The Australian market has recently shown resilience, with the ASX200 rising 1.3% to close above 7970 points, buoyed by a rally on Wall Street and strong performances in the Energy and Materials sectors. This positive sentiment provides an opportune moment to explore some lesser-known small-cap stocks that could offer significant potential. In this article, we will discuss three hidden gems: Bell Financial Group and two other promising small-cap companies that may benefit from the current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

|

Name |

Debt To Equity |

Revenue Growth |

Earnings Growth |

Health Rating |

|---|---|---|---|---|

|

Fiducian Group |

NA |

9.94% |

6.48% |

★★★★★★ |

|

Lycopodium |

NA |

15.62% |

29.55% |

★★★★★★ |

|

Bailador Technology Investments |

NA |

11.17% |

10.16% |

★★★★★★ |

|

Sugar Terminals |

NA |

2.34% |

2.64% |

★★★★★★ |

|

Hearts and Minds Investments |

NA |

18.39% |

-3.93% |

★★★★★★ |

|

SKS Technologies Group |

NA |

31.29% |

43.27% |

★★★★★★ |

|

AMCIL |

NA |

5.16% |

5.31% |

★★★★★☆ |

|

A2B Australia |

15.83% |

-7.78% |

25.44% |

★★★★☆☆ |

|

Paragon Care |

340.88% |

28.05% |

68.37% |

★★★★☆☆ |

|

Boart Longyear Group |

71.20% |

9.71% |

39.19% |

★★★★☆☆ |

Let’s review some notable picks from our screened stocks.

Simply Wall St Value Rating: ★★★★☆☆

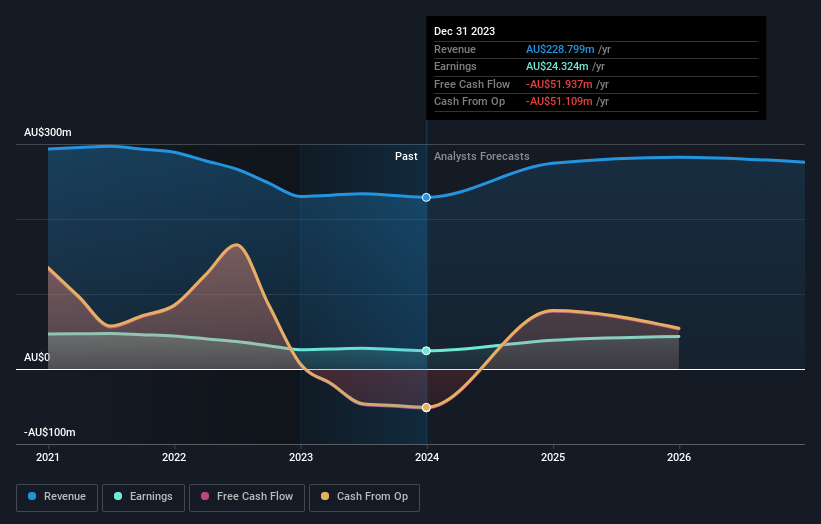

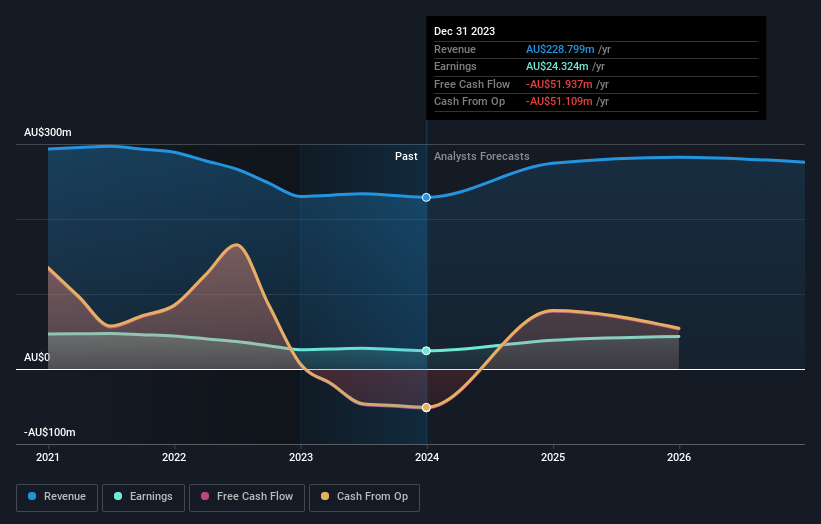

Overview: Bell Financial Group Limited offers broking, online broking, corporate finance, and financial advisory services to private, institutional, and corporate clients with a market cap of A$452.25 million.

Operations: Bell Financial Group generates revenue primarily from broking, online broking, corporate finance, and financial advisory services. The company has a market cap of A$452.25 million.

Bell Financial Group has shown promising growth, with earnings increasing by 8.5% over the past year, outpacing the Capital Markets industry’s 5.5%. The company repurchased shares in 2024 and declared a dividend of A$0.04 per share for June 2024. Trading at a price-to-earnings ratio of 15.1x, below the Australian market average of 19.7x, BFG’s debt to equity ratio significantly improved from 43.9% to just under 0.09% in five years.

Simply Wall St Value Rating: ★★★★★☆

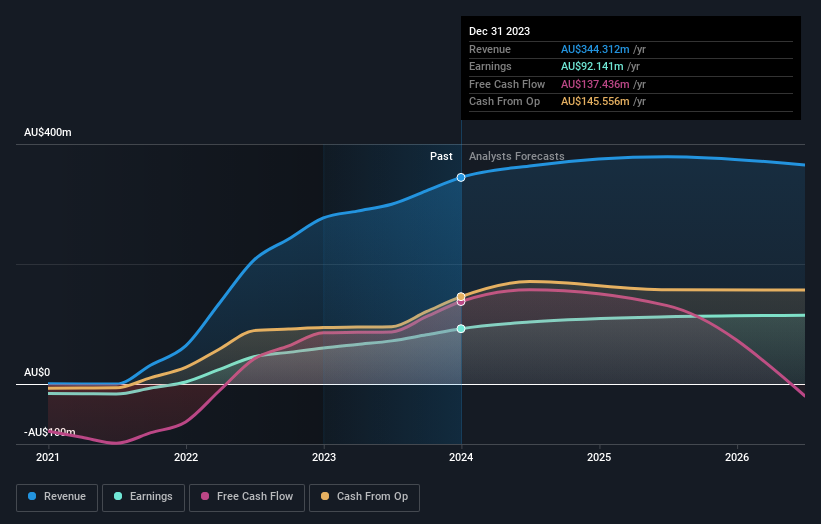

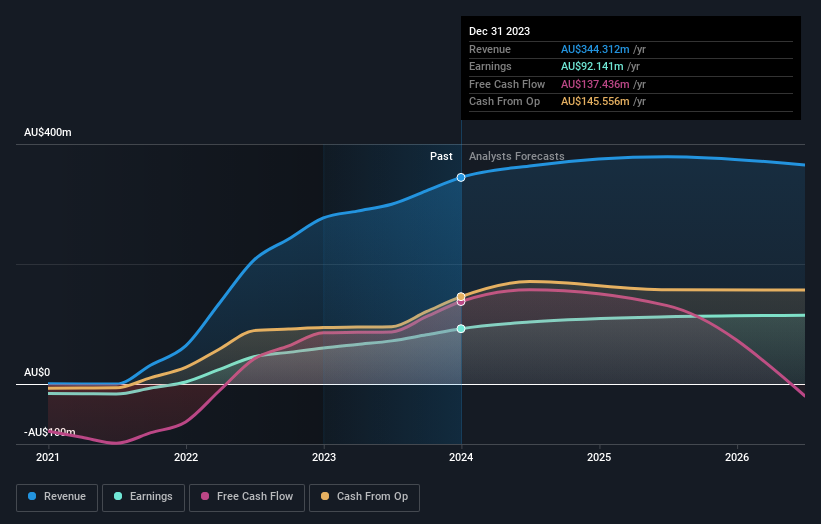

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.51 billion.

Operations: Emerald Resources NL generates revenue primarily from mine operations, amounting to A$339.32 million.

Emerald Resources, a smaller player in the Australian mining sector, has shown robust financial performance. Over the past year, earnings surged by 53.4%, significantly outpacing the Metals and Mining industry average of -19%. The company is trading at 58.6% below its estimated fair value and holds more cash than total debt despite an increase in its debt-to-equity ratio from 0% to 14.5% over five years. Additionally, interest payments on debt are well covered by EBIT at 14x coverage.

Simply Wall St Value Rating: ★★★★★★

Overview: Westgold Resources Limited is involved in the exploration, operation, development, mining, and treatment of gold assets primarily in Western Australia and has a market cap of A$2.78 billion.

Operations: Westgold generates revenue from its Bryah and Murchison segments, with the latter contributing A$537.63 million and the former A$153.05 million.

Westgold Resources has made notable strides, becoming profitable this year and trading at 58.5% below its estimated fair value. The company is debt-free and has seen a significant increase in its Ore Reserve to 3Mt @ 2.8g/t Au for 277koz, driven by the South Junction mine’s maiden reserve of 225koz. Despite substantial shareholder dilution over the past year, revenue is forecasted to grow nearly 45% annually, positioning Westgold as a compelling prospect in Australia’s mining sector.

Make It Happen

Curious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:BFG ASX:EMR and ASX:WGX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com