MyArtBroker, an online art brokerage platform specialising in prints and editions, has unveiled the MAB100 (abbreviated from MyArtBroker 100), a groundbreaking print market index designed to transform the way investors and collectors perceive the secondary art market.

Driven by a team of experts across the art, tech and data industries. The MAB100, powered by MyArtBroker’s proprietary SingularityX algorithm is intended to revolutionise the prints and multiples blue chip art market.

The MAB100 has the potential to offer a level of transparency never seen before in the art world. It is being made freely available to all collectors and industry professionals. Art collectors of all levels of experience can navigate the historically opaque world of art with much more clarity.

What is the MAB100?

The MAB100 is the first dedicated print index specifically designed to monitor the top 100 prints, evaluating their liquidity and market significance based on the total expenditure over the past five years. The MAB100 features works from renowned artists such as Banksy, Andy Warhol, David Hockney, Keith Haring, Roy Lichtenstein, Yayoi Kusama and more.

Prints and editions are the only truly comparable market in the wider secondary art market, but typically aren’t discussed to such a large extent in conversations about “investing in art” whilst offering more affordable entry points into art collecting.

The MAB100 includes, as the name suggests, 100 index constituents ranked by their individual cumulative spending, extracted from real, historic auction sales sourced from over 350 auction houses, as well as 40 other data inputs which affect pricing.

Uniquely compared to other art market trackers, the MAB100 goes beyond historical pricing by considering private sales pricing, valuations, artists’ trends, and related print series, including prices for alternative colourways, artist’s proofs, printer’s proofs and corresponding portfolios. The cumulative spend is recalculated on a quarterly basis (i.e. the constituents of the index are rebalanced every quarter to reflect the latest values and make sure we track the prints of most up-to-date ‘interest’).

By incorporating diverse data points, the algorithm builds a comprehensive picture of an artwork’s value. It strives to include overlooked data points, such as the last bid price on unsold works, the sell-through rates within series, and all key markers towards a work’s value.

Why is the MAB100 disruptive?

The art market, especially in the prints and multiples blue chip segment, has been shrouded in opacity and uncertainty. The MAB100 powered by SingularityX aims to disrupt the art world by bringing a never publicly accessible blend of transparency, data-driven insights, and liquidity to this enigmatic market.

The MAB100 seeks to solve several issues collectors, or art sellers, encounter when looking to make trading decisions.

The MAB100’s data-driven approach fosters credibility and trust within the art world, erasing the shadow of opacity and enhancing the market’s reputation.

One of the primary issues is the lack of visibility regarding the true market value of art. Owners may possess valuable pieces, from Banksy and Warhol to Lowry and Picasso, but struggle to understand why their print is worth a certain amount. Current market information often boils down to what similar pieces are being auctioned for, leaving collectors in the dark.

The MAB100 powered by SingularityX acts as a market maker, a crucial role in illiquid markets like art. By providing bid and ask prices, coupled with the trading floor which shows supply and demand in the private marketplace, it injects liquidity into the market, bridging the gap between buyers and sellers. The product benefits both buyers and sellers, enhancing transparency – and essentially giving collectors ‘inside information’.

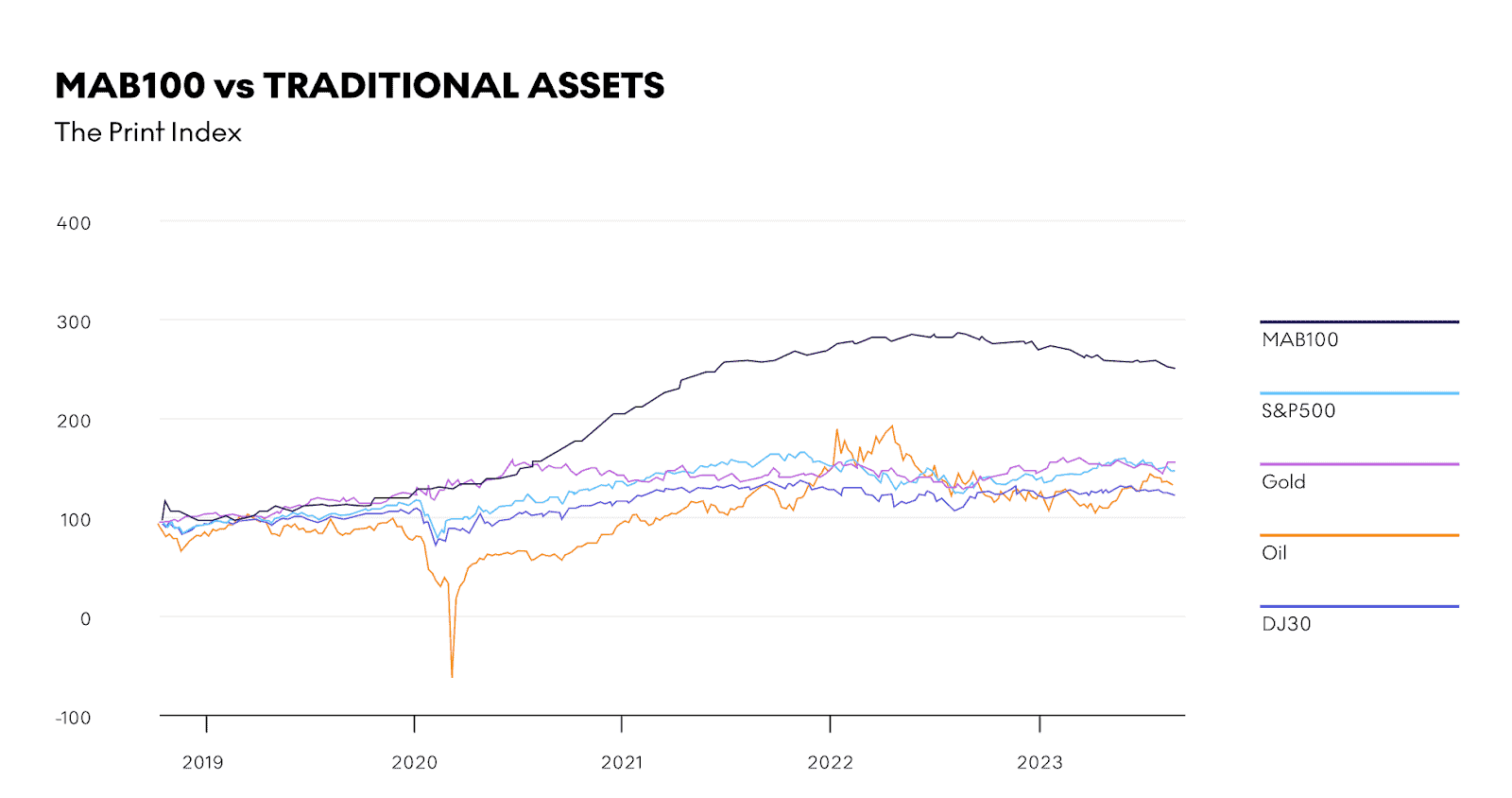

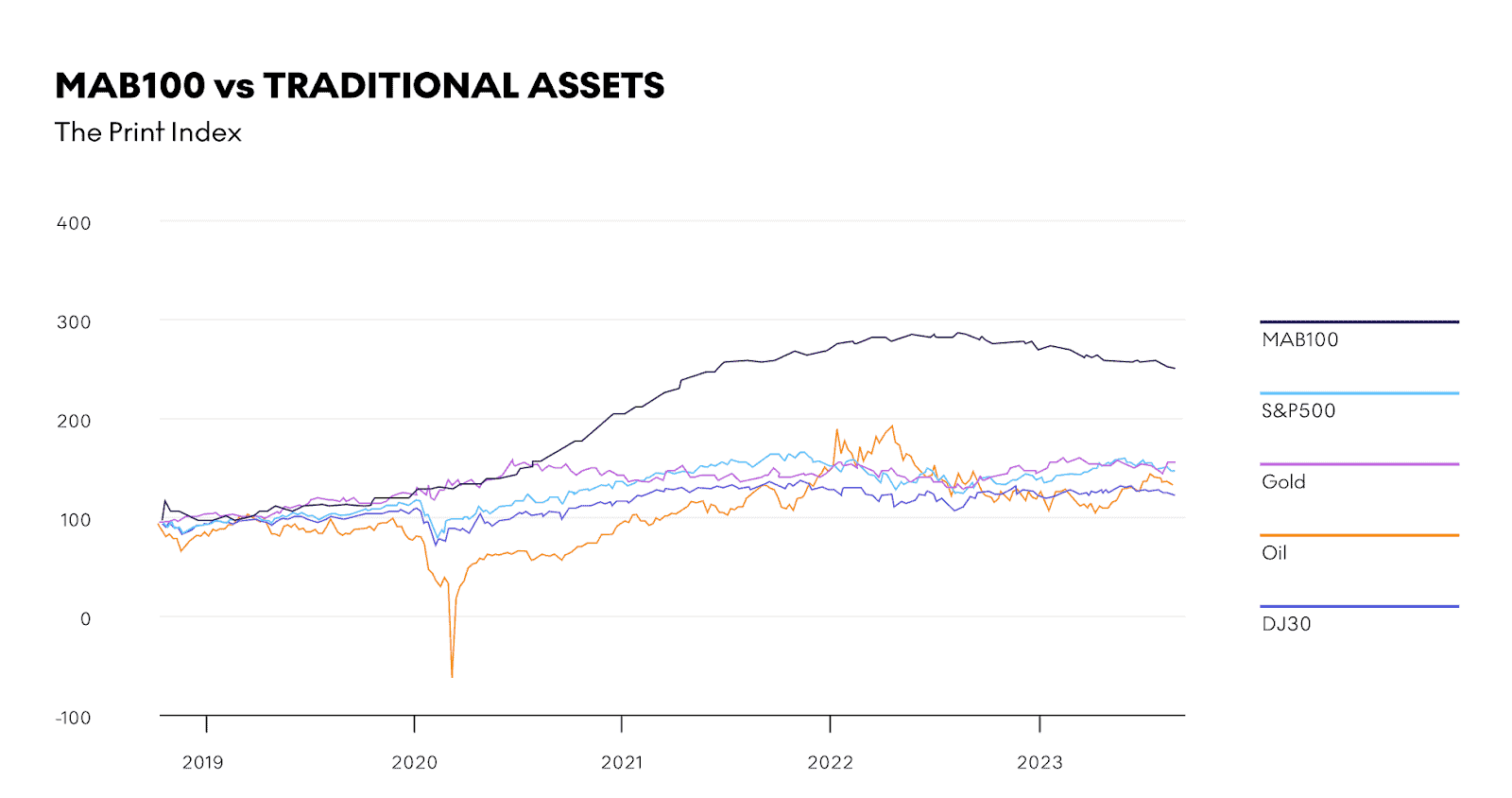

Art outperforms traditional assets in 2023

Unlike traditional assets, art maintains a stable value regardless of market fluctuations, a quality starkly evident during the 2020 pandemic-induced economic downturn. While stocks and other investments experienced volatility, the art market remained resilient, reaching its zenith in 2022 despite uncertainties. The MAB100 print index serves as a reliable benchmark, providing financiers with a dependable tool for investment decisions.

The index operates on a quarterly update schedule, offering real-time insights. With its user-friendly interface and sophisticated technology, the MAB100 empowers a wide range of professionals.

Investing in top ranking artists worldwide with precision data

MAB100 includes meticulous curation of the most coveted blue chip artists. This selection isn’t arbitrary; it is an outcome of rigorous analysis, spotlighting artists with exceptional print sales and proven resilience even in economic downturns.

The MAB100 primarily features Post War and Contemporary artists. These artists serve as reliable benchmarks for comparable markets. In 2022, the Post War category accounted for 52% of prints and editions auctions sales. This year, there’s been significant growth in markets attributed to iconic figures such as Andy Warhol and Jean-Michel Basquiat, both falling within the Post War genre. Additionally, David Hockney is anticipated to significantly contribute to the Contemporary category. MAB100 allows users to make informed decisions, backed by data that was once the preserve of industry insiders.

MyArtBroker is disrupting and transforming the art market via its own fintech product suite by making the dealing of art more accessible, transparent, efficient, and diverse. From bespoke portfolio management to in-depth value data, both of which the firm specialises in within the 100% ownership space, the buying and selling of art with financial control is now a tangible reality.

Powered by the cutting-edge SingularityX

This advanced system navigates the intricacies of individual prints, delving into distinct attributes like various colour variations and items that were either purchased or left unsold. MAB100’s technology operates on a Repeat-Sales-Regression (RSR) by aggregating data and analysing multiple print sales from various sources, estimating the fluctuations in the value of sales of the same print.

The sophistication in MAB100’s technology is that it takes into account often ignored aspects, such as the final bid price on unsold lots and the success rates within specific print series. By incorporating these nuanced data points, MAB100 ensures heightened accuracy in determining fair market values.