Introduction to the Transaction

On September 30, 2024, Harel Insurance Investments & Financial Services Ltd. (Trades, Portfolio) made a significant addition to its investment portfolio by acquiring 4,915,503 shares of Tower Semiconductor Ltd. (NASDAQ:TSEM). This transaction not only increased the firm’s total holdings in Tower Semiconductor to 8,678,600 shares but also impacted its portfolio by 3.94%, marking a strategic enhancement in its investment approach.

Profile of Harel Insurance Investments & Financial Services Ltd. (Trades, Portfolio)

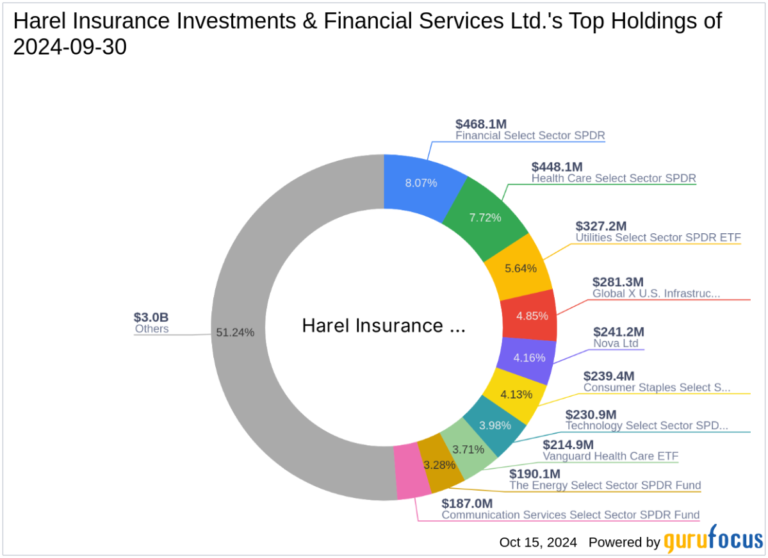

Based in Ramat Gan, Israel, Harel Insurance Investments & Financial Services Ltd. (Trades, Portfolio) is a prominent player in the financial services sector. The firm operates with a keen focus on value investment, seeking to capitalize on market inefficiencies through rigorous analysis and a disciplined investment strategy. With a diverse portfolio that includes significant holdings in sectors like technology and consumer cyclical, Harel Insurance Investments manages an equity portfolio valued at approximately $5.8 billion.

Details of the Trade

The recent transaction was executed at a price of $44.26 per share, reflecting a strategic move by the firm to bolster its position in the semiconductor industry. Post-transaction, Tower Semiconductor accounts for 6.95% of Harel Insurance Investments’ total portfolio, with the firm holding a 7.80% stake in the semiconductor company. This trade not only underscores the firm’s commitment to the technology sector but also highlights its confidence in Tower Semiconductor’s growth prospects.

Overview of Tower Semiconductor Ltd.

Tower Semiconductor Ltd., headquartered in Israel, operates as a global specialty foundry leader in the manufacture of semiconductors. Since its IPO on October 25, 1994, the company has focused on delivering integrated circuits for diverse markets such as consumer electronics and automotive. With a market capitalization of $4.98 billion and a PE ratio of 10.07, Tower Semiconductor is recognized for its robust operational capabilities and innovative technology solutions.

Stock Performance and Valuation Metrics

Tower Semiconductor’s stock has shown a remarkable year-to-date increase of 47.26%, with a modest gain of 0.78% since the recent transaction. Despite these gains, the stock is currently deemed significantly overvalued with a GF Value of $32.51, indicating a price to GF Value ratio of 1.37. The company’s financial strength and profitability are reflected in its high Profitability Rank and Piotroski F-Score, underscoring its operational efficiency and financial stability.

Market Impact and Strategic Importance

The acquisition by Harel Insurance Investments is strategically significant, enhancing its exposure to the technology sector, which is a top sector focus for the firm. This move aligns with its investment philosophy of targeting high-growth industries and reflects confidence in Tower Semiconductor’s market position and future growth trajectory.

Comparative Analysis

When compared to other major stakeholders like Barrow, Hanley, Mewhinney & Strauss, Harel Insurance Investments’ recent acquisition positions it as a significant investor in Tower Semiconductor, potentially influencing the company’s strategic decisions and shareholder value.

Conclusion

In summary, Harel Insurance Investments & Financial Services Ltd. (Trades, Portfolio)’s recent acquisition of shares in Tower Semiconductor Ltd. not only increases its influence within the company but also strategically diversifies its portfolio towards high-growth sectors. This move is indicative of the firm’s robust investment strategy and its commitment to generating long-term shareholder value.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.