(Bloomberg) — Mexico’s finance minister downplayed the idea of a major reworking of the state oil company’s debt in the near future, saying no “large operations” are currently planned.

Most Read from Bloomberg

The government will wait to plan any moves for Petroleos Mexicanos until after the June 2 presidential election in coordination with the incoming administration’s team, Rogelio Ramirez de la O told Bloomberg News. Even then, a new strategy could take months or years to implement, he said.

“We can’t speculate how it would be done, by what amount,” he added. “The business plan must be determined with a high level of political support by whoever is responsible for the next government. We can discuss the financial aspects, but only when the outlook for a solution is determined.”

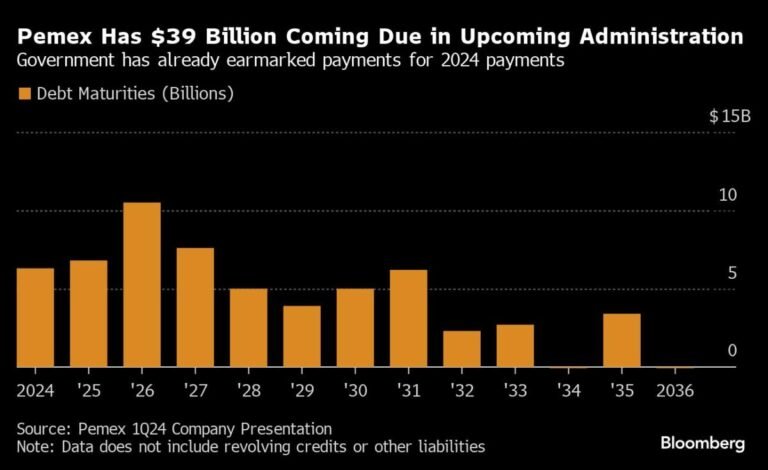

The comments are a reality check to investors who anticipated that Mexico’s new president could inherit a sleeker, less leveraged version of Petroleos Mexicanos. The oil producer’s bonds rallied earlier this month after Bloomberg reported on an investor meeting in New York with a top finance ministry official who discussed the government’s options to absorb as much as $40 billion in Pemex debt.

Bond prices should “normalize” as investors come to understand that no major operation is imminent, said Ramirez de la O. Leading candidate Claudia Sheinbaum has said she would like him to stay in the role initially if she wins the election, and he has previously said it would be “an honor” to serve in any circumstance.

“I would by no means take for granted the next team will resolve this in the first half of the year, in the second half of the year,” he said. “I don’t dare say if addressing these amounts is viable in six years or however many years. It’s a gigantic amount.”

The incoming president will need to help determine the best strategy for Pemex debt, Ramirez de la O said. That could include a bond repurchase, among many other potential mechanisms, he said.

Any banks that are discussing large Pemex debt operations with clients are doing so “at their own risk and without our approval,” he added. If the ministry did go forward with a strategy that involves repurchasing the bonds, it would choose institutions with large balance sheets.

The ministry received queries from credit-rating companies following Bloomberg’s report on the New York investor meeting, Ramirez de la O said.

“Usually rating agencies bring questions when the time is right,” he said. “Now the questions are coming ahead of time. We need to be very responsible.”

Pemex’s financial strategy must go hand-in-hand with a business strategy, he said. The ministry is well aware of the case of South African utility Eskom, where a financial strategy of backing the company with a sovereign guarantee was not followed by a long-term business strategy.

President Andres Manuel Lopez Obrador, who will leave office at the end of September, has focused on investing in refineries to boost Pemex’s revenue. The Dos Bocas refinery, one of his signature infrastructure projects, is still under construction after receiving a final disbursement in 2023, de la O said.

Pemex bonds drifted lower on Friday following sharper losses on Thursday amid a global selloff of riskier assets. William Snead, an analyst at Banco Bilbao Vizcaya Argentaria in New York, said hedge funds have been cashing in on the assets following a rally in May that was boosted by comments from both Sheinbaum and the finance officials on potential plans for Pemex financing. Investors are betting that Mexico will continue to support the company for at least the next six years, he added.

“Finance Minister Ramirez de la O’s comments are fair and expected,” Snead said. “Any meaningful announcements are likely to take place after the elections.”

–With assistance from Michael O’Boyle.

(Updates with analyst comment in thirteenth paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.