One of crypto’s most prolific investors, OKX Ventures, backs technologies that expand decentralised finance and cryptocurrency use.

If there has been any waning of investor enthusiasm for blockchain technologies recently, no one gave Jeff Ren, who heads up OKX Ventures, the memo. The venture arm of cryptocurrency platform OKX has been investing at a fast pace.

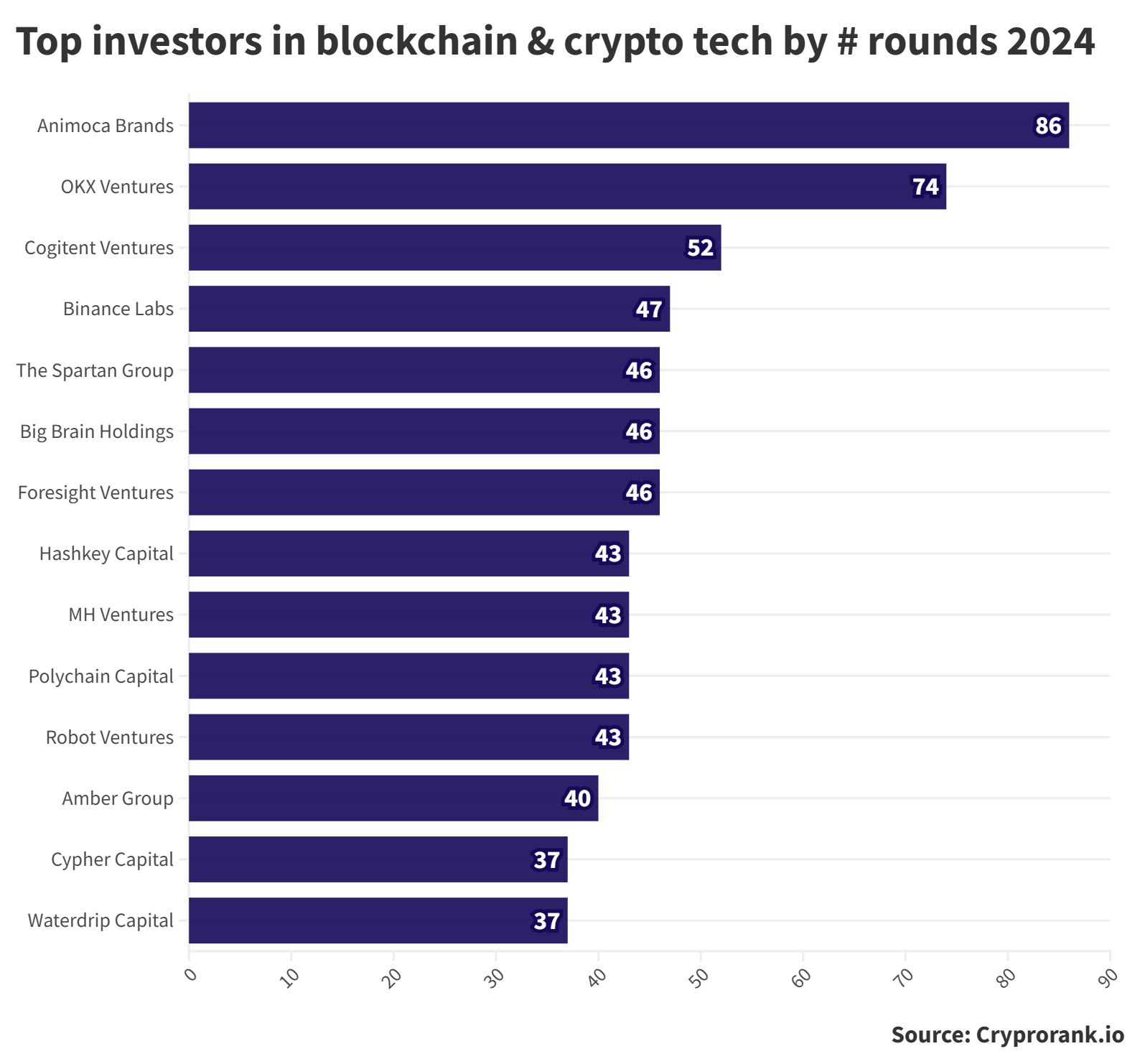

In fact, OKX Ventures is among biggest investors in crypto and blockchain startups this year. According to Cryptorank data, which goes back to 2023, the team is the second most prolific investor in the sector, having made 74 transactions so far in 2024.

Ren is bullish on the future of cryptocurrencies, which he believes have demonstrated a grassroots staying power despite the scandals involving bad actors in the sector like FTX, the cryptocurrency exchange that collapsed in 2022 following a massive fraud.

“Based on the number of users and transaction volume, don’t think we haven’t seen a retreat. Every government is progressing with the regulation for crypto. Crypto is here to stay. It’s not created by governments so it can’t be killed by governments,” he says.

If anything, Ren is expecting to see the crypto market, estimated to be worth around $2.5tn, to increase in value because innovations in the sector are allowing cryptocurrencies to be used in new ways.

”We want to bring more real-world assets on to the blockchain,” says Ren. “We look at the blockchain technology that can solve the real bottleneck issues for those assets.”

For example, Ren believes intellectual property and other ownership rights will increasingly be put on the blockchain so that these can be turned into assets to trade. Blockchain technologies are ideal, for example, for tracking licensing arrangements, he says.

Another, more novel idea, is putting the ownership of enterprise-grade compute power — the very same that cryptocurrencies use in vast quantities — onto the blockchain so that it can be traded and made available for fractional ownership. OKX Ventures invested in June in Compute Labs, a Singapore-based startup that provides this kind of tokenisation of graphics processing units, or GPUs.

The state of crypto

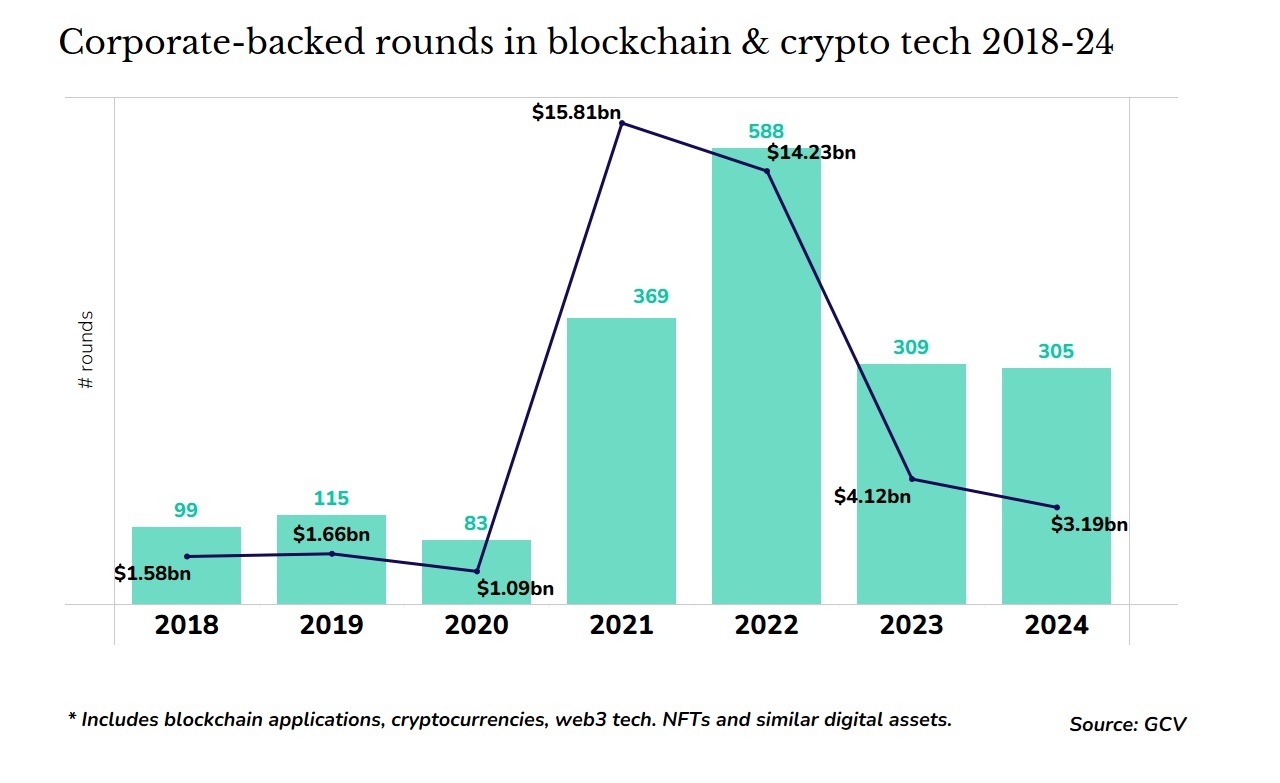

Ren and OKX are not the only ones bullish about cryptocurrencies. The recently published State of Crypto 2024 report by VC firm a16z, or Andreessen Horowitz (admittedly a heavy investor in crypto and Web3), struck a cautiously optimistic note. The number of active cryptocurrency wallet users rose rapidly in 2024, increasing to a record 29 million globally. Use of cryptocurrencies — once a heavily US-centric activity — is becoming global, with rapid uptake in large emerging markets such as Nigeria and India.

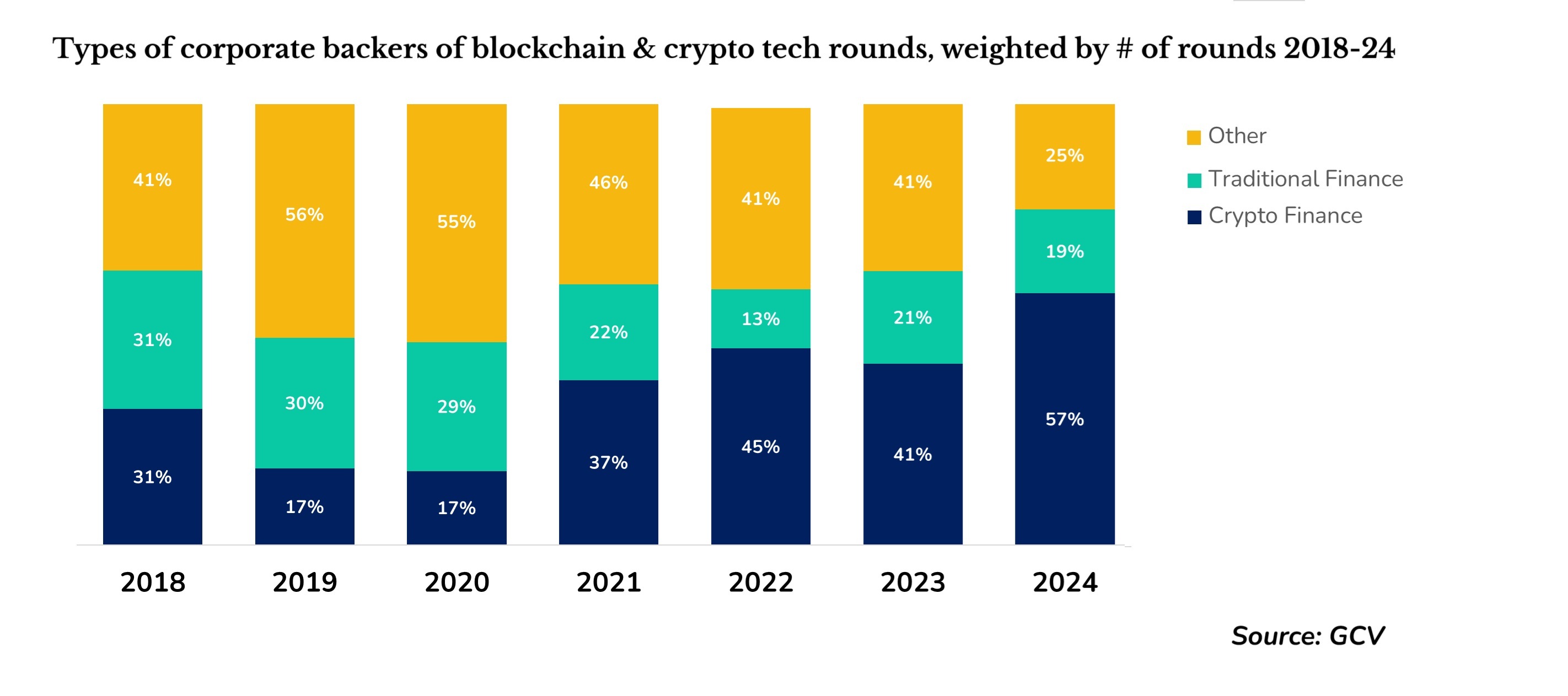

At the same time, traditional financial investors have continued to invest in cryptocurrencies and Web3, from providing crypto custody services like SC Ventures’ Zodia Custody to Deutsche Bank investing in clearing and settlement blockchain company Patrior.

Financial institutions have tended to focus more on digital currencies and using the blockchain to digitise traditional financial instruments, says Ren.

“We’re glad to see more innovation there and more adoption. But it’s not really our focus. Our big thing is really bringing more assets on chain,” he says.

Another development that makes Ren bullish about the expansion of crypto is recent innovations in Bitcoin. Bitcoin is the most valuable cryptocurrency in the world but was considered limited because it lacked the capability to be used for smart contracts. That made Bitcoin holders unable to participate in the rapidly growing decentralised finance (DeFi) economy. In the past year, however, several startups have created solutions that will allow for smart contracts on Bitcoin.

“Since beginning of last year there are more innovations for Bitcoin and all these assets that could be created. Bitcoin is a digital gold but now we can get even more yield from it,” says Ren.

Many of OKX Ventures’ recent investments have been in companies building these new Bitcoin capabilities, such as US startup SatLayer, a Bitcoin staking platform, and Solv Protocol, a Singaporean Bitcoin staking protocol.

OKX investment style

OKX Ventures, which was set up in 2021, invests from a $100m fund and has a very wide remit for what it will back. Like many cryptocurrency exchanges it invests to help build the ecosystem around its own platform and around the Web3 ecosystem more generally.

“We’re making direct investments. We are also supporting certain funds as the as the anchor LP,” says Ren, who is a lawyer by training and who spent time as an investment banker before making the switch to investing in the cryptocurrency sector. The company also builds its own crypto startups.

The corporate venture team has about 20 people and has made some 400 investments to date.

OKX invests in gaming companies that use cryptocurrencies — for example it backed Web3 gaming startup Curio in August. For companies like these OKX will provide a lot of hands-on practical support. “We support them by providing a lot of industry resources and investment leads. So, we’re not just sitting back and being a capital provider,” says Ren.

In other cases the company might invest in important Web3 platforms and development companies to make sure it has a view for what is coming next.

“We invest in the largest developers to get close to them. They are the builders, and they dictate where the whole ecosystem goes,” says Ren. The unit is careful, however, to not influence the direction these developers are going. “We try to behave in a way that is as decentralised as it gets. We don’t want to overstep. We don’t want to come in and become another corporate investor.”

The company has also recently set up an accelerator together with blockchain developer Aptos Labs to give it easier access to early-stage startups.

Becoming mainstream?

There have been few exits so far for cryptocurrency investors but Ren believes these will come as the sector matures.

“While the current market has seen fewer exits, this environment allows for deeper innovation and stronger foundations to be built. I believe that as projects mature and demonstrate their potential, exit activity will naturally increase. I’m optimistic that the next wave of successful exits will follow as the ecosystem evolves.”

For now, Ren’s main focus still is firmly on just increasing cryptocurrency use and turning it more mainstream.

“At OKX Ventures, our primary focus isn’t solely on exits; we prioritise supporting the long-term growth of the blockchain and crypto space. We invest in projects that showcase real use cases and provide value to their users and communities,” says Ren.

Crypto, in the early days, was a little like a cult of believers, he says.

“Now it’s very different. it’s not just some crazy people,” he says. “You have many financial instruments attached to Bitcoin. You have ETFs. This is already very much an industrial production. It’s a very mature product.”

And while there may have been some bad actors, such as FTX, this has not, in Ren’s view, derailed the sector. Scandals, happen “all the time when you when you have some new boys in town,” he says. “There have been some bad actors in any particular business.” Banks have been issued hefty fines in the past for wrongdoing — a $249m fine for a share sale leak at Morgan Stanley earlier this year — Ren points out. These have not ended the financial services sector.

“It doesn’t change anything,” he says. “If anything, I think it [has helped] the public identify and understand where the real risk is.”