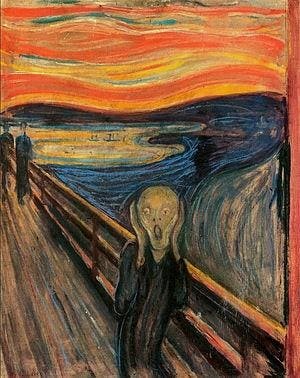

In May Edvard Munch’s “The Scream” will come up for auction at Sotheby’s in New York. Officials at the auction house project this pastel-on-board painting will fetch a bid that may make you cry out: $80M.

Last year Hans Holbein the Younger’s “Madonna With the Family of Mayor Meyer” sold for more than $70 million to German billionaire Reinhold Würth. One of Paul Cezanne’s “The Card Players” paintings sold for $250 million to the Qatari royal family. Zhang Daqian’s “Eagle Standing on Pine Tree” sold for $65 million in Beijing. The list goes on.

The wealthy don’t merely collect art—they invest in it. Many even regard art as just another asset class, like real estate, precious metals, commodities, stocks, bonds or cash. And indeed, art prices have kept up pretty well with stocks over the past half-century. With the price of famed artworks like “The Scream” soaring to such heights, some wealthier investors are pooling their resources, via a new breed of hedge funds that specialize in buying fine art.

Hedge funds, jaw-dropping prices, intense bidding… How do the rest of us get our hands on a work like “The Scream?”

It turns out we have two choices. The first is to shrug and join in on the hedge-fund frenzy. The second, better option is what I’ll call the Thomas Olsen play.

First, let me touch upon the fine art hedge funds. When these were first introduced a few years ago, some had trouble raising money. Now so many of these funds have sprung up that some of them opt to specialize in niches like Chinese art investments.

All of these funds are touting the extraordinary returns that high-end art has generated over the years. Most point to an index developed by Professors Jianping Mei and Michael Moses of New York University. The pair created a benchmark index of the market for well-established art, the “Mei Moses Fine Art Index,” as well as a family of sub-indices that track the value of works from particular artistic movements or time periods. Their main index, the Mei Moses World All Art index, tracks more than 30,000 pairs of repeat sales of art at Christie’s and Sotheby’s auction houses around the world, a technique known as repeat sales regression. (It’s the method that Fiserve Case-Schiller uses to measure housing prices.)

The Mei-Moses World All Art index climbed 22% in 2010 and 10.2% in 2011, soundly beating the S&P 500’s total return. According to data from Castlestone and Bloomberg, art produced an annualized return of 10.9% between 2000 and 2010. By contrast, stocks produced a -0.5%, bonds a positive 4.9% and commodities a paltry 1.6%.

For wealthy investors who want to be able to enjoy the art their money helps purchase, funds like these are willing to loan the works to shareholders. Just don’t expect the funds to buy art that suits your personal taste.

The fine art funds aren’t accessible to many of us because of their high investment minimums. Art Photography’s is $70,000 Euros. Fine Art’s is $500,000. Even if you admire Hoffman and his team, you’ve no business investing in his fund if you’re a “mass affluent” or “high net worth” investor with $1 million of liquid assets. Pouring 50% of your liquid net worth into an illiquid asset class like art is crazy.

Even if you have the money, is handing your capital to one of the current fine art funds the best way to invest in art? They are primarily focused on acquiring established, or what I call large-cap, artists. These artists are known quantities whose work already sells for thousands or even millions of dollars.

I think there’s a better way for rest of us to invest in art works like “The Scream.” Leave the hedge funds and billionaire collectors to fight over blue-chip art and instead behave more like Thomas Olsen.

Olsen was the Norwegian shipping magnate who was a friend and patron of Munch. Olsen bought “The Scream” after Munch painted it in 1895 at a tiny fraction of its present value. He “acquired ‘The Scream’ as well as many other works by the artist,” his son Petter explained, when the Munch family announced it would auction the painting in February. The shipping boss was keen to see Munch’s work gain greater recognition outside Norway and knew his purchases would help. Thanks to patron Thomas, the Olsen family and their friends were able to enjoy the Munch works privately for decades. And the rest of us got to see those works in our museums and on our t-shirts.

I’m convinced that winning at the art-investment game is to play it like Olsen did. Sprinkle around $100 to $10,000 amounts on original works of art that you love by artists you believe deserve a wider audience and will work to gain one. Enjoy your investments now and hope to hit a few jackpots eventually.

Remember why some art spikes in value. It’s a case of massive demand for a nearly nonexistent supply. When an artist creates a painting, there is only that one. The artist may later gain renown, license the work and even make a copy or two—or three, as Munch did—and still, there’s only the one original.

Yes, sometimes the copies can zoom upward in value, too. But don’t count on it. So buy original work. Preserve it. And pay special attention to artists who seem likely to produce great work and eventually gain renown.

The good news is that you don’t have to be as wealthy as Thomas Olsen. You can apply the kind of passion that Herb and Dorothy Vogel did when they were accumulating their art collection. Filmmaker Megumi Sasaki documented their remarkable story.

Herb Vogel was a postal worker and Dorothy Vogel a librarian. They bought pieces directly from artists for rock-bottom prices. They lived on Dorothy’s salary and invested all of Herb’s income into their art collection. Along the way, the Vogels thrilled in getting to know the artists, talking about their work, going on studio visits and developing their eye for the avant-garde. They ended up amassing what became one of the most important and valuable collections of modern art. When they donated their holdings to the National Gallery of Art later in their lives, it was valued at several million dollars.

How many of us can honestly say that we’re “passionate” about our investments? If you don’t find owning shares of Proctor & Gamble or that consumer staples ETF scintillating, maybe you should do what Thomas Olsen and the Vogels did: collect small-cap art.

I’m talking about work by artists who are not currently well known and whose work is priced below $10,000. This is a market where transactions are being done through small private galleries or directly through the artists, many of whom do not report their sales to price databases like ArtNet.

Much of this market is transacted in cash or bartering. This is the segment that would be impossible for professors Mei and Moses to track. Consequently, small-cap art lacks pricing transparency and is highly inefficient—so there’s heightened need for due diligence. And just as in micro-cap stocks, the most successful investors will be those who buy in for pure enjoyment, find a way to exercise some personal control over pricing or obtain some information advantage. The vast majority of the work trading at this level is not important. But that realm is also where the next Andy Warhol, Jackson Pollock or Pablo Picasso is currently struggling and unknown. So the small-cap market favors collectors who have a bit of money, time and savvy (which can be learned) to spare.

I have come to view small-cap art collecting as an important part of my overall investment portfolio—the most fun and rewarding part. I’ve plunked down as little as $100 for artwork that I admire. A few of those pieces are worth $1,000 or more now. As my friend and well-known Chicago artist Tony Fitzpatrick pointed out to me the other day, “In Europe people regularly go out on a Saturday afternoon, and they buy a piece of art after stopping by the bakery or the café. Buying art is just part of their leisure routine. A plumber and a teacher should be able to buy art. Everybody should be able to possess beauty.”

The KIA Art Fair (Photo credit: Wikipedia)

It’s probably only a matter of time until some noted art critic, gallery owner or investment guru starts the first small-cap fine art fund. (I’ve considered the idea myself.) If there were a professionally managed art fund with minimums of $10,000 that would allow more people to add this asset class to their portfolio, I might invest in it. It seems like a way to reconcile my desire to support artists who are on the verge of breaking through, at the very margin of the art world’s radar, with my desire to get a reasonable return on my money.

For now, I’m content to do some collecting on my own. Imagine if more of us mass-affluent folks were actively buying art as part of everyday life—for the benefit of our portfolios and for the benefit of our humanity. There’s great art and therefore potentially great investments all around us. That artist friend of yours may be the next Edvard Munch.