Cryptocurrency prices dumped on Friday as rising Middle Eastern tensions triggered risk-off panic selling across financial markets, with Bitcoin (BTC) losing 5% in the past 24 hours to fall under $67,000, and Ether (ETH) dropping 9% to the $3,200 area.

Israel is braced from a counterattack from Iran after they recently took out IRGC military leaders in Syria. Reports emerged on Friday that the US is moving warships to ready itself to defend Israel.

🚨🇺🇸🇮🇱 JUST IN: The United States has pledged to DEFEND ISRAEL if Iran attacks. Iran has stated this will make the US a target of Iran. pic.twitter.com/Esn0bPXWFX

— Jackson Hinkle 🇺🇸 (@jacksonhinklle) April 12, 2024

Tensions have been high in the Middle East since the October 7th Hamas attack against Israel, and Israel’s devastating counterattack into Gaza.

Rising fears that the US and Iran could find themselves engaged in a hot war roiled sentiment on Friday.

The S&P 500 hit its lows level in nearly a month just above 5,100, dropping 1.4% on the day.

Safe havens like the US dollar and Gold both jump. The DXY rallied above 106 for the first time last November, while gold briefly hit record highs above $2,400.

It’s no surprise then that cryptocurrency prices came under pressure – many investors deem cryptocurrencies as a high beta risk assets.

Altcoins Bear the Brunt as Cryptocurrency Prices Dump

The Friday sell-off in Bitcoin was decidedly mild compared to that of many major altcoins.

As per CoinMarketCap, the likes of Solana, XRP, Dogecoin, Toncoin, Cardano and Avalanche all dropped between 10-16% in 24 hours.

Dogwifhat, Bonk and Arbitrum were amongst the worst-performing names in the top 100 by market capitalization.

Friday’s carnage saw open interest in altcoin cryptocurrencies slashed by 30%.

Altcoins lost ~$6 billion in open interest.

30% drop in total open interest.

Massacre.

🩸

— Zaheer (@SplitCapital) April 12, 2024

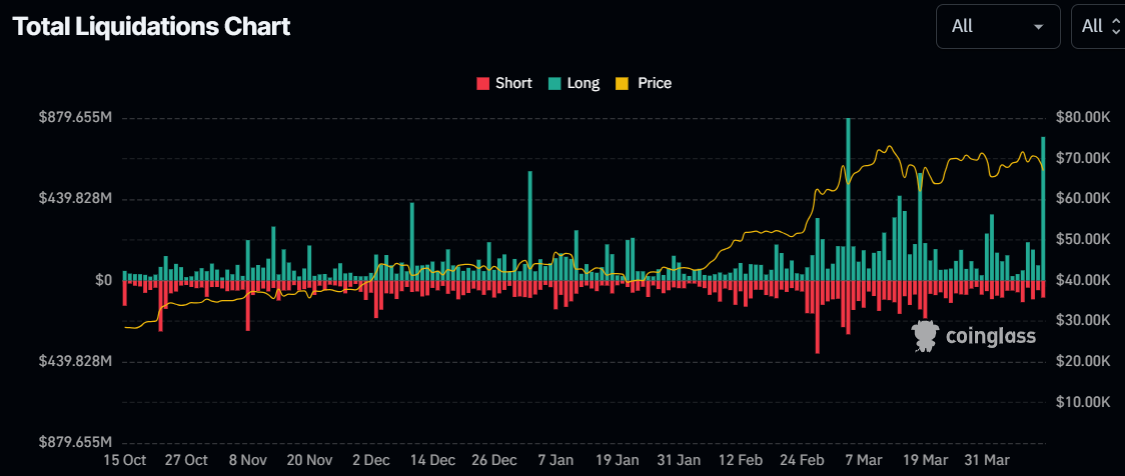

That comes after $770 million in leveraged long crypto futures positions were wiped out on Friday, as per coinglass.com data.

Most of the aforementioned altcoins are at least 25% down from recent highs.

Some, like Arbitrum and Bonk, are down over 50% from yearly highs.

Indeed, it had already been an ugly few weeks for most alternative cryptocurrency prices, even prior to Friday’s sharp.

After a strong finish to 2023/start to 2024 that saw many major altcoins posting 2-3x or more gains, as well as Bitcoin recovering to new record highs, momentum has stalled, and profit-taking has taken over.

Jitters about a Bitcoin halving related turbulence, fading Fed rate cut bets and geopolitics have added fresh reasons to derisk.

Where Next For Cryptocurrency Prices?

It remains far too early to say definitively that the latest drop in cryptocurrency prices is over.

After all, there remains plenty of room left for escalation between Iran and Israel.

The altcoin pullback presents a great opportunity for investors to get in at bargain prices versus a few weeks ago.

But anyone jumping into the market now should be ready for significant two-way volatility.

Or, if they fancy buying a crypto that carries a much lower risk of near-term 15% intra-day moves, there’s Bitcoin.

Yes, Bitcoin has dropped 5% in 24 hours on risk off flows. But trading in the $67,000s, BTC is only down 8% from the record highs it hit near $74,000 last month.

Moreover, it remains locked well within recent ranges.

That could reflect the fact that many view Bitcoin to actually be a safe haven asset, much like gold.

And its general resilience in recent weeks could reflect a reluctance to sell ahead of the halving/amid ETF optimism.

While a post-halving “sell-the-fact” reaction could see Bitcoin dip back towards the $60,000s, its outlook remains strong.

Prior halvings have typically been followed by huge price run-ups to fresh record levels within a few months.

Big US deficit spending and global central bank easing suggests that macro will remain a tailwind. That’s even if the Fed is comparatively slow to begin cutting rates, amid robust US data.

And finally, institutional demand for spot Bitcoin ETFs has added a new, long-term source of buy pressure to the market.

$100,000 Bitcoin for later this year remains very much on the cards.

And that suggests that, while the near-term altcoin outlook is bumpy, traders should brace for strong comebacks later this year.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.