India’s alternative investment market is rapidly growing, offering higher returns with lower risk than equities. Experts discuss AIFs, private debt funds, and future growth projections.

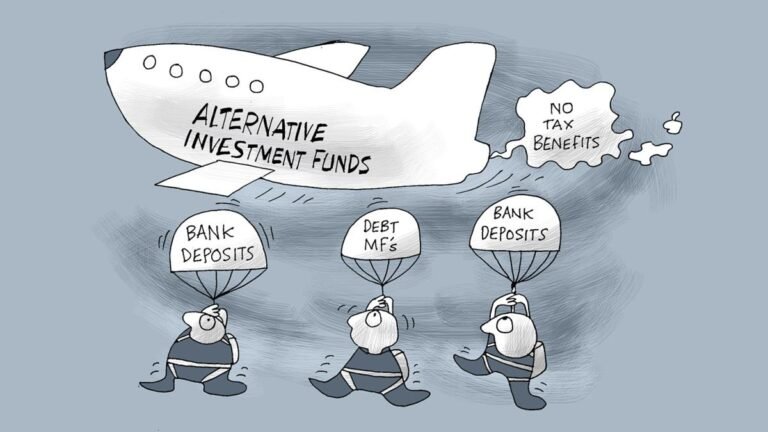

An alternative investment is an asset that does not fit into the categories of conventional equity, income or cash. Venture capital, hedge funds, real estate and commodities are examples of alternative investments.

Speaking at an event organised by Venture Soul Partners and Spur Advisors, President (Finance and Strategy) at Atha Group, Vishal Vithlani, highlighted the sector’s explosive global growth, with the private debt market estimated at USD 2.5 trillion, half of India’s current GDP.

Highlighting the broader growth in this segment, SEBI Whole-Time Member Ananth Narayan said, “Perhaps something that is less noticed is the growth in the Alternate Investment Funds (AIFs), much of which is invested in the unlisted space.”

As of March 2025, commitments into AIFs stood at Rs 13.5 lakh crore, a growth of over Rs 1.7 lakh crore over the previous year, he said..

“Over the past five years, AIF commitments and investments have seen a 30 per cent Compounded Annual Growth Rate, heartening signs for capital formation,” Narayan said.

In India, the segment is still nascent but is projected to grow nearly tenfold from Rs 25,000-40,000 crore in FY23 to Rs 2 lakh crore by 2027, Vithlani said.

“This is a market with significant headroom to expand further. Private debt funds globally have consistently outperformed, and we expect similar trends in India,” Vithlani said.

He noted that the increasing appetite for such funds to finance mergers and acquisitions and buyouts areas where traditional banks remain cautious.

Industry leaders highlighted the growing appeal of alternative debt funds, which are currently offering yields in the range of 16-18 per cent, significantly higher than traditional fixed income avenues, Ashish Gala of Venture Soul Partners said.

Lalit Khetan, Executive Director & CFO of Ramkrishna Forgings, said AIFs, particularly those focused on debt, are maturing in India and offer credible diversification opportunities for family offices and corporates seeking stable cash flows and enhanced portfolio returns.

“AIFs are not entirely risk-free, but prudent allocation can significantly enhance overall returns,” Khetan said, stressing the need for alignment with the investor’s philosophy and a thorough understanding of the fund manager’s approach before committing capital.

Mahendra Kumar Chajjer, CFO of Graphite India, cautioned that while alternative funds are witnessing strong traction amid rising demand from startups and the wider ecosystem, investors must remain mindful of risks, particularly around collateral quality and the fact that past performance is not necessarily indicative of future outcomes.

“Alternative funds will play a tremendous role, but due diligence remains key,” Chajjer said.

“The era of 11-17 per cent returns from government securities and bonds is behind us. But the alternative debt space offers superior returns while being less exposed to market volatility,” said one of the panellists.

Drawing comparisons with global benchmarks, speakers noted that the S&P 500 delivered 8.4 per cent returns over the past two decades, while US private debt funds returned between 8-13 per cent in USD terms over the same period, roughly 1.6 times the index.

With India’s macroeconomic environment marked by robust liquidity and a softening interest rate outlook, experts believe the momentum in private debt markets will only strengthen.

Large institutional investors, including insurance companies, have already begun increasing allocations in this space, they said.

India’s inclusion in global debt indices is also expected to further boost the growth and maturity of this investment class.