Three popular and highly capitalized cryptocurrencies have registered increased sell-offs this week, raising an alert to the cryptocurrency market. These selling activities can bring volatility as market participants speculate on increased supply pressure’s effects on price, increasing the risks.

The whole landscape has suffered from significant crashes, and most projects have accumulated two-digit losses month-to-date. Overall, more than $304 billion has left the market this month since a $2.6 trillion peak on June 5.

In this context, the following three cryptocurrencies currently present a higher risk than most projects, considering they rank among the most valuable tokens in the space and, yet, have seen an astounding sell-off activity.

Avoid XRP amid Ripple’s largest monthly sell-off to date

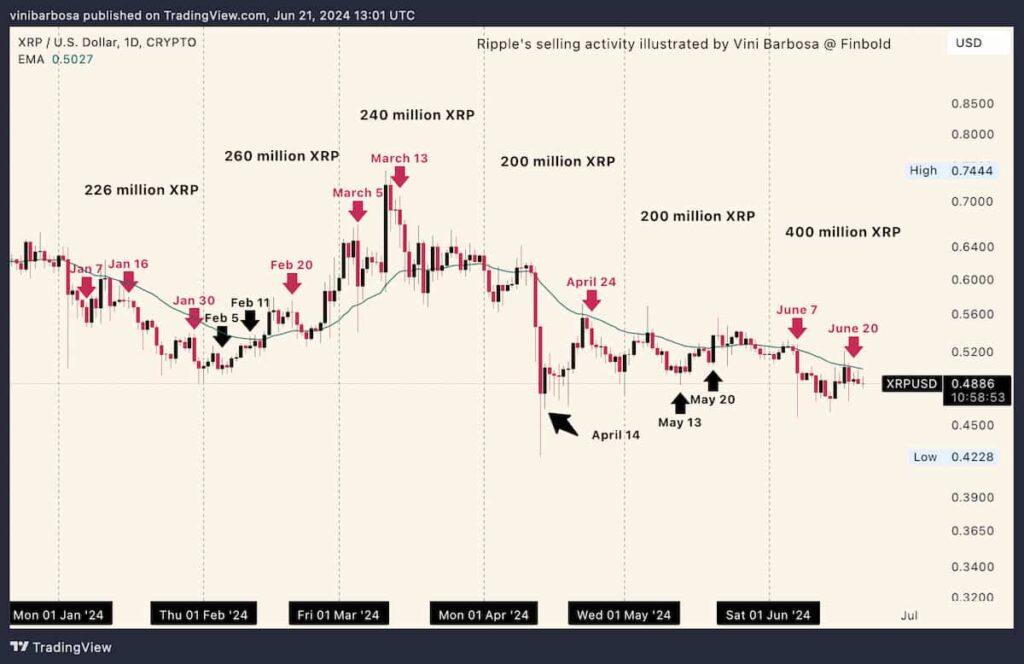

First, the XRP Ledger (XRP) native token is a $27.10 billion market cap asset, ranked seventh. Ripple, the company behind its development and XRP’s largest holder, has starred significant sell-offs every month since its launch.

However, June’s activity has been the largest reported sell-off to date, with 400 million XRP spent from the treasury account. This amounts to $200 million at an average monthly price of around $0.50 per token.

While Ripple’s account has already spent the tokens, they will gradually become supply pressure on crypto exchanges. This may affect XRP price, as the year-to-date chart suggests.

Only five of the 14 sell-off days had positive price action: February 5, 11, April 14, May 13, and 20. All nine other days were of local crashes, evidencing the importance of monitoring the company’s activities.

Moreover, XRP’s year-to-date monthly performance has been negative in three of the first five months of 2024.

Mysterious Avalanche (AVAX) whale activity creates turmoil

Second, Avalanche (AVAX), with a $10.30 billion market cap, has lost nearly 5% of its value in the last 24 hours after a mysterious whale started selling AVAX on multiple exchanges like Binance and Coinbase. This was first reported by ZachXBT in a Telegram channel on June 22.

The nearly $55 million sell-off has put traders on red alert. Thus, many panic-sold in response to fear, uncertainty, and doubt (FUD).

Avalanche traded at $26.14 by press time, with 32.18% losses year-to-date. Additionally, the token accrued even bigger losses from this year’s top at $60.

Chainlink (LINK) ongoing inflation and constant sell-off pressure

In closing, Chainlink (LINK) is the third crypto to avoid trading this week, as the project’s vesting contracts have put 21 million LINK in circulation on Friday, for a massive sell-off worth nearly $300 million.

As reported by Finbold, the team sent 18.75 million of the unlocked amount to a Binance deposit address. Hence, the company showed intent to sell nearly 88% of the inflated supply immediately, at a $265 million market value, by reporting.

This represents 3.5% of Chainlink’s $8.4 billion market cap, which can create strong supply pressure on the exchange. LINK currently trades at $13.79, with 14.26% losses month-over-month.

Traders and investors must monitor further activity from these cryptocurrencies to improve decision-making. Massive sell-offs are part of volatile markets, and many projects still suffer from ongoing supply inflation, which worsens the scenario. For that reason, investors should study each cryptocurrency’s tokenomics to avoid becoming the exit liquidity of early whales.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.