October 2025 may tilt toward consolidation for many large tokens, making room for fresh narratives to emerge. Among the crowd, Mutuum Finance (MUTM) is drawing attention as the DeFi crypto under $0.05 with the strongest foundational design. But before we dig into MUTM, here are two of the bigger names that investors are watching this month and why MUTM may outperform them in the next leg.

Solana (SOL)

Solana (SOL) continues to draw institutional capital and developer attention. It trades around $220–$230 USD, with a market capitalization near $120–130 billion. Its performance is rooted in fast throughput, broad DeFi/NFT activity, and a strong ecosystem.

Yet Solana also carries headwinds. At its scale, further percentage gains demand large capital inflows. The network has experienced occasional outages, and some investors question whether SOL’s next upside will be multiplicative or incremental. As more chains compete on scaling, Solana must justify why it remains among the top picks, especially for new money entering mid-cycle.

Pepecoin (PEPE)

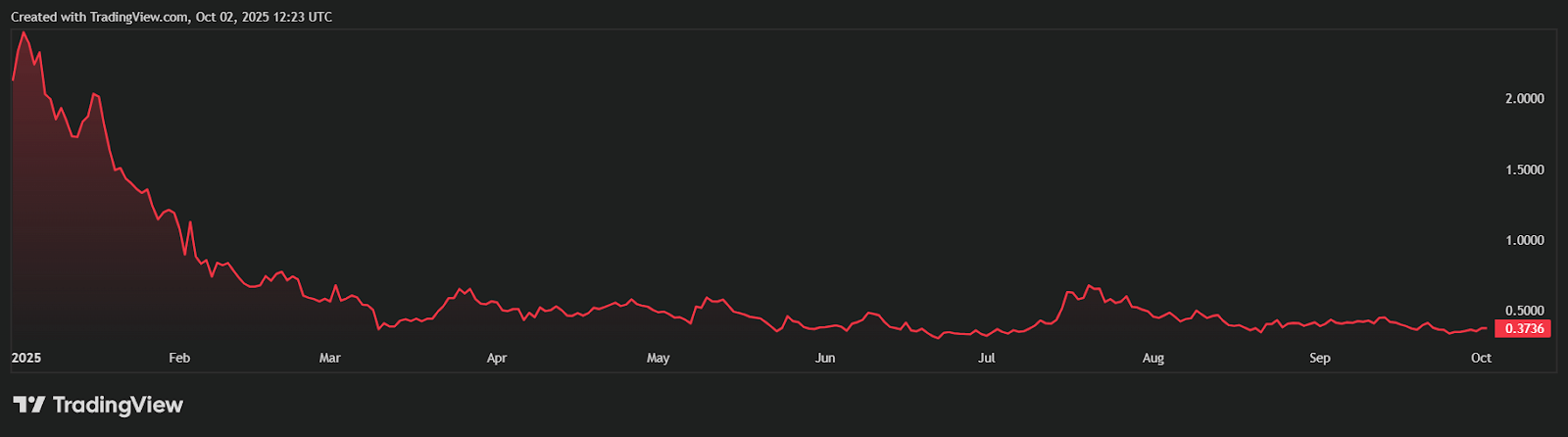

Pepecoin (PEPE) is still a meme-coin phenomenon. It trades near $0.000010 USD, with a circulating supply of 420 trillion tokens and a market cap hovering around $5 billion. The volatility is real: large moves are possible on sentiment, social trends, or hype cycles.

But that volatility is also its curse. With such enormous supply, any sustained upward move requires massive inflows or a change in token dynamics (burns, deflation, utility). Absent that, PEPE will likely continue to see spikes followed by sharp retracements. For traders, that’s a risk, especially when other projects are building real mechanisms behind their tokens.

Mutuum Finance (MUTM)

Mutuum Finance (MUTM) is a decentralized, non-custodial credit protocol built on Ethereum that focuses purely on lending and borrowing. Its architecture is designed such that every supply, borrow, or staking action contributes to token demand.

purely on lending and borrowing. Its architecture is designed such that every supply, borrow, or staking action contributes to token demand.

The presale began at $0.01 in Phase 1, offering early backers a highly accessible entry point. Since then, the structured sale has advanced through five progressive stages, with the token now priced at $0.035 in Phase 6, representing a 250% appreciation for those who joined at the very start. This steady climb reflects not only consistent demand but also the project’s clear commitment to staged, transparent growth.

Phase 6 is already more than halfway sold, with momentum building toward the next step at $0.04 in Phase 7. The roadmap locks in the official listing price at $0.06, ensuring that participants at every stage enter with predictable upside. So far, the presale has raised over $16.8 million, allocated more than 740 million tokens, and welcomed over 16,700 holders, a level of adoption that signals both strong investor confidence and a broad distribution base ahead of launch.

MUTM vs SOL & PEPE

When comparing these three tokens, the differences become clear. Solana (SOL) has already cemented its position as one of the largest blockchains, but its multi-billion-dollar market cap makes each percentage gain harder to achieve. Even in a bullish environment, SOL’s upside is often capped at incremental moves, as it requires vast inflows of new capital to sustain larger rallies.

Pepecoin (PEPE), on the other hand, lives entirely in the meme coin space. Its value is tied to community enthusiasm rather than embedded utility. With a massive supply and no structural demand drivers, PEPE’s price is vulnerable to hype cycles and sharp pullbacks once momentum fades. For many investors, this makes it a risky bet without long-term fundamentals to support growth.

By contrast, Mutuum Finance (MUTM) is still in presale, trading at just $0.035, and has been designed with mechanics that tie usage directly to token demand. Its dual lending markets, overcollateralized loans, and built-in buy-and-distribute model ensure that real activity—borrowing, lending, staking, translates into token appreciation. This early positioning gives MUTM asymmetric upside that SOL can no longer deliver and a utility-driven foundation that PEPE never had.

Security, Transparency & Community Incentives

Mutuum Finance supports its design with strong trust signals. The protocol has passed a CertiK audit, achieving a 90/100 Token Scan score. It launched a $50,000 bug bounty across multiple tiers to crowdsource defense against vulnerabilities. On the community front, a $100,000 giveaway, a live dashboard for tracking balances and allocations, and a Top 50 leaderboard rewarding major contributors have all helped foster engagement and visibility.

These elements matter. In a month where new narratives bubble, MUTM stands out not just for potential gains but for transparency, defense, and a clearer path to delivering utility. For October 2025, while many eyes focus on SOL and meme plays, MUTM may be the one setting up for the DeFi crypto breakout.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance