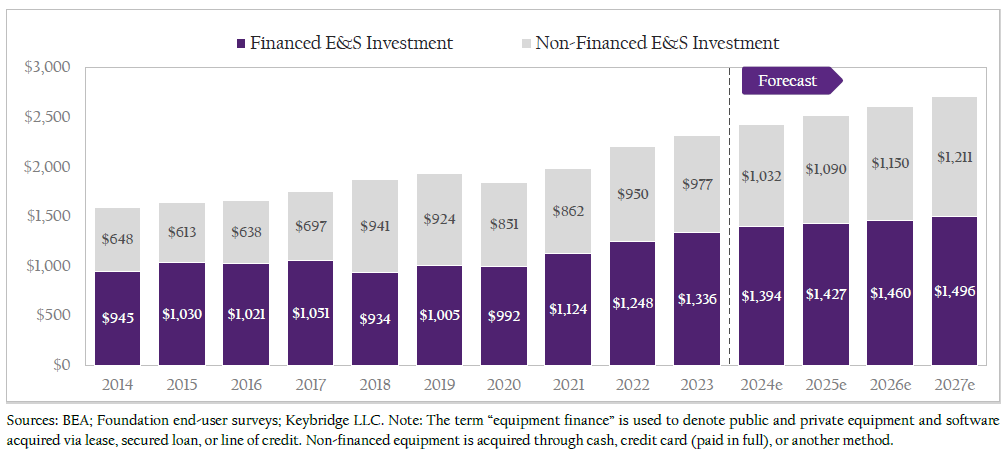

WASHINGTON, Oct. 28, 2024 (GLOBE NEWSWIRE) — The equipment finance industry expanded to an estimated $1.34 trillion in 2023—a new all-time high—with 82% of end-users using some form of financing to fund their equipment and software (E&S) acquisitions, according to an end-user survey from the Equipment Finance Industry Horizon Report 2024. The report, which was released today by the Equipment Leasing & Finance Foundation and prepared by Keybridge, also reveals that approximately 57.7% of the $2.3 trillion (nominal) in E&S investment in 2023 was financed.

The Horizon Report focuses on the Foundation’s biennial survey of equipment end-users, which was conducted this summer. Using data collected through the survey, the Foundation estimates the current size of the equipment finance industry, assesses the propensity to finance private sector equipment investment for key equipment verticals, and forecasts end-user plans to acquire and finance equipment in 2025.

Leigh Lytle, President of the Foundation, and President & CEO of the Equipment Leasing and Finance Association, said, “The trillion-dollar equipment finance industry has always been the backbone of capital investment, which is a critical component of the U.S. economy. This Horizon Report clearly shows the extent to which businesses and other organizations rely on commercial financing with the majority of public and private sector capital expenditures acquired through loans, leases, or lines of credit. Our industry financed supply chains and supported business growth that helped stave off recessionary pressures amid elevated inflation and high interest rates, enabling equipment and software investment to expand in 2023. The report also indicates the industry is well positioned to support forecasted increases in equipment and software, including innovative, high-growth areas like generative AI, equipment-as-a-service (EaaS) subscription-based models, and climate financing. This report delivers must-have insights that will help business leaders and decision makers stay ahead of the game.”

Highlights from the Horizon Report include:

- Equipment finance industry growth. According to official government figures, E&S investment (both financed and not financed) expanded by a solid 5.3% in 2023 to $2.3 trillion (nominal). The Foundation’s estimate that approximately 57.7% of this investment (and 64.2% of private sector investment, per the end-user survey) was financed yields an estimated industry size of $1.34 trillion. This figure represents 7.1% nominal growth for the equipment finance industry compared to 2022.

- End-user reliance on financing. The end-user survey revealed that 82% of respondents who acquired equipment or software in 2023 used at least one form of financing to do so. This represents a slight uptick from the 79% of respondents indicated in the 2022 survey.

- Increase in equipment and software acquisitions in 2025. End-users were roughly three times more likely to believe their E&S acquisitions will increase in 2025 (42%) versus decrease (15%). The most commonly selected verticals among end-users who plan to boost acquisitions were software, computers, office equipment, and communications equipment, reflecting the importance of these verticals to business operations in which hybrid/remote working arrangements, online sales channels, and incorporating AI and other new technology tools are critical. Importantly, more than three-fourths of end-users expect to use a financing method to cover at least a portion of the cost to acquire this equipment.

- Emerging industry growth drivers. Tracking emerging trends in the equipment finance industry, the Foundation’s 2024 survey finds that currently, 42% of E&S end-users use generative AI in their businesses, and an additional 42% indicated that they intend to do so over the next two years. Regarding EaaS, half of end-users already use a subscription-based model for equipment and an additional 23% indicated that they intend to pursue this option in 2025. Meanwhile, nearly one-third of E&S was acquired to support energy-related, climate-related, or other environmental goals and pledges in 2023. With global climate finance expected to grow to $9 trillion by 2030, this is likely to be a key area of growth for the industry in the years ahead.

- Top methods of payment to acquire equipment and software. According to the end-user survey, the most important payment method used by businesses to acquire equipment and software in 2023 was leasing (26% of total acquisitions), followed by secured loans (16%), lines of credit (14%), and unsecured loans (8%). Among non-financed acquisitions, paid-in-full credit card purchases were the most prevalent payment method (20%) followed by cash (16%).

- Top reasons for financing. The top reasons end-users chose to finance their E&S acquisitions were “optimization of cash flow” (62%), “protection from equipment obsolescence” (55%), and “tax advantages” (51%).

Zack Marsh, Chair of the Equipment Leasing & Finance Foundation and SVP, Accounting and Analysis, AP Equipment Financing, said, “The Horizon report offers a detailed look at equipment acquisition and financing decisions for specific equipment verticals and industries, the key factors influencing the decision to use financing, and how financing decisions are likely to evolve over the next year. Looking ahead, both the report end-user survey and the overall economy provide reason to be optimistic about the industry’s prospects in 2025. Equipment finance industry executives can use the report information to better position their businesses for faster growth.”

Equipment Finance Industry Size, 2016–2027, Billions of Dollars (Nominal)

About the study

The Industry Horizon Report can be used in combination with other Foundation reports, including the quarterly Equipment Leasing & Finance U.S. Economic Outlook, the monthly Foundation-Keybridge U.S. Equipment & Software Investment Momentum Monitor, and the annual Industry Future Council report, to better understand the current and near-term economic conditions and other relevant trends facing the equipment finance industry.

How to access the study

The 2024 Equipment Leasing & Finance Industry Horizon Report is available for free download at https://www.leasefoundation.org/industry-resources/horizon-report/.

All Foundation studies are available for free download from the Foundation’s online library at http://store.leasefoundation.org/.

JOIN THE CONVERSATION

X/Twitter: https://twitter.com/LeaseFoundation

LinkedIn: https://www.linkedin.com/company/10989281/

Vimeo: https://vimeo.com/elffchannel

ABOUT THE FOUNDATION

The Equipment Leasing & Finance Foundation is a 501c3 non-profit organization that propels the equipment finance sector—and its people—forward through industry-specific knowledge, intelligence, and student talent development programs that contribute to industry innovation, individual careers, and the advancement of the equipment leasing and finance industry. The Foundation is funded through charitable individual and corporate donations. Learn more at www.leasefoundation.org.

Media Contact: Kelli Nienaber, knienaber@leasefoundation.org

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/0fc0b66b-b5a6-4b2c-964d-6dcd71560b44