Investors should consider the extra costs of art maintenance, such as storage in a climate-controlled environment and insurance to protect the investment.SERCAN ERTÜRK/AFP/Getty Images

Sign up for the Globe Advisor weekly newsletter for professional financial advisors on our sign-up page. Get exclusive investment industry news and insights, the week’s top headlines, and what you and your clients need to know. For more from Globe Advisor, visit our homepage.

Investing in artwork is gaining steam among the ultra-high-net-worth set. According to the annual Knight Frank Wealth Report, a worldwide study that reviews trending asset classes among the wealthy, investing in art increased by 29 per cent last year. Art is also ranked as the report’s top investment of passion.

Samantha Sykes, senior investment advisor with Sykes Wealth Management at Raymond James Ltd. in Toronto, says some of her clients hand-pick art collections to house on their walls but also have an eye on those paintings increasing in value, eventually earning them money to put toward their retirements.

“Investors buy art not necessarily because it’s going to perform better, but as a way to diversify their portfolio away from stocks and bonds,” she says.

Ms. Sykes will often direct clients interested in art to the annual Deloitte Art & Finance report, which offers a primer on how they can get started, names sources in the art industry, and details any pertinent information about art as a wealth management strategy.

She says clients who desire to make money from their art collections need to forget about their personal likes and dislikes. She notes that trying to predict emerging art trends is impossible, as artists and genres go in and out of favour, which affects the resale value and return on the investment. So, she suggests clients first network with gallery owners and auction houses of interest, and visit museums and artist studios regularly.

‘Diversifier for patient investors’

Tina Tehranchian, senior wealth advisor at Assante Capital Management Ltd. in Toronto, personally collects art, owning some limited-edition photography and paintings by artists she admires. She prefers to concentrate on buying what she likes and isn’t looking to make money off her pieces.

“If you get enjoyment out of the art you have purchased and it happens to go up in price over time, then you will have the best of both worlds,” she says.

She says art is not priced on a daily basis and does not fluctuate as widely as equity prices, for example.

“But it can be a diversifier for patient investors who want to minimize volatility in their portfolio,” she explains.

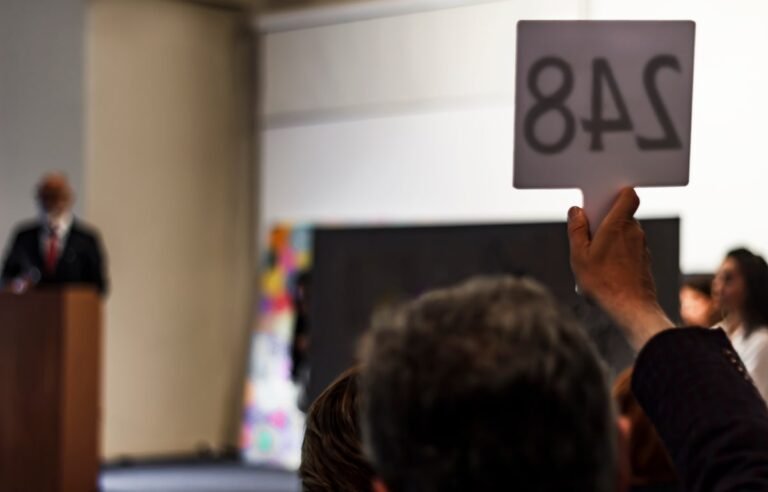

Ms. Tehranchian makes clients aware of the extra costs of art maintenance, such as storage in a climate-controlled environment and insurance to protect the investment. Similar to a house renovation, these costs also need to be factored into the art’s overall return on investment. She emphasizes that clients should have a formal inventory list of all their art and notes that auction houses can assist with both managing the value and the client’s collection. This assists when the client wants to sell part of or their entire collection.

The pros and cons of selling art

Selling art is different from disposing of an investment as it can take time. And collectors need to realize that it can be difficult to find a buyer who wants to pay the collector’s asking price.

Ms. Sykes is currently going through this process with a collector client whose catalogue includes everything from rare paintings, sculptures, stained-glass windows and exclusive recordings from musicians to first-edition literature. While the client invests in art for sheer passion, he still wants his desired price, and plans to use the proceeds to buy more traditional investments toward his retirement, Ms. Sykes says.

Some other clients neglect adding to their investment portfolios in favour of collecting art, which is a misguided decision, Ms. Sykes says. She notes they still need an investment portfolio to derive an income for retirement.

For those clients passionate about art who want an alternative to investing in a collection, some firms such as Masterworks LLC specialize in buying and selling shares in companies that collect art.

And of course, with an art sale comes the tax consequences. Art deemed of value will be treated similarly to any other investment for tax purposes, says Debbie Pearl Weinberg, executive director of tax and estate planning at CIBC Private Wealth in Toronto.

That means any valuable art sold to a buyer will result in a 50 per cent capital gain (or loss) for the proceeds minus the adjusted cost base. Art with proceeds of less than $1,000 won’t result in a capital gain. Donating art may be eligible for the charitable donation tax credit, she adds.

For more from Globe Advisor, visit our homepage.