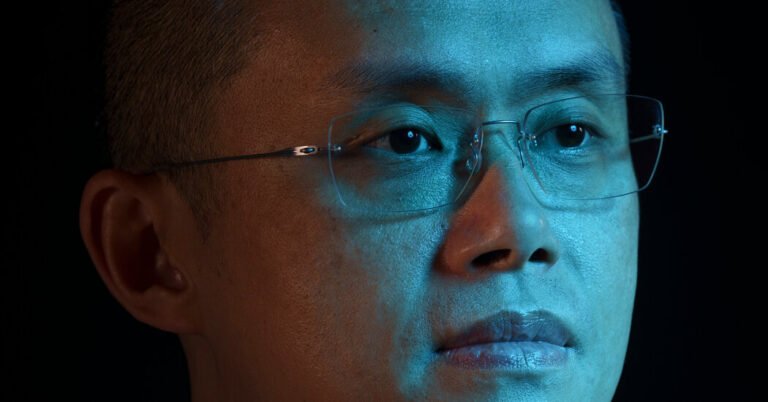

Changpeng Zhao, the founder of the giant cryptocurrency exchange Binance, should go to prison for three years after breaking the law “on an unprecedented scale” and pleading guilty to a money-laundering violation, federal prosecutors wrote in a court filing on Wednesday.

Defense lawyers countered in their own memo that Mr. Zhao, 47, should receive no prison time and face a sentence of probation, arguing that he had accepted responsibility for his crime and showed a commitment to philanthropy.

A federal judge in Seattle, Richard A. Jones, is set to evaluate those dueling recommendations at a sentencing hearing for Mr. Zhao on Tuesday. His sentencing will be the latest landmark in a series of criminal prosecutions that have targeted some of the most powerful figures in the global cryptocurrency industry.

Just 18 months ago, Mr. Zhao, riding high as Binance’s chief executive, helped set off the chain of events that led to the collapse of FTX, Binance’s largest rival, and the imprisonment of the FTX founder Sam Bankman-Fried, who was sentenced to 25 years for fraud. Now Mr. Zhao faces his own prison sentence after cutting a deal with prosecutors in November, admitting that he failed to set up an adequate system at Binance to prevent money laundering.

Under federal guidelines, that crime carries a sentence of 12 to 18 months, prosecutors wrote in their memo. They noted that the U.S. probation department had recommended five months behind bars for Mr. Zhao. But the government is seeking a three-year sentence, the memo said, because of the “the scope and ramifications” of Mr. Zhao’s behavior.

As Binance’s founder, Mr. Zhao was once arguably the most powerful executive in the cryptocurrency industry. At times, Binance processed as much as two-thirds of all crypto transactions. Mr. Zhao has a fortune worth $33 billion, according to Forbes.

But for years, he was dogged by accusations that Binance had broken the law to expand its business worldwide. In November, the company agreed to pay $4.3 billion in fines and restitution to the U.S. government, settling charges that it had violated economic sanctions against Syria, Cuba and Iran while allowing criminal activity to flourish on its platform.

Separately, Mr. Zhao pleaded guilty to failing to maintain an adequate anti-money-laundering program at Binance. As part of the deal, he agreed to pay a $50 million fine and step down as Binance’s chief executive. He was replaced by Richard Teng, a former regulator in Singapore who had been groomed to succeed him.

In court papers, Mr. Zhao admitted to prioritizing Binance’s growth over its compliance with the Bank Secrecy Act, which requires companies to avoid doing business with criminals or people facing economic sanctions. He told Binance’s employees that it was “better to ask for forgiveness than permission,” court papers said, and allowed Binance customers to create accounts without sharing the sort of detailed personal information that financial services firms usually require.

“Zhao’s sentence should reflect the gravity of his crimes,” prosecutors wrote in the filing on Wednesday. “Zhao and Binance put U.S. customers, the U.S. financial system and U.S. national security at risk.”

In their memo, Mr. Zhao’s lawyers argued that he deserved lenience, emphasizing that he came to the United States from his home in the United Arab Emirates to plead guilty. They wrote that while Mr. Zhao had admitted to a compliance failure at Binance, he had not pleaded guilty to engaging in money laundering, fraud or theft.

“Mr. Zhao is not a symbol. He is a devoted father, a philanthropist,” the defense memo said. “He has already shown remorse for his offense and, more importantly, has remediated.”

The memo included letters from Mr. Zhao’s friends and Binance employees, some of whom wrote that the company was working hard to cooperate with law enforcement organizations around the world. Defense lawyers cast Mr. Zhao as “frugal and humble,” saying he intended to give away 90 to 99 percent of his wealth.

Among the letter writers were Mr. Zhao’s two adult children, both students at American universities, and Max Baucus, a former U.S. senator and ambassador to China. In his letter, Mr. Baucus, who worked as an adviser to Binance, described Mr. Zhao as a “near genius” and “one of the most decent persons I have known.”

“My impression was that Binance grew exponentially and became somewhat unwieldy,” he wrote. “He now clearly understands he should have exercised much more diligence.”

Since his guilty plea, Mr. Zhao has remained in the United States, after Judge Jones rejected his request to return home to his family in Dubai before his sentencing. Prosecutors said in the memo that he had traveled freely throughout the country, including to Telluride, Colo., and Los Angeles.