- The climate crisis is affecting business across industries, and the art market is no exception.

- Art investors, collectors, and curators can take steps to build more sustainable portfolios.

- For more climate-action news, visit BI’s One Planet hub.

In an era when the climate crisis is redefining business across industries worldwide, the art market is also faced with the need to adapt to the effects of rising emissions.

Extreme weather events, temperature fluctuations, and pollution are no longer abstract concerns but tangible threats to the longevity of art collections. Pollutants such as sulfur dioxide and nitrogen oxides, produced from fossil fuel combustion, can cause pigments to degrade more rapidly than in controlled environments. This could reduce both the lifespan and the value of artworks.

As a result, some investors, collectors, and gallery curators in the art market are placing emphasis on environmental responsibility when assembling their portfolios — part of a practice called “impact investing.”

Hauser & Wirth, a gallery at the forefront of this movement, has set a new precedent for major galleries by committing to reduce at least 50% of its greenhouse-gas emissions by 2030 by adopting renewable energy, reducing freight travel, and collaborating with climate-conscious artists who promote sustainable practices in the industry. The gallery’s approach exemplifies how investors in the art world can adapt to and mitigate the effects of the climate crisis when curating their collections.

From investing in artists who also prioritize environmental awareness to adopting renewable energy in art facilities, here are four green strategies for building a low-carbon art portfolio.

Invest in artists who promote environmental awareness

Some artworks that tackle environmental themes have been rising in market value, as more collectors and galleries recognize the growing importance of backing artists whose work resonates with the climate priorities of younger generations.

The value of art is often linked with its cultural relevance — aligning a portfolio with social-impact initiatives can elevate its worth by tackling current issues.

For instance, David Bohnett, a philanthropist and tech entrepreneur, is known for his contemporary art collection focused on social justice and sustainable art. His collection features notable figures like Keith Haring, an artist who championed LGBTQ+ rights, and Robbie Conal, known for his street art critiquing societal and environmental injustices. Bohnett’s portfolio, estimated to be worth $300 million, reflects a broader trend in which a growing demand for civic art, especially in niche markets, can drive value appreciation.

Reduce carbon emissions in transportation

From public exhibits to private collections, the global transportation of art can significantly increase the carbon footprints of galleries, collectors, and investors — especially when air travel is involved.

Our World in Data found that air travel is one of the most carbon-intensive shipping methods. Exploring transportation alternatives offers collectors an opportunity to make a substantial impact.

The art collector Sibylle Rochat opts for consolidated land transport that combines multiple shipments into one vehicle and sea freights that use fuel-efficient ships for long distances, both of which can significantly reduce carbon emissions.

Transition to renewable energy for art facilities

Art storage facilities are designed to maintain optimal conditions for artworks, ensuring appropriate temperature, humidity, and lighting to prevent deterioration or damage.

These sites traditionally rely on energy-intensive climate-control systems powered by fossil fuels. By transitioning to renewable energy sources like wind and solar, upgrading climate-control systems for greater energy efficiency, and adopting LED lighting that can cut energy consumption by up to 75%, collectors and gallery curators can reduce the environmental impact of their art storage.

The art collector Patrizia Sandretto Re Rebaudengo is known for her philanthropic work in the arts and sustainability. She plans to transform the small Italian island of San Giacomo into an art center with galleries, performances, and educational programming. The island is set to open to the public in 2026 and will be fully powered by green energy, Sandretto Re Rebaudengo said.

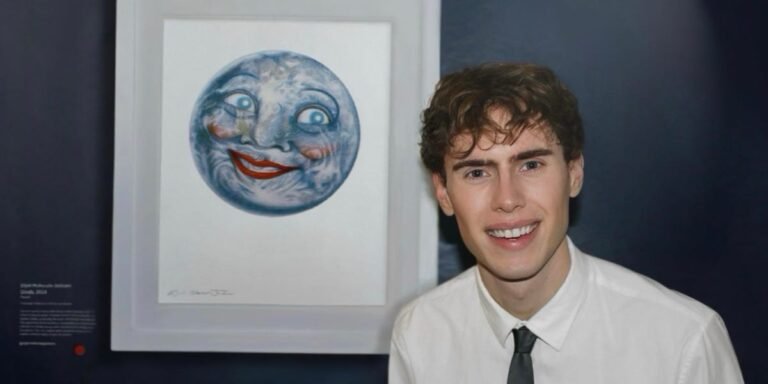

Roberto Serra – Iguana Press/Getty Images

Go digital

The international art circuit consists of global exhibitions, events, and art auctions. It has long relied on extensive travel and foot traffic that can increase the industry’s carbon footprint.

As digital platforms gain widespread adoption, online exhibits present a cost-effective way to diversify investments while reducing transportation and storage needs.

The COVID-19 pandemic prompted galleries like Deitch Projects to adopt digital showcases and online viewing rooms, reducing international travel and reshaping art acquisition practices. The Stephen Friedman Gallery is hosting five online viewing room showcases throughout 2024, bringing in-person exhibitions directly to screens at home.

Collectors, gallery curators, and investors play a crucial role in shaping a sustainable future. The assembly of portfolios that prioritize environmental responsibility actively contributes to a greener legacy that will inspire future generations to take action and stand as a testament to art’s power to shape a better world.

From supporting artists who promote environmental awareness to reducing carbon footprints in operations and embracing digital platforms, collectors, gallery curators, and investors are preserving art and its legacy in their fight to curb the climate crisis.