China plans to cap the annual salaries of financial workers at around 3 million yuan (US$412,460), as the government doubles down on its campaign to eradicate extravagance and hedonism from the industry and narrow the wealth gap amid a persistent downturn in economic growth, according to people familiar with the matter.

The limit will be applied to all state-backed brokerages, mutual fund firms and banks, except financial institutions backed by private investors, the sources said, adding that the information is not meant to be made public.

The measure will be applied retroactively, meaning those who earned more than 3 million yuan over the past few years will probably have to return the excess money to their companies, the sources said.

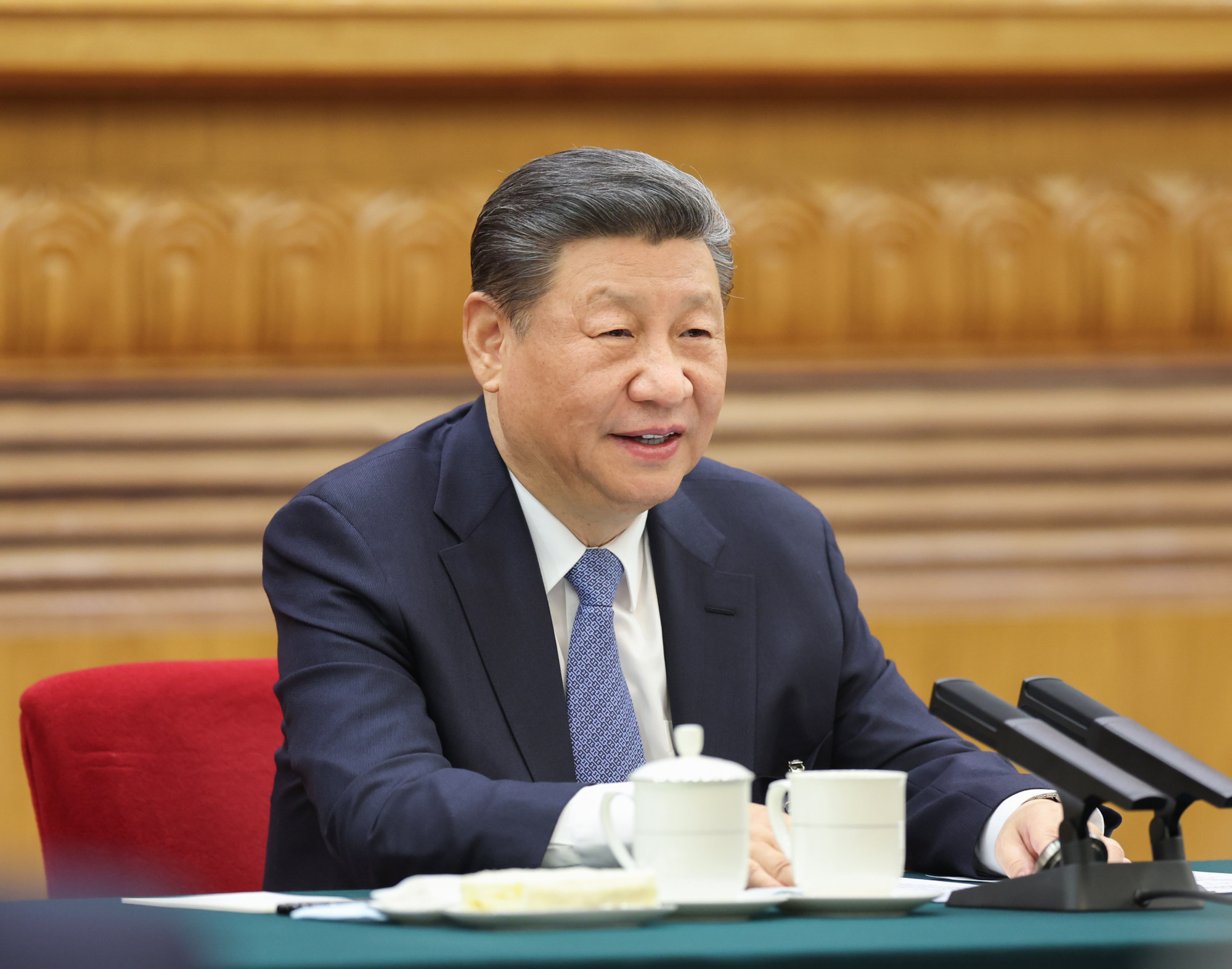

The move is the latest in a series of steps to align with President Xi Jinping’s initiative of common prosperity, which stresses even wealth distribution at a time when the nation is facing economic headwinds.

“The financial industry hasn’t done much to contribute to the real economy in recent years and the industry’s image isn’t that good among the public,” said Dai Ming, a fund manager at Huichen Asset Management in Shanghai.

The pay cap may also have something to do with the fiscal stress facing the government, which is seeking to diversify revenue sources amid a decline in tax collections and land sales, Dai added.

A clutch of Chinese listed companies said last month that they may have to make tax payments dating back from three decades ago, with the state tax bureau subsequently denying that it was taking retroactive action.

Some big financial companies, including top mutual-fund firms, have stepped up scrutiny of expense reimbursements as these are used as a covert form of salary payments to circumvent regulatory oversight, according to one source.

Some big brokerages have already worked out measures to implement the salary cap, while the rest have no plans in place yet, said another source.

While Xi has stressed the significance of the financial industry, which he wants to build into a global powerhouse, the sector has come under increased regulatory surveillance in recent years as part of the Communist Party’s anti-corruption drive.

Apart from the government crackdown, the shrinking profitability of the financial industry, which has been battered by a three-year bear market and a slumping property market, has also prompted companies to tighten their budgets and refrain from doling out hefty pay increases and bonuses.

The average wages at Citic Securities, China’s biggest brokerage, fell by 5.3 per cent to 792,000 yuan last year, while the pay of its chairman Zhang Youjun dropped to 5.05 million yuan from 5.6 million yuan the previous year, according to data compiled by Wind and the company’s annual reports.

The first-quarter profit of 51 publicly traded Chinese brokerages fell by an average 23 per cent from a year earlier as revenue decreased from the investment banking business, while the net incomes of 37 listed banks slipped 0.7 per cent on shrinking net-interest margins, according to brokerage reports.

The outlook for the financial industry may not improve immediately, as the rebound in the yuan-denominated stock market falters and the downturn in home prices continues amid a patchy economic recovery.

The latest official data showed that China’s manufacturing industry shrank for a second consecutive month in June, highlighting that more easing measures will be needed to revive growth.

“Judging from the public’s perspective, the pay cut and cap is justified and reasonable,” said Wang Chen, a partner at Xufunds Investment Management in Shanghai.

“We’ve seen a constant decline in the profit margins of the financial industry in recent years, so the industry salary should also return to the social average level, underscoring equality in society.”