Mutuum Finance (MUTM) is capturing significant attention in the crypto market as investors seek high-yield opportunities. The opening phase of the presale offered tokens at $0.01, and today, phase 6 has surged to $0.035, reflecting a 250% gain for early participants.

Phase 6 is now 45% filled, raising $16,250,000 and attracting 16,570 holders since presale launch. The current momentum shows a rapid sellout, as phase 7 is set to increase prices to $0.04, with the official launch at $0.06. Early buyers could see a return on investment of 367%, highlighting MUTM’s growth potential.

Mutuum Finance Presale Performance

The presale has advanced steadily through eleven phases, with the current phase offering strategic entry for investors. Phase 6 provides discounted access before price increments in phase 7.

Investors are responding to MUTM’s utility and roadmap, which includes lending and borrowing protocols on Ethereum, a future Layer-2 expansion, and an over-collateralized USD-pegged stablecoin. The dual-market approach, Peer-to-Contract for pooled liquidity and Peer-to-Peer for custom loans, has enhanced user flexibility.

Additionally, the team has introduced a leaderboard dashboard rewarding the top 50 holders with bonus tokens, incentivizing long-term participation.

Investors are also encouraged by Mutuum Finance’s robust security framework. The Certik audit has been finalized, awarding a 90/100 token score, indicating strong security measures. Complementing this, the Bug Bounty Program offers $50,000 USDT for vulnerabilities across critical, major, minor, and low tiers.

A $100,000 MUTM giveaway is ongoing, split among 10 winners, each receiving $10,000, providing extra engagement and token distribution. Participants can join by submitting wallet addresses, completing quests, and meeting a $50 minimum presale investment requirement.

Mutuum Finance Price Projection

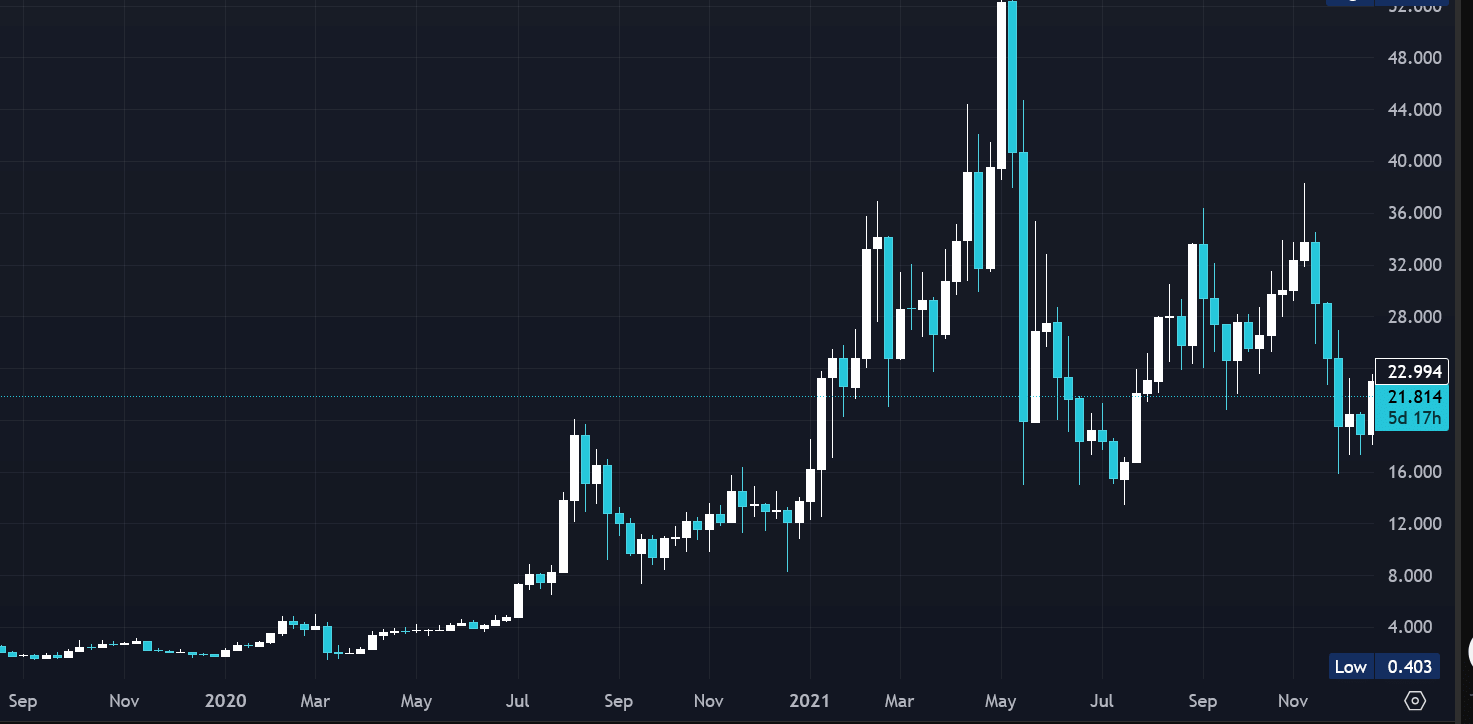

Mutuum Finance (MUTM) is displaying strong market dynamics. Historical trends suggest tokens with steady early growth often experience sharp appreciation at launch. For context, Chainlink (LINK) rose from $0.17 in 2020 to $52 in 2021 within roughly 12 months, delivering over 30,000% ROI.

MUTM’s trajectory mirrors this pattern with early presale gains and structured price increments. By 2027, MUTM could potentially reach $4.2 if adoption continues steadily, paralleling LINK’s rapid early surge. This estimate accounts for liquidity management, active borrowing, and collateralized lending, which drive platform utilization and token demand.

Consequently, investors entering now at $0.035 could achieve a 367% ROI once trading begins at $0.06, underscoring the opportunity in phase 6.

Token Utility and Market Mechanics

Mutuum Finance leverages advanced liquidity models, including stable and dynamic interest rates, overcollateralization, and enhanced collateral efficiency. These features maintain system solvency and support lending growth. Users can deposit assets to earn interest via mtTokens or borrow against holdings without relinquishing custody.

Deposit caps, borrow caps, and liquidation parameters mitigate risks, while price discovery relies on Chainlink oracles and fallback feeds to ensure accurate valuations. Stable interest rates provide predictability, while variable rates adjust dynamically, keeping the protocol balanced even in volatile markets. These mechanics ensure MUTM remains integral to platform operations and adoption.

Investor Opportunities and Engagement

Phase 6 is selling rapidly, and the remaining tokens offer a rare chance to secure early gains. Mutuum Finance has launched its presale rewards, security measures, and leaderboard incentives, reinforcing investor confidence.

The dual-market system and planned stablecoin deepen utility, positioning MUTM as a versatile DeFi asset. Investors can access transparent returns, robust protocol design, and community-driven engagement while leveraging early presale prices before the next phase.

Tracking Mutuum Finance Price

Mutuum Finance (MUTM) is establishing itself as a noteworthy altcoin for crypto investors. Early presale performance, security audits, dual-market lending, and strategic price increments indicate strong potential.

The token’s structured growth, paired with functional utility, makes it a significant option for those seeking what crypto to invest in today. Investors have a clear opportunity to participate before prices rise further.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance