The importance of climate finance in driving green investments has never been more pronounced as highlighted by Avangrid’s True North solar project in Falls County, Texas. The project, benefiting from subsidies under the Inflation Reduction Act, reflects a growing trend towards climate-friendly initiatives supported by government incentives.

However, meeting global climate goals requires significant scaling up of investments in renewable energy, energy efficiency, and ecosystem restoration. The International Renewable Energy Agency estimates that an average of 11,000 gigawatts of renewable power capacity needs to be built annually until 2030, calling for substantial financial commitments.

Bridging the Climate Funding Gap

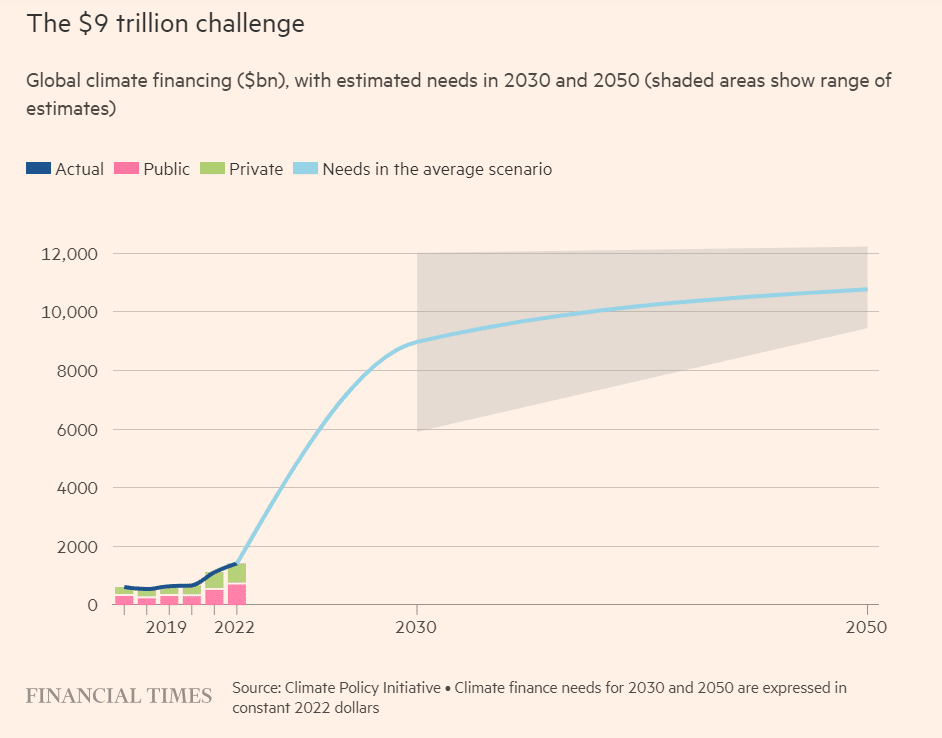

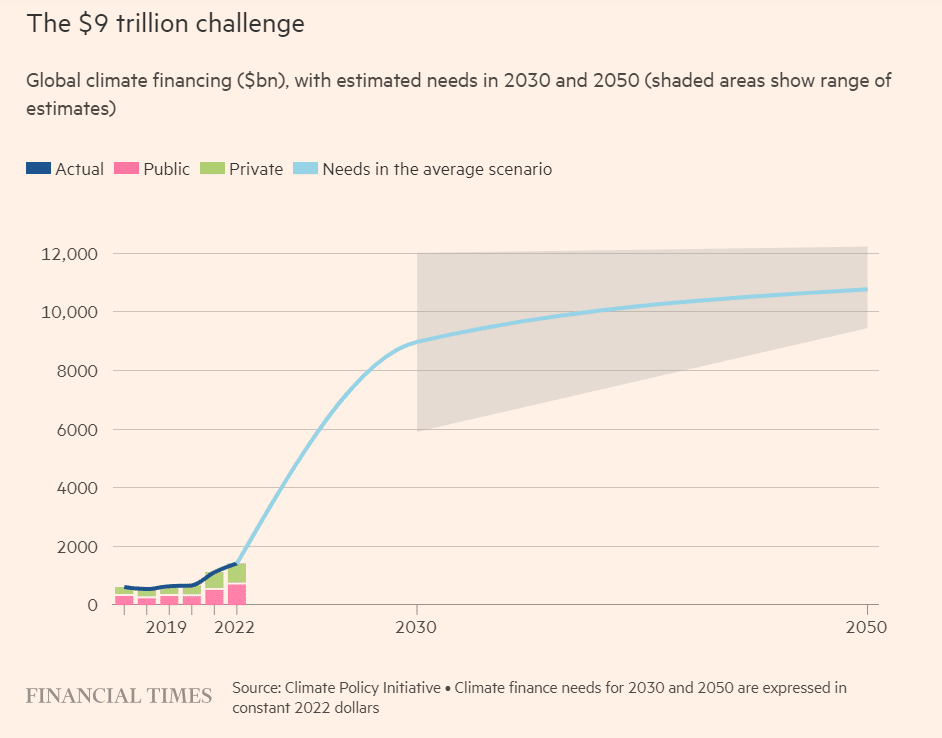

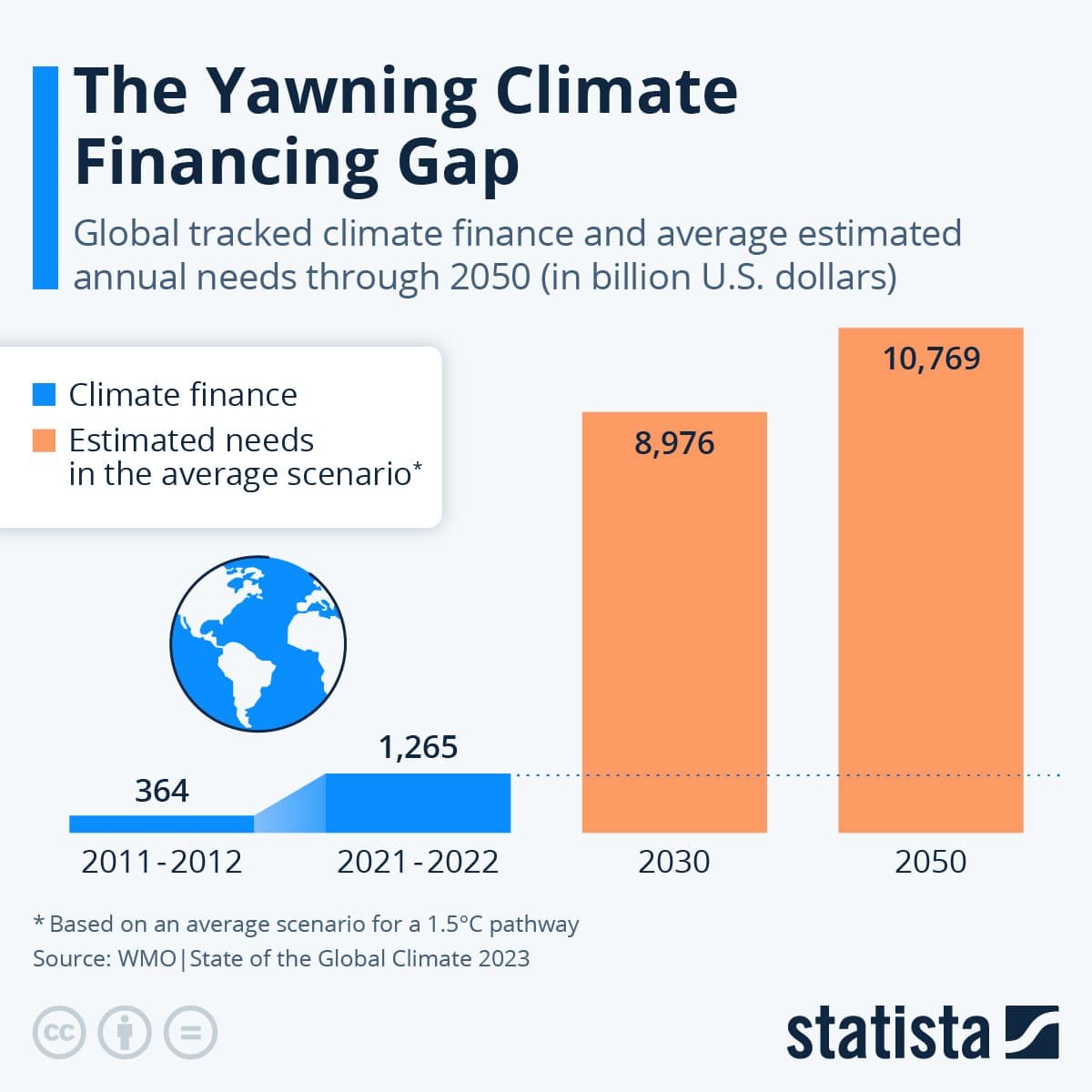

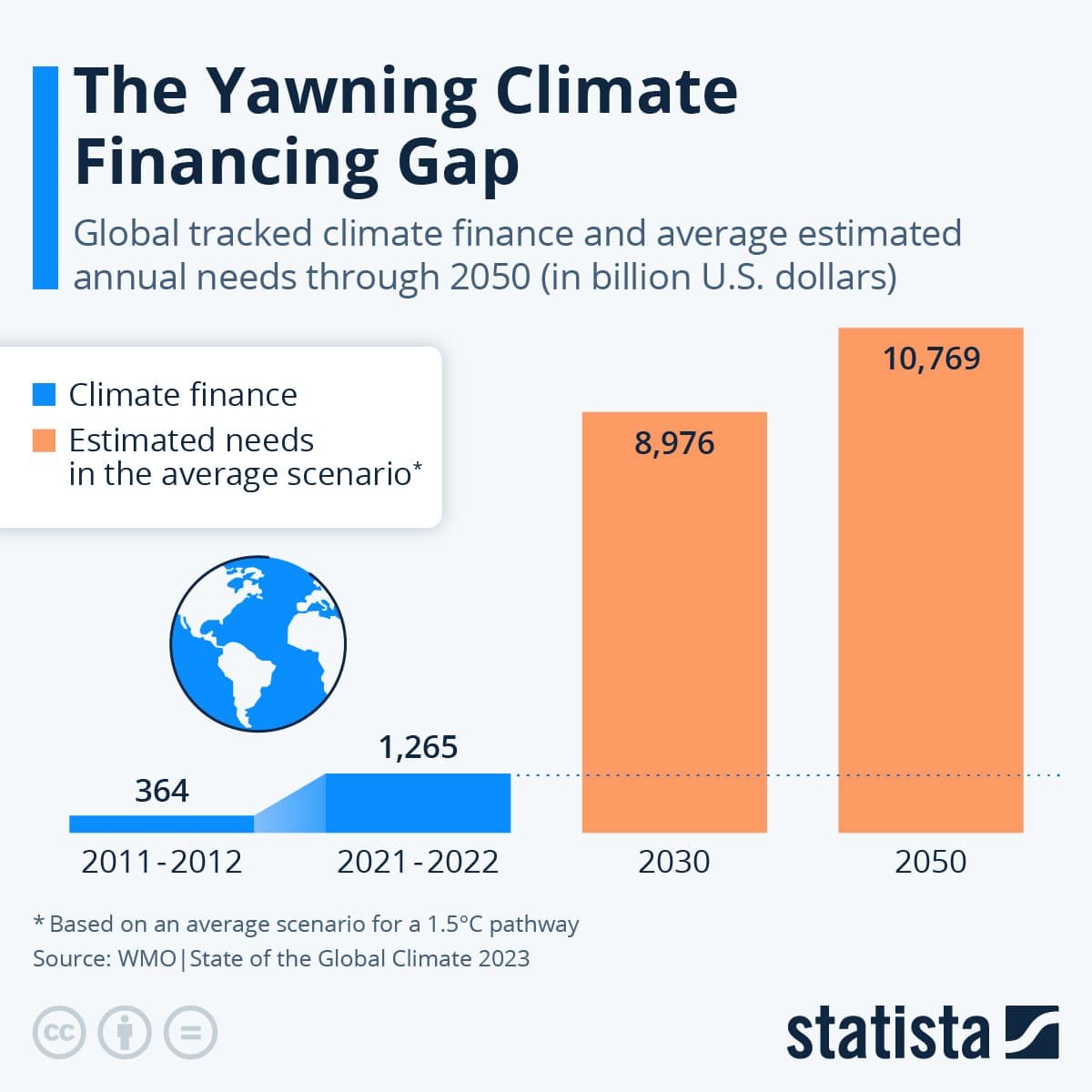

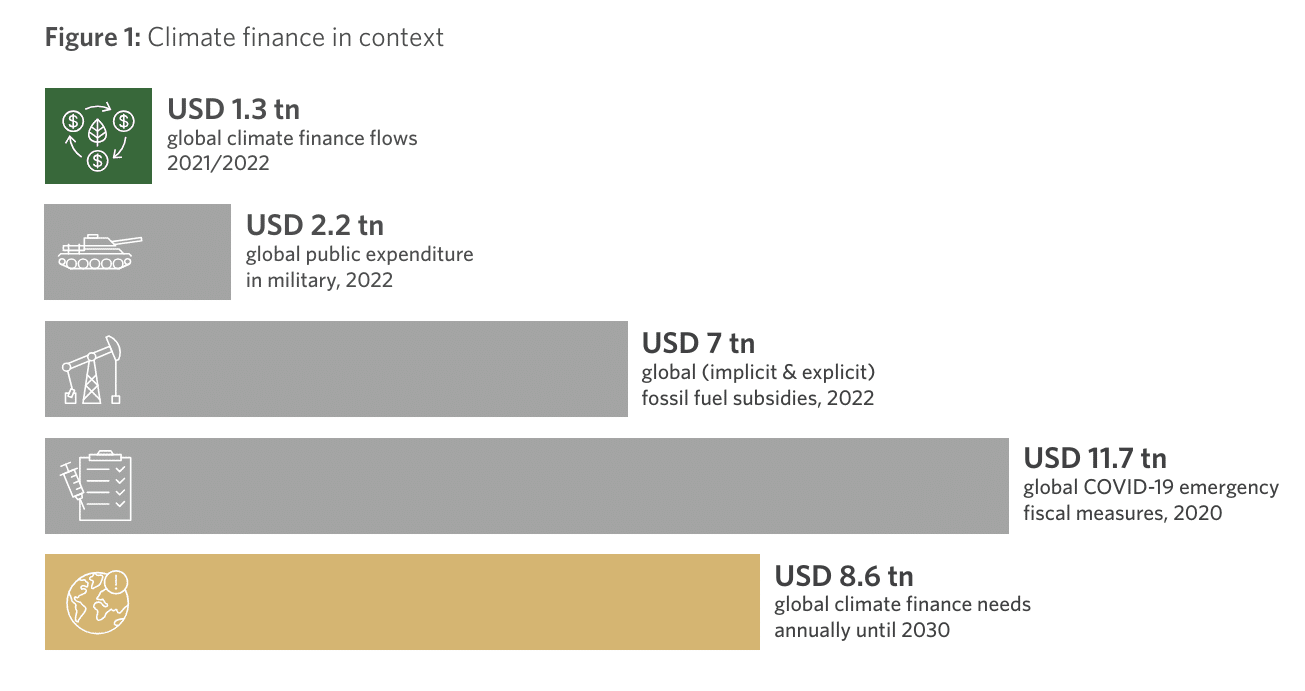

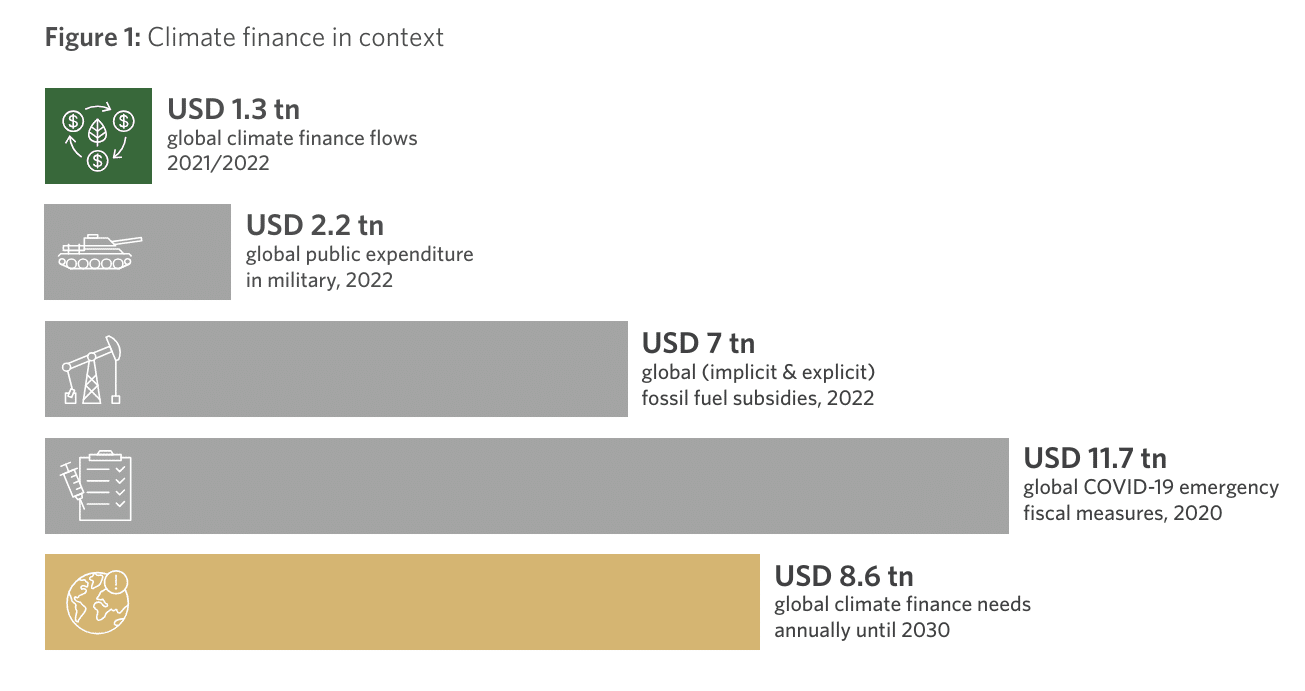

According to the Climate Policy Initiative, global climate finance needs to increase to about $9 trillion annually by 2030 to limit average global temperature rises in line with the Paris Agreement. Europe alone requires €800 billion in energy infrastructure investment to meet its 2030 climate targets. The region needs a total of €2.5 trillion needed for the green transition by 2050.

In 2021-22, climate financing reached almost $1.3 trillion, a significant increase from $364 billion in 2011-12. Most of this growth is attributed to mitigation finance, particularly in renewable energy and transport sectors. Notable increases are in clean energy investments in China, the United States, Europe, Brazil, Japan, and India.

However, adaptation finance lags behind, reaching only $63 billion in 2021-22. This is far from the estimated $212 billion needed by developing countries alone by 2030. Adaptation finance aims to enhance communities’ resilience to climate hazards, but funding falls short.

Analysts estimate that the $9 trillion has to rise to over $10 trillion annually from 2031 to 2050.

To address this financing gap, governments are exploring various mechanisms, including wealth taxes, levies on shipping, and corporate taxes. For instance, the US plans to raise $300 billion over a decade through a minimum tax on corporate profits and a stock buyback tax to fund climate initiatives.

Ramping Up Climate Finance

The urgency of climate finance has been underscored by international commitments to phase out fossil fuels and triple renewable energy capacity by 2030.

The upcoming COP29 conference in Baku, Azerbaijan, is expected to focus extensively on climate finance, particularly establishing global goals to support developing nations’ transition efforts.

The private sector has a significant role in financing the green transition (70%), but the public sector must also contribute. The International Energy Agency suggests that public finance will need to cover about 30% of global climate finance. Public funds should primarily focus on critical infrastructure and adaptation measures.

Governments are exploring various revenue-raising options, including carbon pricing mechanisms and taxes on fossil fuel extraction. Ireland’s carbon tax, for example, allocates increased revenues to climate-related investments and fuel poverty prevention.

Other countries are considering innovative financing approaches, such as windfall taxes on oil and gas companies and tourism taxes. Additionally, efforts are underway to phase out fossil fuel subsidies, redirecting funds towards climate action initiatives.

Navigating the Climate Financing Maze

Despite the financing challenges, energy strategist Kingsmill Bond argues that capital is available but must be deployed effectively. Intelligent regulation and incentives like the EU’s REPowerEU strategy can mobilize private investments in renewables and drive sustainable growth.

In developing countries, where financial constraints are more pronounced, international cooperation and concessional financing are crucial. Sovereign green bonds and climate finance frameworks aim to mobilize private sector investment and support green projects in emerging economies.

The authors of the CPI’s Global Landscape of Climate Finance 2023 report suggest that closing the funding gap is theoretically feasible, particularly given global spending trends. They point out that while global military spending reached $2.2 trillion in 2022 (SIPRI, 2023), emergency fiscal measures totaling $11.7 trillion were announced globally in response to the COVID-19 pandemic in 2020, according to the International Monetary Fund.

Moving forward, the CPI recommends addressing inequalities in current climate finance distribution. Despite agriculture and industry being significant emission sources, they received disproportionately low funding in 2021-22 relative to their mitigation potential. The report also emphasizes the importance of investing in emerging technologies like battery storage and hydrogen, highlighting untapped investment opportunities.

Ultimately, achieving a sustainable and resilient future requires concerted efforts from governments, businesses, and financial institutions. By shifting financial resources towards climate-friendly investments, the global community can accelerate the transition to a greener economy and mitigate the impacts of climate change.