China and Russia agreed to expand their economic cooperation using a planned banking system, which analysts say is aimed at supporting their militaries and undermining U.S.-led global order.

The two countries issued a joint communiqué agreeing “to strengthen and develop the payment and settlement infrastructure,” including “opening corresponding accounts and establishing branches and subsidiary banks in two countries” to facilitate “smooth” payment in trade.

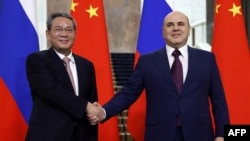

The communiqué was issued when Chinese Premier Li Qiang met with Russian Prime Minister Mikhail Mishustin in Moscow on Wednesday, Russian news agency Tass reported the following day.

At the meeting, Mishustin said, “Western countries are imposing illegitimate sanctions under far-fetched pretext, or, to put it simply, engaging in unfair competition,” according to a Russian government transcript.

Mishustin also noted the use of their national currencies “has also expanded, with the share of roubles and RMB in mutual payments exceeding 95%,” as the two have strengthened cooperation on investment, economy and trade.

Li and Mishustin signed more than a dozen agreements on Tuesday on economic, investment and transport cooperation. Li was making a state visit to Moscow at the invitation of Mishustin.

David Asher, a senior fellow at the Hudson Institute, said, “This meeting between the Russians and the Chinese is important because it’s getting into a much widening aperture of cooperation” that would have “a bigger military dimension,” threatening U.S. national security.

Asher added that their bilateral cooperation could lead to “Russia’s assistance to China in the Pacific and the South China Sea” in return for Beijing’s support for Moscow’s economy and industry that aid Russia’s war efforts in Ukraine, “in defiance of the U.S.”

A spokesperson for the State Department told VOA Korean on Thursday that the U.S. is “concerned about PRC [People’s Republic of China] support for rebuilding Russia’s defense industrial base, particularly the provision of dual-use goods like tools, microelectronics and other equipment.”

The spokesperson continued: “The PRC cannot claim to be a neutral party while at the same time rebuilding Russia’s defense industrial base and contributing to the greatest threat to European security.”

“China is Putin’s only lifeline,” said Edward Fishman, an adjunct professor at Columbia University’s School of International and Public Affairs who helped the State Department design international sanctions in response to Russia’s aggression in Ukraine.

“Chinese firms have taken advantage of Russia’s weak bargaining position and cut a slew of favorable deals,” Fishman said. “But these deals have more than just commercial significance. They keep Putin’s war machine going.”

The U.S. Treasury Department on Friday imposed sanctions on more than 400 entities and individuals that support Russia’s war efforts in Ukraine, including Chinese firms that it said were helping Moscow evade Western sanctions by shipping machine tools and microelectronics.

In response to a China-Russia plan to set up a financial system to facilitate trade, U.S. Deputy Treasury Secretary Wally Adeyemo told the Financial Times that Washington “will go after the branch they’re setting up” and the countries that let them.

Analysts said China and Russia could increasingly turn to alternative methods of payments to evade sanctions.

Russia in June suspended trading in dollars and euros in the Moscow Exchange, in response to a round of sanctions the U.S. had issued targeting Russia’s largest stock exchange. The move by Russia prohibits banks, companies and investors from trading in either currency through a central exchange.

Shortly before Russia invaded Ukraine, the U.S. cut big Russian banks off from the U.S. dollar, the preferred currency in global business transactions.

“There is clearly a desire in both Moscow and Beijing to build financial and trade connections that operate beyond the reach of U.S.-led sanctions,” said Tom Keatinge, director of the Center for Finance and Security at the London-based Royal United Service Institute.

“This includes the development of non-U.S. dollar payment and settlement mechanisms and a wider ‘insulated’ payment system that allows other countries in their orbit to avoid U.S. sanctions,” he continued.

Other possible methods of payments could involve central bank digital currencies as well as cryptocurrencies and stable coins, Keatinge added.

The Chinese yuan replaced the dollar as Russia’s most traded currency in 2023, when the U.S. imposed sanctions on a few banks in Russia that could still trade across the border in dollars, according to Maia Nikoladze, an associate director of the Atlantic Council’s GeoEconomics Center, in a June report.

Nikoladze told VOA that transactions made in renminbi and in rubles allowed Moscow to mitigate the effects of sanctions until Washington in December 2023 created an authority to apply secondary sanctions on foreign banks that transacted with Russian entities.

“Since then, Russia has struggled to collect oil payments from China,” with some transactions delayed “up to six months,” even as Moscow found a way to process transactions through Russian bank branches in China, Nikoladze said.

According to an article this month from Newsweek, the Russian newspaper Izvestia reported that as many as 98% of Chinese banks are refusing Chinese yuan payments from Russia.

Hudson Institute’s Asher said even more critical than the Russian use of yuan is the use of U.S. dollars in Beijing-Moscow transactions through the Hong Kong Monetary Authority’s Clearinghouse Automated Transfer Settlement System (CHATS), a payment system used by banks such as HSBC that trade “hundreds of billions of dollars a year.”

“It can settle transactions in a way that is not visible to the U.S. government,” Asher said. “I’m talking about U.S. dollar reserves that are not in the United States, that are not controlled by the U.S. government, that we don’t have good visibility on, and Hong Kong is providing that financial service.”

The Hong Kong government has said it does not implement unilateral sanctions but enforces U.N. sanctions at the urging of China, according to Reuters.

William Pomeranz, an expert on Russian political and economic developments at the Wilson Center, said that despite Beijing’s and Moscow’s talk this week about financial and economic cooperation, “China does not want to get onto the bad side of European and American markets” and will not risk its economic ties with the West “just to help Russia in a problem that, quite frankly, is of Russia’s own making.”