Green light. Renewable energy companies had a tough old 2023. After years of robust valuations and cheaper power costs, green stars like Danish offshore wind developer Orsted crashed to earth. Despite the threat posed by Donald Trump’s possible re-election as U.S. president, discerning investors should experience a rebound.

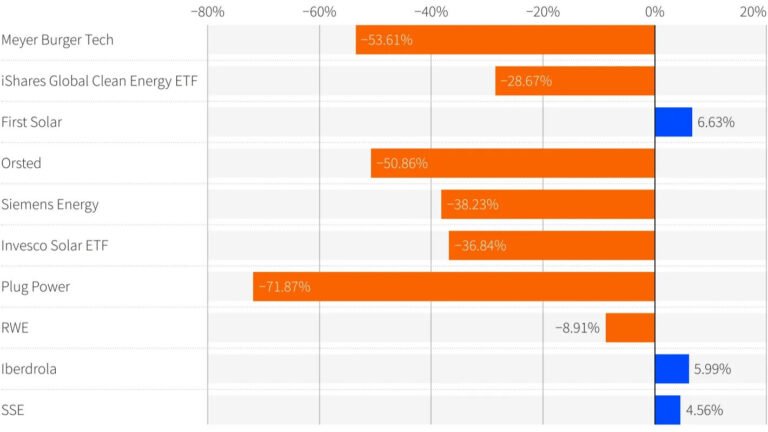

On the face of it, clean energy is a sector to swerve. Power prices’ failure to keep pace with soaring input costs meant shares in Orsted and wind turbine maker Siemens Energy fell over 50% between June and the end of November, prompting billions of dollars of writedowns and state support. As of end-November the MAC Global Index of solar companies had fallen almost 40% in 2023 and the iShares Clean Energy ETF had slumped nearly 30%, even as benchmark European and U.S. indexes both rose. Quarterly inflows into global sustainable funds fell from over $180 billion globally in early 2021 to $14 billion in the third quarter of 2023, with funds in the U.S. recording actual outflows.

In 2024, the scope for Trump to gut $369 billion of clean energy support from the U.S. Inflation Reduction Act adds another risk. Yet the long-term trajectory of green capital demand is up. The International Energy Agency thinks clean energy investment will exceed $1.7 trillion in 2023, against fossil fuels’ $1 trillion. Solar and wind capacity needs to rise threefold by 2030 to cap global warming at 1.5 degrees Celsius above pre-industrial levels. Equipment cost inflation may have peaked, Bernstein analysts reckon, and the UK government recently joined Portugal and India in hiking renewable subsidies to make project economics stack up.

Moreover, the single biggest driver of wind and solar valuations is that their long duration creates a strong inverse correlation with interest rates. Anyone who thinks borrowing costs have peaked should therefore be buying green stocks. Capital Economics reckons that if 10-year U.S. Treasury yields fall to the analyst’s 3.75% forecast level by the end of 2024, stocks in renewable players might outperform wider energy equities by 50% in the same period.

What’s clear is that investors need to do more than just check their target is green. Breakneck manufacturing of cut-price Chinese solar panels risks exacerbating a supply glut, hurting Western manufacturers like Switzerland’s Meyer Burger Technology, who are vulnerable to falling prices and lack protective tariffs. Solar developers, on the other hand, might gain if the price of kit falls. Offshore wind’s high capital costs will continue to make it a dicier bet than onshore solar and wind. The regulated network arms of diversified utilities like Spain’s Iberdrola, Italy’s Enel and Britain’s SSE give them a hedge against unpleasant surprises.

After reaching absurdly inflated levels in 2021, green assets are relatively cheap. LSEG data as of the end of November suggested Iberdrola, Enel and SSE were trading below their long-term average multiples of forecast EBITDA. Recent results by Iberdrola and Germany’s RWE suggest Orsted’s problems may be idiosyncratic. That implies a handy entry point.