The mysterious source of $17.5 million given to an Australian cryptocurrency influencer who owed millions of dollars to investors has been quietly revealed in a report filed to a Delaware court.

In 2022, Alex Saunders, a Tasmanian cryptocurrency content creator and founder of paid cryptocurrency news Facebook group Nugget’s News, blamed opioid abuse and mental health problems for a “mess”, following 2021 investigations by the Australian Financial Review into his business dealings.

These reports claimed Saunders had raised $15 million through personal loans and ill-fated business proposals he promoted in the Nugget’s News Facebook group.

The funds were allegedly sent to FTX, one of the world’s most popular cryptocurrency exchanges until its sudden collapse in November 2022. Saunders’ apology claimed he repaid, or was in the process of repaying, all those who had given him money.

Thanks to the FTX bankruptcy report by examiner Robert J. Cleary filed late last month, we now know who backed Saunders and his promise to make investors whole: FTX itself.

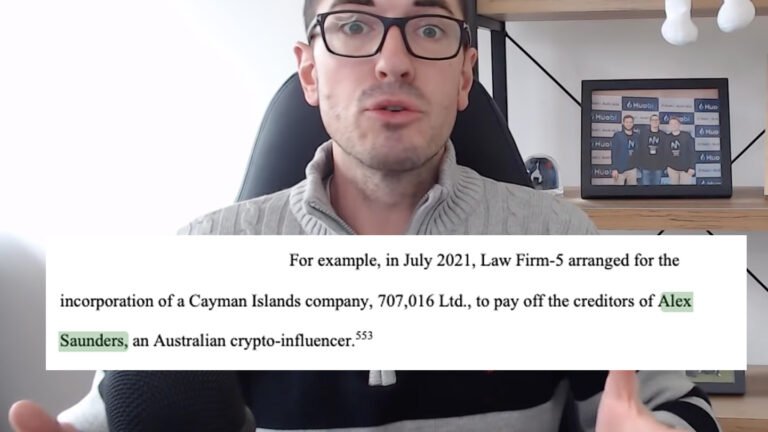

The report states Saunders was loaned US$13.2 million (A$17.5 million at the time) through a Cayman Islands company, 707,016 Ltd., which was set up on behalf of FTX in July 2021. The loan was “to pay off the creditors of Alex Saunders” after he “used borrowed funds to trade on FTX.com, but lost the funds that he traded”. FTX had loaned this significant sum to “avoid negative publicity”, “mitigate reputation harm” and “avoid potential litigation”, Cleary wrote.

Saunders has yet to pay back this loan, according to the report. Saunders wrote on X in 2023 that he was “still waiting on emails from a couple more” but otherwise had paid everyone back. Despite having resumed promoting cryptocurrencies and other blockchain technologies since his 2022 statement, Saunders did not respond to questions sent to the Nugget News email or his Instagram account.

The FTX examiner’s report contains another mystery about the identity of “Law Firm-5”, an unnamed Australian law firm that assisted FTX with its operations between March 2020 and November 2022.

Cleary’s report states Law Firm-5 was responsible for negotiating and setting up the Cayman Islands company for Saunders’ loan. It also said the majority of Law Firm-5’s work was on buying fintech businesses, including Hive Empire Trading Pty. Ltd and IFS Markets Pty Ltd., purchases that allowed FTX to bypass the normal process for getting an Australian financial services licence.

For these acquisitions, an unnamed partner at the firm was personally paid US$727,402 in finders fees. The report said other FTX acquisitions were made with little or no due diligence and at excessive valuations, but it does not state that this was the case for any Australian purchases.

The full extent of Law Firm-5’s duties for FTX may still be unknown as the firm declined to cooperate with FTX’s bankruptcy lawyers. “Quinn Emanuel served Bankruptcy Rule 2004 requests on Law Firm-5 … but the firm refused to produce documents,” Cleary’s report said.

An associate from the US communications firm representing FTX’s debtors, Joele Frank, declined to comment.