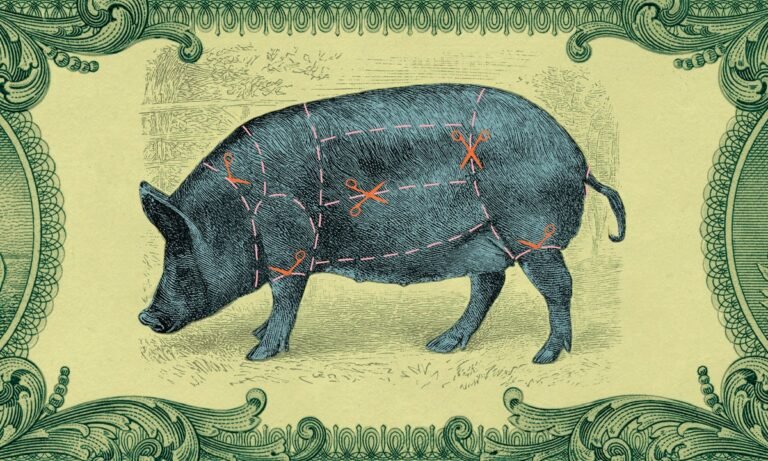

Fractionalisation and tokenisation of art are all the rage. While the notion of unlocking the value in an artwork by selling shares in it has been around for over a decade, a slew of new initiatives is taking it to an explosive new level.

Among the splashiest new launches is Artex Stock Exchange out of Liechtenstein, co-founded by financiers Prince Wenceslas von Liechtenstein and Yassir Benjelloun-Touimi, the latter seemingly the driving force. The project buys art (its first acquisition is Francis Bacon’s Three Studies for a Portrait of George Dyer, 1963) bought for $52m in 2017 at Christie’s and now valued at $55m. Investors can buy shares for as little as $100 in the Bacon which can be traded (or technically, the company that owns it) on the Liechtenstein MTF (an alternative trading platform). Other paintings will follow; trading starts on 21 July.

This is a largely “real world” initiative, but plenty of others harness the blockchain in their start-ups. They are itching to get their hands on just some of $3.3 trillion, which apparently is the value of all the art in the world—in museums and private hands. They want to democratise access to this art and allow investors to share in the upside when it is resold. One such platform, for example is Mintus, in the UK, which targets qualified investors who put in a minimum of $3,000. In the US, Masterworks goes for retail investors at a lower level; however, it has recently had some negative press, notably about the potential returns. Also launching in June is Weng Art Invest, a trading platform for art editions in the form of tokens.

Among the more colourful new entrants is The Rat, out of Ras Al-Khaimah, one of the smaller emirates in the UAE. Its holding company will propel, and I quote, “Rare Age Technologies towards new heights in digital experiences using tokens like the Rare Antiquities Token and FND Token.” No sniggering, please.

Then there are platforms that are less about investment and more about being collectors—for example, Particle, started by Loïc Gouzer, former Christie’s rainmaker, which encourages investors to buy shares and love the art. A rather unconvincing interview of its ceo explains it all. And another start-up, Artrium will encourage collectors to buy shares in artworks in museums, with no gain but the pleasure of being involved.

I asked Pierre Valentin, go-to lawyer for the art world, about all this. He has just, along with five colleagues, moved to the US law firm Boies Schiller Flexner. Valentin will work from London and Milan, as will his colleagues, so extending Boies’ engagement in Europe.

I first asked Valentin whether he had heard of any litigation coming up in the field of fractional investment. “No so far,” he responded: “But this is uncharted new territory, and there is a lot of potential for things to go wrong.” He picks out aspects that the potential investor should think carefully about: who does the due diligence and provenance research, how does the insurance work, how is the work managed, stored and who makes the decision to resell. “If you have just 10% of the work, who makes that decision?” he asks, concluding: “From a lawyer’s point of view, consider this opportunity carefully, and I would want to know that the team behind the offering has the right background and experience.”