Cryptocurrency exchanges, operating in a regulatory grey zone and powered by technologies that race far ahead of policy, have become the newest gateways and hubs for dirty money to cross borders. Indian agencies are now scrambling to keep pace. These findings emerge from The Coin Laundry, an investigation by The Indian Express in partnership with the International Consortium of Investigative Journalists (ICIJ).

Spanning 10 months and involving 113 reporters across 38 newsrooms, including The New York Times, Suddeutsche Zeitung, Le Monde and Malaysiakini, the project uncovers how crypto exchanges worldwide have spawned a shadow economy where illicit transactions flow with unprecedented ease. Over the last nine years, exchanges have faced at least $5.8 billion in fines, penalties and settlements. This is an indication of how large, and how opaque, this parallel financial universe has become, a space that was once dominated by tax havens.

Spanning 10 months and involving 113 reporters across 38 newsrooms, including The New York Times, Suddeutsche Zeitung, Le Monde and Malaysiakini, the project uncovers how crypto exchanges worldwide have spawned a shadow economy where illicit transactions flow with unprecedented ease. Over the last nine years, exchanges have faced at least $5.8 billion in fines, penalties and settlements. This is an indication of how large, and how opaque, this parallel financial universe has become, a space that was once dominated by tax havens.

The India angle, investigated by The Indian Express, reveals:

In just 21 months, between January 2024 and September 2025, the Home Ministry’s Indian Cyber Crime Coordination Centre (I4C) flagged at least 27 crypto exchanges for allegedly being used as laundering channels by cyber-criminals. An estimated Rs 623.63 crore siphoned from around 2,872 victims was routed through these platforms —ranging from Rs 360.16 crore for one exchange to Rs 6.01 crore for another.

The I4C analysed at least 144 cases over the past three years and came across a murky trail through which cryptocurrency is used to funnel money stolen through cyber crimes to transnational syndicates.

How a Russian crypto accused was the face behind a film starring Oscar-winner Kevin Spacey with Bollywood star Disha Patani among the cast; several investor summits targeting Indians; and a birthday party in Mumbai of Elon Musk’s mother Maye Musk.

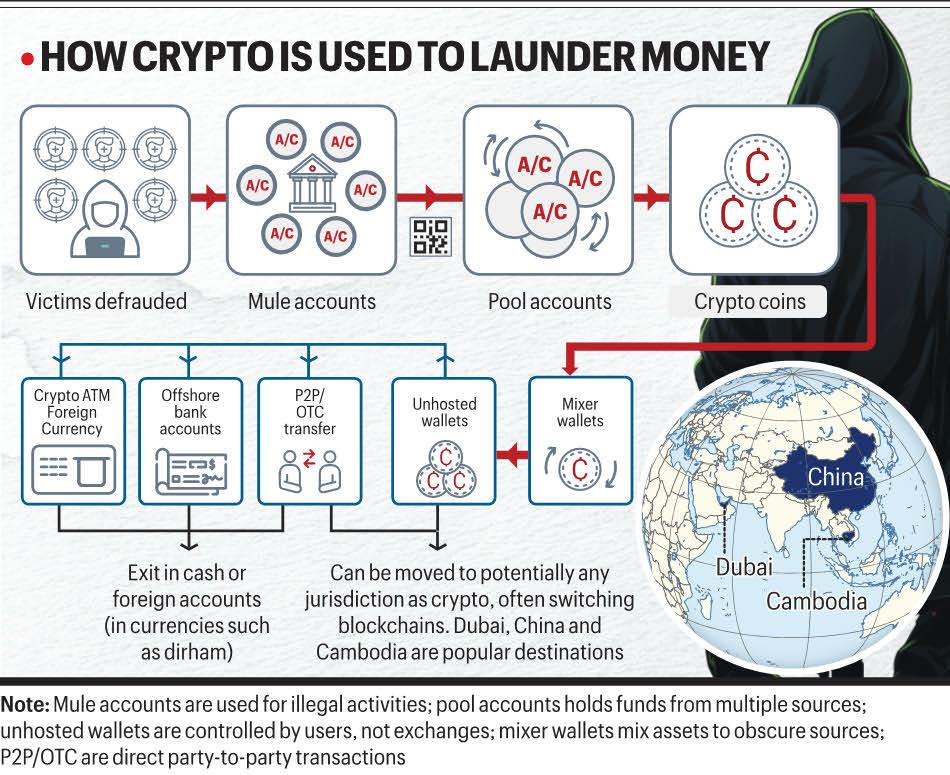

How Crypto is used to launder Money

How Crypto is used to launder Money

These findings, and the tangled money trails they reveal, place The Coin Laundry in the line of earlier ICIJ-linked collaborations — HSBC Leaks, Panama Papers, Paradise Papers, Pandora Papers and others. Like those projects, this investigation follows the circuitry of global dirty money, now routed through digital assets that promise anonymity and transcend borders.

What is crypto & the global risk

Story continues below this ad

A cryptocurrency is a digital token that can be bought, sold or transferred without a bank in the middle. Every transaction is recorded on a blockchain, a public, tamper-resistant ledger, but the people behind those transactions can remain hidden behind wallet addresses. A cryptocurrency exchange is simply the marketplace where buyers and sellers trade these tokens, similar to a stock exchange but with fewer rules, faster transactions and, in many cases, higher anonymity. When these platforms lack strong oversight, the same features that attract genuine investors also make them appealing to fraudsters and money launderers.

Worldwide, crypto regulation is fragmented. Some regions—Japan, Singapore, the European Union—require strict licensing and disclosures. Others offer looser oversight. This patchwork has created a familiar pattern: money slipping through mismatched legal systems, much like what earlier ICIJ projects revealed in traditional offshore finance.

Ransomware groups, drug syndicates, cyber-fraud networks and sanction evaders increasingly prefer crypto for its speed and anonymity. Funds can hop across wallets, exchanges and “mixers” in minutes, often vanishing into jurisdictions where regulation is weakest. India’s experience mirrors this global trend.

After tax havens, dirty money finds a new home: Cryptocurrency

The I4C analysed at least 144 cases over the past three years and came across a murky trail through which cryptocurrency is used to funnel money stolen through cyber crimes to transnational syndicates.

Read 👇🏽… pic.twitter.com/l9kG0iNHlR

— The Indian Express (@IndianExpress) November 17, 2025

India’s regulatory vacuum

Despite booming retail interest, the government remains cautious about regulation. Officials describe a dilemma: regulating crypto could be perceived as endorsing it, drawing more investors into an asset seen as volatile and systemically risky. For now, the Finance Ministry is working on a “discussion paper” on cryptocurrencies — an early-stage, exploratory effort rather than a policy blueprint.

Story continues below this ad

Meanwhile, agencies face a peculiar challenge: where to store seized crypto. The Indian Express has learnt that a premier investigative agency has stored around $4mn in confiscated digital assets with a custody and wallet infrastructure firm as a temporary arrangement. The Enforcement Directorate awaits Home Ministry guidelines on secure storage. For the millions of Indians investing their savings, this absence of a regulatory framework means they have nowhere to turn if an exchange freezes withdrawals or collapses. No RBI ombudsman. No SEBI oversight. Only uncertainty.

Industry strain

Indian exchanges say regulatory uncertainty hampers operations, while offshore platforms, beyond India’s jurisdiction, continue to serve Indian users freely.

The tax regime remains another pain point: a 1% TDS on every transaction and 30% capital gains tax. Industry representatives have told the government that the sector has become “unsustainable”. Between April 2022 and July 2023, trading volumes on Indian exchanges fell 97%, with transactions worth Rs ₹35,000 crore moving to offshore platforms.

A notable feature of major Indian exchanges — CoinDCX, WazirX, Mudrex, CoinSwitch, Pi42, Onramp and BitBNS — is that their ownership structures sit under foreign holding companies. Founders describe this as common fintech practice for raising capital in favourable jurisdictions, though some admit India’s regulatory uncertainty has encouraged this “layered existence.”

Story continues below this ad

Globally, consumer-protection rules are evolving slowly. In the US, enforcement has been inconsistent, exemplified by President Donald Trump’s recent pardon of Binance founder Changpeng Zhao after he pleaded guilty to money-laundering offences.

(With ICIJ reporters)