A keenly awaited plan to mobilise $1.3 trillion a year in climate finance for developing nations by 2035 could spark a “positive tipping point” that drives an exponential shift in global climate funding, COP30 President André Corrêa do Lago said on Wednesday as the document was unveiled.

The 81-page “Baku to Belém Roadmap” offers a shopping list of potential measures that, if put into practice, could deliver on a promise made at last year’s UN COP29 summit to boost the provision of climate cash for poorer vulnerable nations from a range of public and private sources.

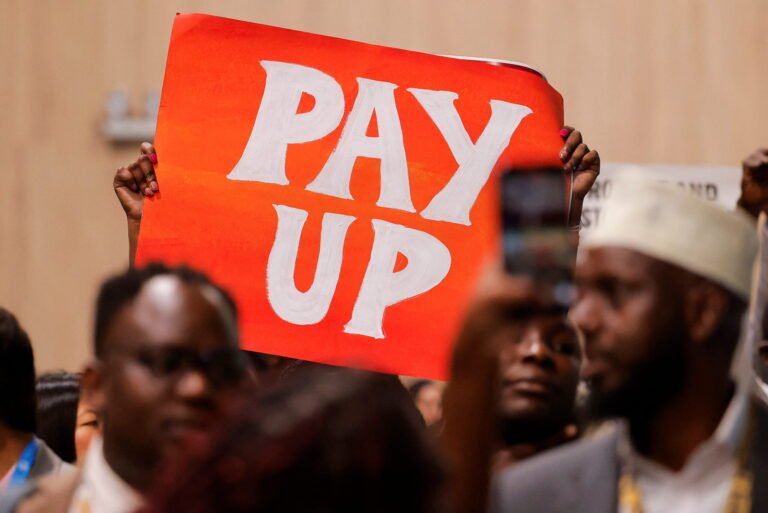

That deal came after developing countries in Azerbaijan were disappointed by wealthy governments offering an annual $300 billion by 2035 under a new UN climate finance goal, known as the NCQG.

Reaching the wider $1.3-trillion target, which includes the $300 billion, would require “significant effort” from traditional climate finance providers – including rich countries and development banks – as well as innovative sources, such as new taxes, the report says, adding that the goal is “achievable”.

In a foreword to the roadmap, the two presidents of COP29 and COP30, which takes place in Brazil over the next two weeks, say the $1.3 trillion “must power the next leap in climate implementation”, to make the Paris Agreement work faster and mainstream it across economies, societies and international finance.

The roadmap presents ideas on five elements of the global financial architecture: public concessional finance, fiscal and debt-related measures, private capital, multilateral climate funds and supervisory bodies, like regulators and central banks. The COP presidents say in their foreword that the roadmap “transforms scientific warning into a global blueprint for cooperation and tangible results”.

Not on the COP30 agenda

Yet it remains unclear how – or even whether – its recommendations will be taken forward.

Corrêa do Lago told journalists “there is no plan” for the roadmap to be formally discussed at the COP30 summit or reflected in its final outcomes. “There is no priority absolutely in having it approved or acknowledged at COP,” he added.

The roadmap was never meant to be a negotiated outcome at the UN climate talks. But the two COP presidencies took on the task of crafting a plan to scale up climate finance, with many developing countries viewing the new NCQG target for government funding as insufficient to meet their needs.

The non-binding report issued just before COP30 in the Amazon city of Belém offers a list of practical short-term actions that could guide the roadmap’s early implementation.

For example, it says developed countries could work together on a plan by the end of 2026 that explains how they will reach their goal of providing at least $300 billion a year. Amid cuts in overseas aid spending and tightening government budgets, the report says this step could improve “predictability” of finance flows.

Comment: Hurricane Melissa’s destruction shows need for climate resilience push

Multilateral development banks – seen as central to the roadmap’s delivery – could outline how they would reach a new “aspirational” climate finance target for 2035, possibly by changing some of their lending rules and adding more capital.

The report also suggests that the world’s 100 largest companies and its 100 largest institutional investors could report each year on how they are contributing towards the implementation of countries’ national climate plans.

In a statement on the roadmap, UN climate chief Simon Stiell said that “by scaling climate finance to match the scope of the climate crisis, we can turn ambition into momentum, making climate action a driver of economic growth, stability and shared prosperity”.

“The task is ambitious, but achievable,” he added. “The tools exist – what’s been missing is coordination and shared commitment.”

Campaigners disappointed

While welcoming some of the roadmap’s recommendations, climate campaigners said it had failed to live up to its promise and did not confront tricky subjects such as continued government subsidies for fossil fuels. Many also criticised it for relying too heavily on finance coming from the private sector.

Rebecca Thissen, global advocacy lead at Climate Action Network International, said the roadmap “feels more like a sketch than a compass”, adding that while pointing in the right direction, “it fails to chart a clear route or provide the tools” to reach the $1.3-trillion target.

Harjeet Singh, founding director of India’s Satat Sampada Climate Foundation, said the roadmap “correctly identifies the symptoms of our broken financial system” yet “fundamentally fails to prescribe the cure” or present “the transformation we have been demanding”.

There were hopes among climate justice experts that the roadmap would show how to raise more money for helping climate-vulnerable countries adapt to more extreme weather and rising seas – an area of climate action that is severely underfunded, with little prospect of rich nations raising their contributions.

Debbie Hillier, global climate policy lead for Mercy Corps said that while the roadmap calls for greater attention to adaptation, “it places too much weight on the mobilisation of private finance” which can cover at most 15–20% of global adaptation needs, according to recent research from the Zurich Climate Resilience Alliance.

Watch Climate Home News panel discussion on adaptation at COP30

Other suggestions in the roadmap focus on insurance against extreme weather events and earmarking spending in national budgets that can be released to help people prepare ahead of climate disasters.

Friederike Roder from the Solidarity Levies Task Force noted that the roadmap supports more debt-free financing, in particular for adaptation, which could be delivered at scale by solidarity levies, such as that supported by a new coalition of countries that aim to tax premium flyers.

Hillier said the report recognises the importance of public and grant-based resources to address adaptation and respond to climate-driven loss and damage, but does not follow the UN climate convention principle that countries that caused the climate crisis have a greater responsibility to meet the finance gap. “As such, it falls far short of what is needed,” she added.