- XRP holds steady at $3.00 amid a spike in broader cryptocurrency volatility, driven by expectations of steady interest rates.

- The White House is set to release a detailed report on crypto to shed light on guidelines for stablecoins and broader regulation clarity.

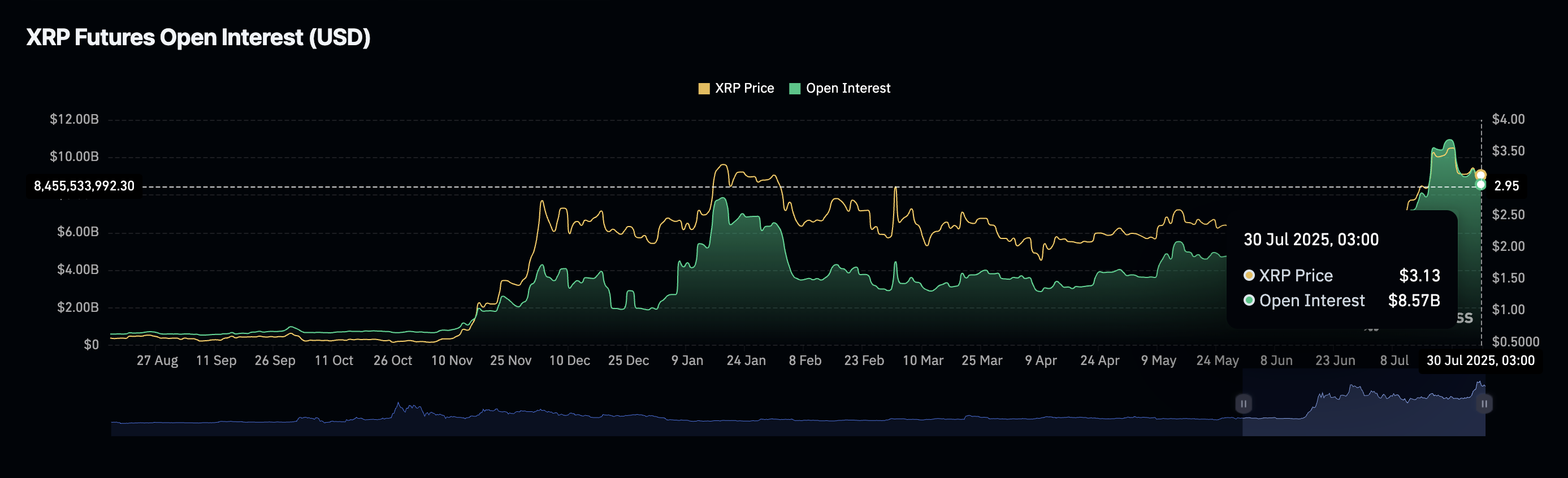

- The derivatives market highlights a decline in interest in XRP as the futures Open Interest and volume slump.

Ripple (XRP) upholds support above $3.00 on Wednesday amid growing concerns about the upcoming Federal Reserve (Fed) decision on interest rates.

While market participants generally expect the central bank to leave interest rates steady in the range of 4.25% to 4.50%, Fed Chair Jerome Powell’s remarks would provide insight into the monetary policy direction, forming the foundation of risk sentiment ahead of the next meeting in September.

US government to release crypto policy report

A task force established by United States (US) President Donald Trump is set to release a policy report on virtual assets on Wednesday that would shed light on the White House’s stance on US Dollar-pegged stablecoins, tokenization and broader market legislation among other critical issues affecting the digital asset industry.

The report marks the working group’s initial findings as part of President Trump’s campaign promise to make the US a global crypto hub.

Key areas of interest include recommendations for the US Securities & Exchange Commission (SEC) to establish clear guidelines for the development of tokenized stocks and treasuries.

The task force, led by Bo Hines, includes Treasury Secretary Scott Bessent, SEC Chair Paul Atkins, and Director of the Office of Management & Budget Russell Vought.

“While there have been regulatory regimes in place that have maybe been piecemeal or have allowed the industry to grow in certain ways, the recommendations that we expect to see in the report will be a good roadmap for how to build out crypto as a continued important part of the economy going forward,” Jito Labs chief legal officer Rebecca Rettig told Reuters.

The White House policy report comes after the US House of Representatives passed key bills, including the GENIUS Act, signed into law by President Trump on July 18, the CLARITY Act and the Anti-CBDC Act, which is heading to the Senate for deliberation.

XRP price remains relatively stable above support at $3.00 ahead of the report. However, interest in the token has been declining as evidenced by a notable drop in the futures Open Interest (OI) to $8.57 billion from $10.94 billion recorded on July 22.

XRP Futures Open Interest | Source: CoinGlass

This decline indicates a reduction in investor conviction in the uptrend, with fewer traders leveraging long positions, reflected by the drop in volume to $10.6 billion from peak levels of $41.23 billion, posted on July 18. If this trend persists, recovery could be suppressed while increasing the probability of the bearish leg extending below support at $3.00.

XRP Futures Volume | Source: CoinGlass

Technical outlook: XRP extends consolidation

XRP is moving sideways above the support range of $2.95 to $3.00 and the seller congestion capping price movement at $3.32. Despite the drop in the futures Open Interest and volume, bulls seem determined to push for a trend reversal, targeting its record high of $3.66, reached on July 18.

The Relative Strength Index (RSI) shows signs of stabilising at 59 after dropping from overbought territory over the past week. With the market no longer overheated, the anticipated recovery could occur backed by a potential risk-on sentiment after the Fed interest rate decision and the White House policy report.

XRP/USDT daily chart

Still, traders should temper their bullish expectations due to a sell signal triggered by the Moving Average Convergence Divergence (MACD) indicator on Friday. Investors may consider reducing exposure if the blue MACD line remains below the red signal line. In the event the decline accelerates below the support at $2.95, traders will shift focus to the 50-day Exponential Moving Average (EMA) at $2.76 and the 100-day EMA at $2.54.