The following is a guest article from Vincent Maliepaard, Marketing Director at IntoTheBlock

What is BlackRock’s BUIDL Fund?

The BUIDL fund, formally known as the BlackRock USD Institutional Digital Liquidity Fund, represents BlackRock‘s venture into tokenized assets on a public blockchain. Utilizing the Ethereum network, BUIDL invests in cash, short-term debt securities, and U.S. Treasury bonds.

The launch of BlackRock’s BUIDL fund excited many in the industry because it showcases how traditional financial instruments can integrate with the innovative capabilities of DeFi.

However, BlackRock is not the first to explore this technology. Other notable firms have also made significant strides in this area. For instance, Abrdn, a major UK asset manager, launched a tokenized version of its £15 billion Lux Sterling money market fund on the Hedera Hashgraph DLT in June 2023 (Ledger Insights).

Similarly, Hamilton Lane, another investment manager, opened a tokenized feeder fund on the Polygon blockchain in early 2023. This fund allows individual investors to access private equity with significantly reduced minimum investment requirements compared to traditional versions (markets.businessinsider.com).

Numerous examples from the blockchain industry have contributed to a growing niche ecosystem within the larger blockchain industry called “Real-world Assets,” or RWAs.

Real-World Assets in Crypto

Real-world Assets (RWA) have emerged as one of the most significant areas of focus in the blockchain industry this year. Projects in this space aim to channel yield and assets from the traditional economy into the digital space. This integration leverages the inherent interoperability of DeFi, enabling new forms of asset utilization and yield generation.

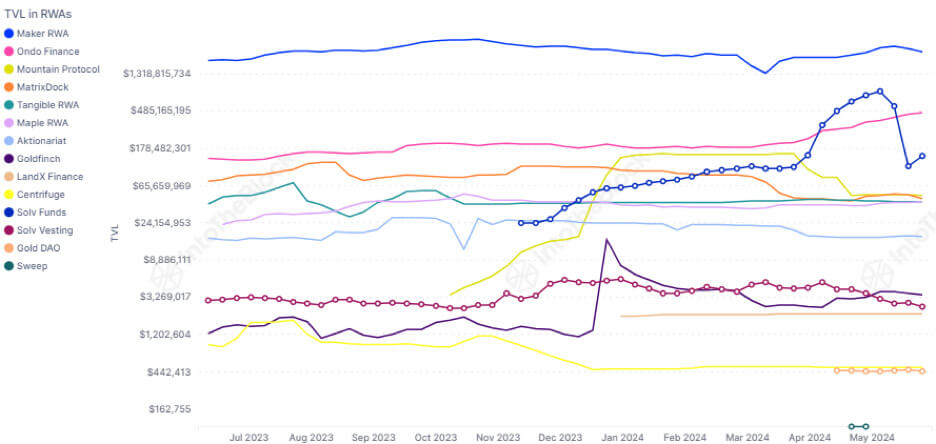

In 2023, significant strides were made in this sector, marked by successfully incorporating U.S. Treasury bond yields into DeFi through protocols like Mountain Protocol. As a result, the total value locked (TVL) in RWA protocols soared to over $2.9 billion. Top protocols in the RWA ecosystem now count over 194,000 RWA protocol token holders between them, reflecting its rapid adoption and growing influence.

Development and Growth of the BUIDL Fund

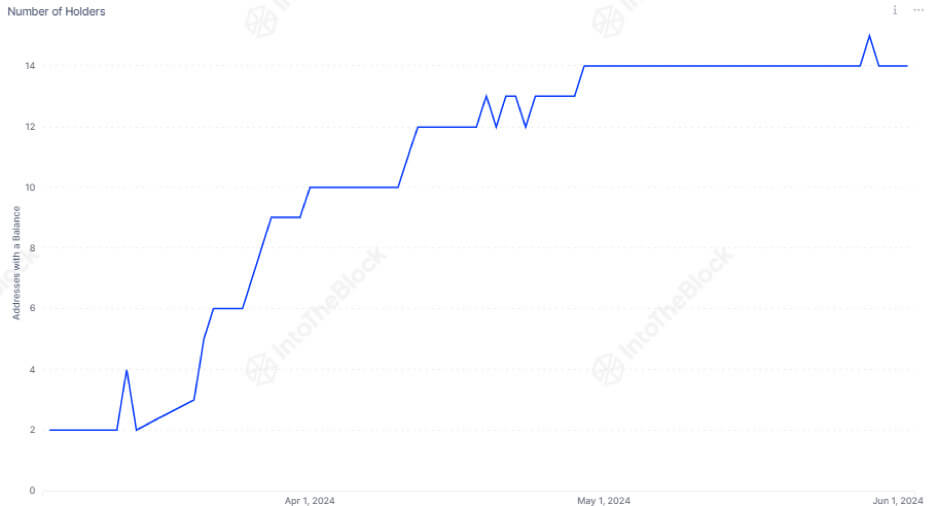

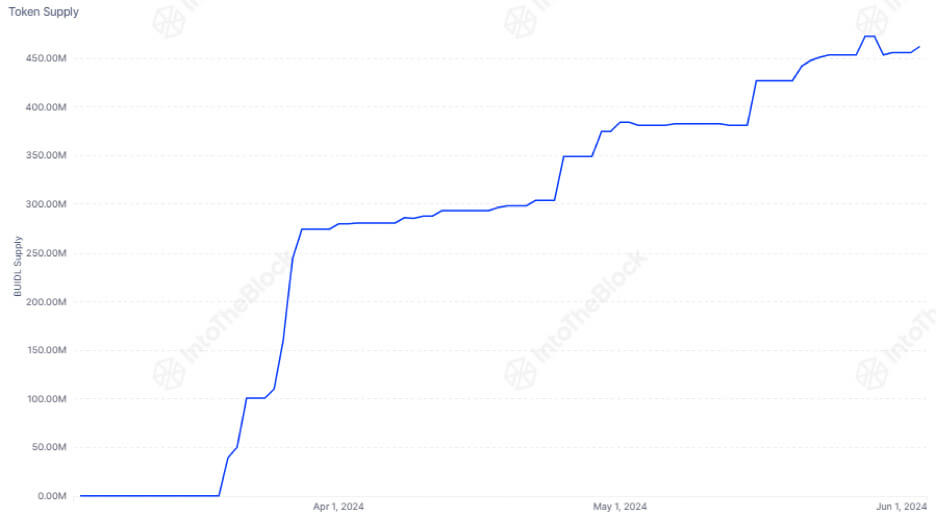

The structure of BlackRock’s BUIDL fund is designed to cater to institutional investors, requiring a minimum investment of $5 million per entity. The fund has 14 holders and has showcased gradual but notable growth since its launch.

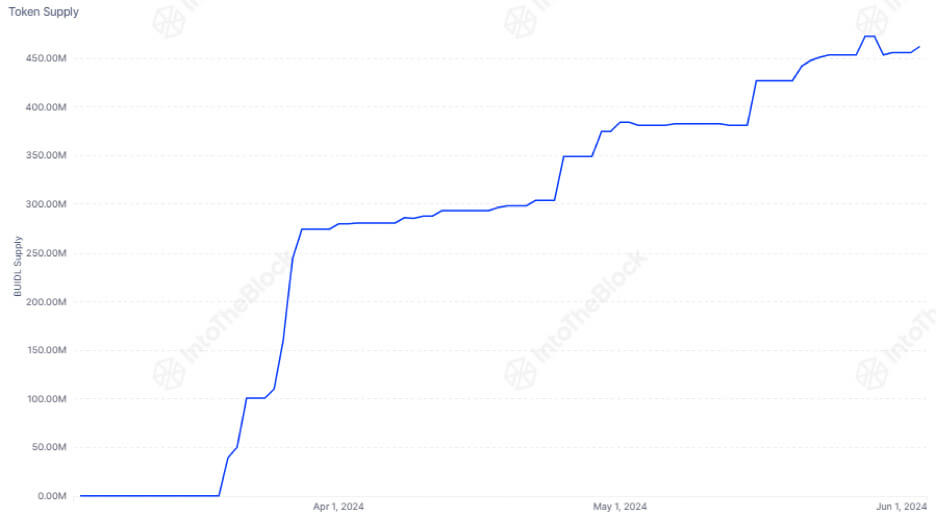

While the number of holders may grow gradually, each new investor significantly boosts the fund’s total holdings. Current data shows there are 462,542,901 circulating tokens, each representing roughly $1, bringing the total fund value to $462 million.

The Future of BlackRock’s BUIDL Fund and RWA in DeFi

As the DeFi sector continues attracting attention from traditional financial players, integrating RWAs like those in the BUIDL fund is expected to accelerate. This trend is driven by the inherent advantages of tokenization, including increased transparency, liquidity, and access to a broader range of investors. This evolution extends beyond the blockchain industry and sets the stage for a more interconnected and efficient global financial system.