If you are looking for an energy stock today, one company that should be on your shortlist is Chevron (NYSE: CVX). It has long been a safe harbor in what is often a turbulent environment for this industry.

Here are four reasons why this integrated energy giant should be in your portfolio today, tomorrow, and well into the future.

1. Chevron has a diversified energy business

The energy sector is generally broken down into three subgroups: the upstream (energy production), the midstream (pipelines), and the downstream (chemicals and refining). Each of these segments of the broader industry behaves a little differently. For example, the midstream is driven by fees for the use of infrastructure assets and therefore is a relatively consistent cash-flow generator. The downstream, meanwhile, can benefit from the low oil prices that hurt the upstream because oil is an input cost.

Chevron is what’s known as an integrated energy company, which means that it has exposure to all three segments of the industry. Oil and natural gas prices will still be the main determinant of financial results, but the midstream and downstream businesses help to soften the peaks and valleys for which the energy sector is known.

2. Chevron has a rock-solid balance sheet

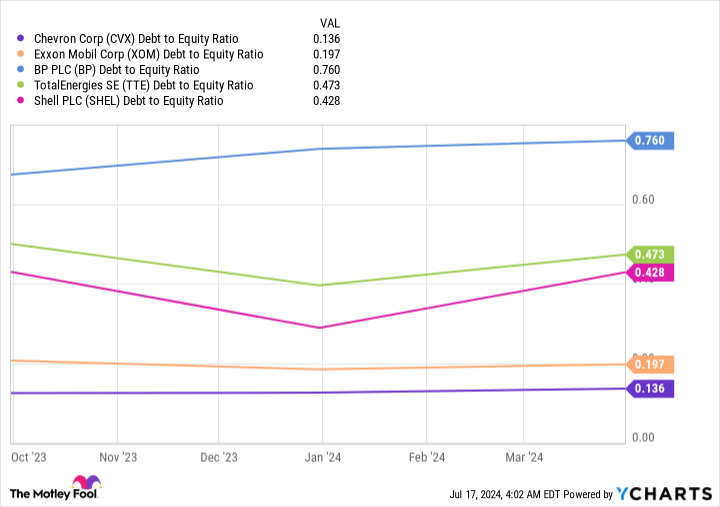

Underneath that diversification is a very strong financial foundation. Chevron’s debt-to-equity ratio is currently around 0.14. That would be a very impressive number for any company, but it also happens to be the lowest debt-to-equity ratio among Chevron’s closest peer group.

So for the moment, Chevron is better prepared for the industry’s ups and downs than any of its peers. However, it is important to understand why a strong balance sheet is important. Simply put, when the next downturn arrives, Chevron will be able to increase its leverage to support its dividend and its investment plans. And, if history is any guide, after oil prices recover, it will pay down the extra debt it took on in preparation for the next downturn. You can count on Chevron to survive the full energy cycle in relative stride.

3. Chevron’s dividend just keeps growing

One of the key benefits of Chevron’s diversified business and strong financial position is that it can afford to reward investors with regular dividend increases. The streak of annual dividend hikes is up to 37 years, which is pretty incredible when you consider the volatility of the energy sector.

But think a little bit more about that 37-year span. It includes the coronavirus pandemic (when U.S. oil prices actually fell below zero!), the Great Recession, and the 2000 tech bubble. And that’s just a few of the major market disruptions that took place in the last 24 years. The payout may not increase by a huge percentage every year, but it is clear that this energy giant believes strongly in returning value to shareholders via reliable dividend payments.

4. Chevron’s yield is relatively attractive

The best time to buy Chevron is probably when oil prices are in a deep downturn. During those periods, the yield can rise to as much as 10%. Right now, Chevron’s dividend yield is roughly 4.1%. However, that’s above the energy industry average of 3%, using Vanguard Energy Index ETF as an industry proxy. It’s more than triple the meager 1.3% or so on offer from the average stock in the S&P 500 index. It is also higher than fellow U.S.-based energy giant ExxonMobil, which has a roughly 3.3% yield. While you can get higher yields from some of the company’s European peers, their backstories are vastly different. Specifically, BP and Shell both cut their dividends in 2020, while TotalEnergies is moving far more aggressively into the clean energy space.

If you want a financially strong and diversified energy stock with an attractive yield, Chevron stands out as the best option right now.

Buy Chevron and keep buying

Given Chevron’s diversified business, strong financial condition, dedication to its dividend, and relatively attractive yield, it is easy to see why investors looking for an energy stock would want to load up on its shares. But don’t think of it as a one-time purchase, especially if you don’t plan to use the dividend to pay for living expenses. Reinvesting dividends and adding to your Chevron stake during energy downturns are both good ideas with this longtime industry leader.

Should you invest $1,000 in Chevron right now?

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $741,989!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Reuben Gregg Brewer has positions in TotalEnergies. The Motley Fool has positions in and recommends BP and Chevron. The Motley Fool has a disclosure policy.

4 Reasons to Buy Chevron Stock Like There’s No Tomorrow was originally published by The Motley Fool