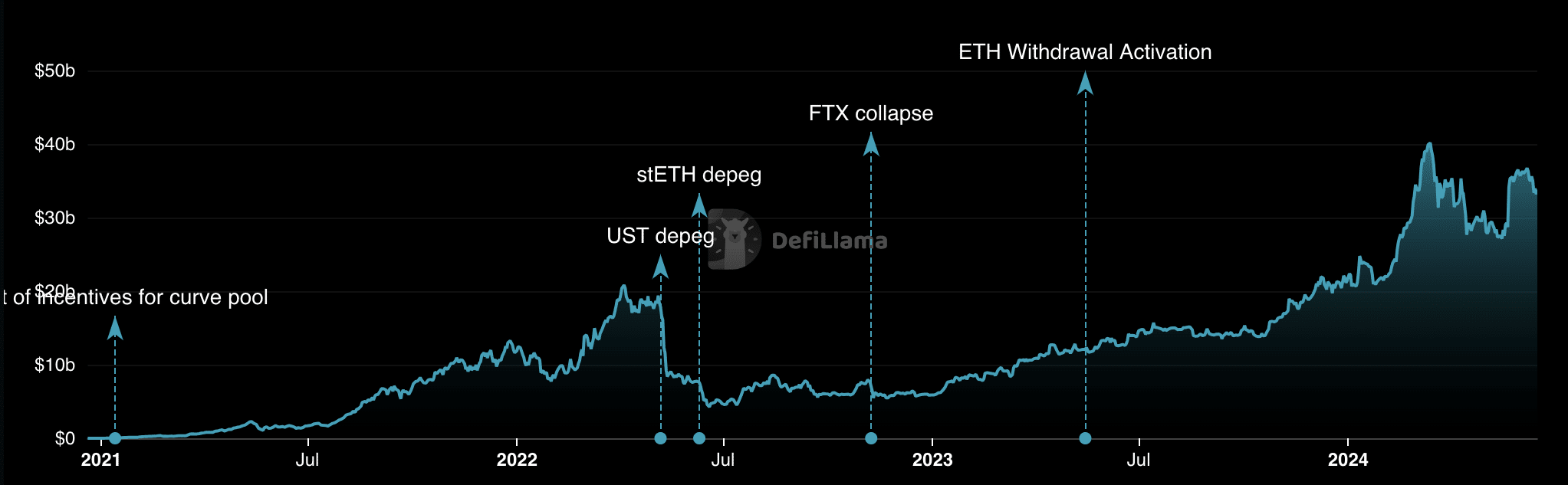

Lido Finance [LDO], the liquid staking platform built on the Ethereum [ETH] blockchain, has reclaimed the number one spot per Total Value Locked (TVL).

At press time, Lido’s TVL was $33.77 billion. This, after a 19.51% hike in the last 30 days. Here, TVL measures the total value of assets locked in a protocol. An increase in this metric implies that users trust the protocol to offer a good yield.

Lido takes the baton from EigenLayer

On the other hand, a decline suggests skepticism about the potential returns a project might offer. Therefore, the recent hike implied that market participants are now back to trusting Lido on this front again.

A few weeks ago, EigenLayer took over the leaderboard. This, after early users of the project anticipated rewards for their participation. In May, EigenLayer launched the non-transferrable EIGEN token, leading to a rise in withdrawals from the protocol.

This decline which led Eigen’s TVL to $18.81 billion gave Lido Finance the chance to top the table again. However, apart from Lido’s TVL, the native token of the project, LDO, also recorded an increase on the charts.

According to CoinMarketCap, LDO was valued at $2.05 at press time, representing a 5.12% hike in the last 24 hours. The price hike made the token one of the market’s best performers at a time when rest of the market bled.

From an on-chain perspective, there seem to be a good level of activity going on behind the scenes with Lido too.

Attention shifts, but will LDO hold $2?

At the time of writing, social dominance had risen to 0.285%. This metric measures community interaction with a project online. Therefore, a hike in social dominance implies that interest in LDO has risen.

As such, it is not surprising that the rising interest led to demand. However, if the discussion about LDO gets overheated, it could spur a retracement in the token’s price.

If this is the case, the value of Lido’s native token might slide below $2. Ergo, it’s worth making note of the fact that 24-hour active addresses on Lido’s network have been increasing since 14 June.

Active addresses refer to the number of unique addresses participating in a transfer of a cryptocurrency. When the metric decreases, it implies a fall in interaction with a network.

However, a hike suggests that more users are visiting the blockchain. It was the latter case for Lido at press time, reinforcing the notion of greater interest in the project and token as well.

While LDO’s price might later fall below $2, its mid-term potential might lie with ETH. Historically, LDO has shown a strong correlation with ETH.

Realistic or not, here’s LDO’s market cap in ETH terms

With speculation spreading that Ethereum ETFs would start trading in July, ETH might rally. Should this be the case, LDO might also join in.

Therefore, a possible hike above $3 could be possible by then.