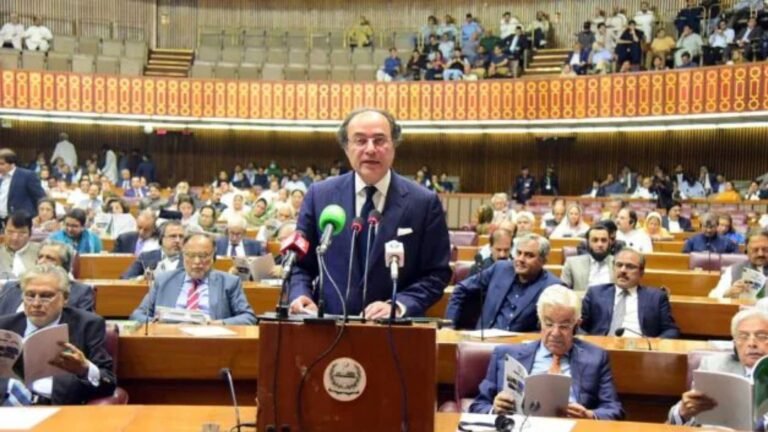

Pakistan’s Finance Minister Muhammad Aurangzeb on Sunday conceded that the people were stressed due to new taxes imposed in the budget after his revenue measures were criticized by almost everyone.

His comments came as President Asif Ali Zardari accorded his approval to tax-laden Finance Bill 2024 on the advice of the Prime Minister under Article 75 of the Constitution. The bill would be effective from July 1, according to the press release by the President Secretariat.

The National Assembly on June 28 passed the budget as a bill with certain amendments, but it kept unchanged the target of the gross revenue receipts which have been estimated at Rs 17,815 billion, including Rs12,970 billion in tax revenues and Rs 4,845 billion in non-tax revenue.

Addressing a press conference, Aurangzeb said he understood that the salaried class was particularly experiencing financial strain from new taxes. He pledged to offer relief to salaried individuals once any financial respite becomes feasible.

“I completely understand the stress that people from different sectors feel about additional taxes; I completely empathise and sympathise, but we need to work for it,” he said.

He also argued against the category of “non-filers,” expressing confidence that government initiatives will eventually make the category obsolete.

He said that the tax on retailers will start from July 1 and people feel pressured due to the new taxes but it was important to get rid of the IMF programs in future. He said “Forty-two thousand retailers were registered till yesterday” adding if a company makes a loss, it will not be taxed.

According to the minister, there has been a consultation with the IMF regarding the budget. “We cannot go ahead without a new IMF program at present and even the critics know this,” he said.

Aurangzeb said that the government was going to do a long-term program with the IMF and an agreement with the IMF was expected in July.

He said that the government made a cut in the Public Sector Development Program (PSDP) and it would go for Public Private Partnership instead of PSDP like is being done in the Sindh province.

According to Aurangzeb, the construction sector is also being brought into the tax net.

The finance minister claimed that economic stability was coming in the country and the inflation rate had been reduced from 38 to 13 per cent and due to economic stability, the confidence of foreign investors was being restored. He said micro stability is the biggest challenge right now.

He said that the government was focusing on taking the tax-to-GDP ratio to 13 per cent in the next three years and carrying out reform in the energy sector and also plugging the theft and leakages in the system.

“The work that we have to do is how to stop leakages, corruption and theft, and concrete steps are being taken on this issue through digitization of the Federal Bureau of Revenue (FBR). The aim is that the fewer people involved in the process, the less corruption there will be,” he said, adding that currently both the FBR officials and the taxpayers are involved in the theft.

He said that Pakistan’s foreign exchange reserves were $9 billion. He said Rs1 billion have been approved by the World Bank for Dasu hydroelectric power project and another $400 million by IFC for Pakistan Telecommunication Corporation Limited.

The federal minister claimed that the ministers have refused to take salaries while “we are paying our utility bills ourselves”.

First uploaded on: 30-06-2024 at 21:00 IST