The US dollar has been steadily falling all year. For US-based investors, that can give you a nice tailwind – in GLOBAL stocks and funds. Find out what’s driving this dynamic market – and how can you profit – from MoneyShow experts this week.

In this episode of the MoneyShow MoneyMasters Podcast, emerging markets legend Dr. Mark Mobius shares his outlook on global markets, from Asia’s top growth engines to Latin America’s reform stories.

Mobius explains why China is outperforming India, how Japan’s corporate reforms are creating new opportunities, and why Taiwan and Vietnam remain hotspots for tech and manufacturing. He also highlights the role of Brazil and Argentina in the next wave of growth, and why he favors defense ETFs, technology stocks, and gold over crypto.

Plus, he lays out his views on the US dollar, Fed policy, and President Trump’s potential impact on global markets, while addressing geopolitical risks in Europe and Taiwan. Finally, Mobius reveals why stop-loss discipline is essential after the big run in global equities. You won’t want to miss which global markets are Mobius’ favorites for 2025-2026 – and why.

For more investing guidance from top experts, join us at the 2025 MoneyShow/TradersEXPO Orlando, scheduled for Oct. 16-18 at the Omni Orlando Resort at ChampionsGate. Click here to register.

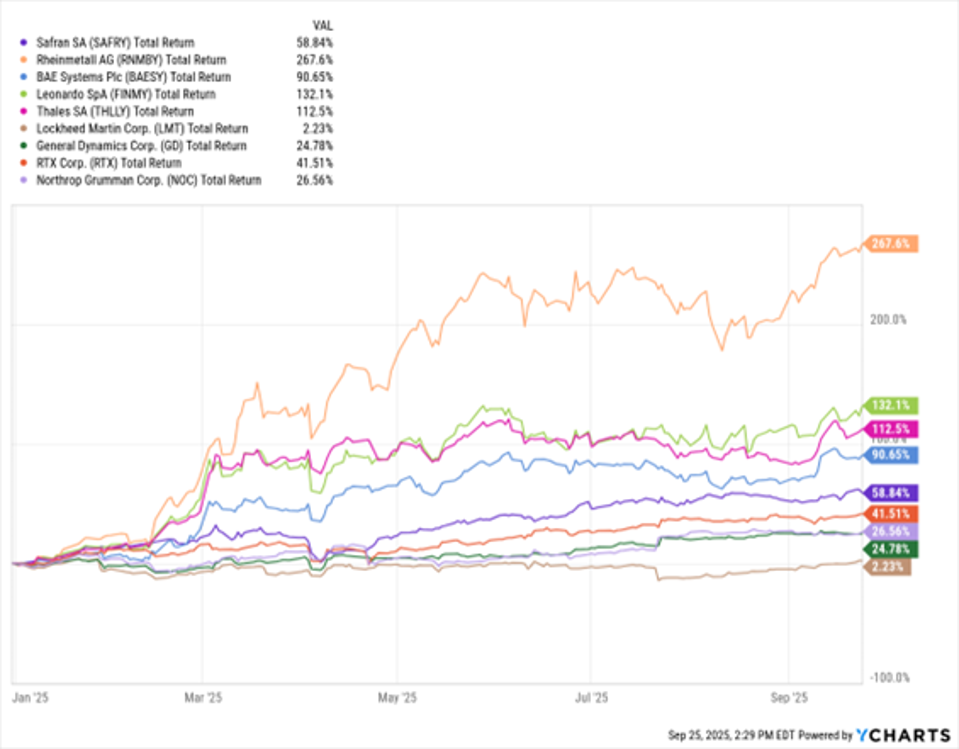

Defense is big business in 2025 thanks to the ratcheting up of geopolitical tensions globally. But US contractors aren’t leading the way when it comes to stock market PERFORMANCE. European contractors are the ones playing offense!

Just look at the MoneyShow Chart of the Day here. It shows that leading US suppliers of everything from missiles and fighter jets to tanks and nuclear submarines are generally performing well. Stocks like General Dynamics Corp. (GD) and RTX Corp. (RTX) are up 24.7% and 41.5%, respectively, so far this year — with only Lockheed Martin Corp. (LMT) truly lagging at plus-2.2%.

When it Comes to Defense, European Contractors are Playing Offense!

YCharts

But get a load of the US-traded shares of top contractors based in the UK, France, Germany, and Italy. Safran SA (SAFRY)? Up 58.8%. BAE Systems Plc (BAESY)? Up 90.6%. Then you have names like Leonardo SpA (FINMY) and Rheinmetall AG (RNMBY) surging 132.1% and 267.6%!

What’s driving the outperformance? President Trump’s approach toward NATO and the defense of Europe differs from the approach of his predecessors. That has encouraged European countries to ramp up their own defense spending plans.

The ongoing Russia-Ukraine war is right at Western Europe’s doorstep, too, adding urgency to those efforts. Plus, recent alleged Russian drone and fighter jet incursions into the airspace of countries like Estonia, Poland, and Denmark are ratcheting tensions up even higher.

Dr. Mark Mobius talked about European defense ETFs as an investment to consider in this week’s MoneyShow MoneyMasters Podcast. The Select STOXX Europe Aerospace & Defense ETF (EUAD) is one you might consider because it owns all the stocks mentioned earlier. We all wish it was a less-dangerous world. But that just isn’t the case. The performance of European defense stocks reflects that.

Federal Reserve Chair Jerome Powell admitted there is little clarity for policy at this time, and this week’s cut may serve as insurance against slower economic growth. Two funds I like are the WisdomTree International SmallCap Dividend ETF (DLS) and WisdomTree Japan SmallCap Dividend ETF (DFJ)..

Powell said risks to the Fed’s dual mandate — subdued inflation and maximum employment — are both currently leaning to the negative. The Fed also indicated two more interest rate cuts were on the table for the last three months of this year.

DLS, DFJ (YTD % Change)

YCharts

Our global stock markets were all higher for the reporting period. From Sept. 11 through Sept. 17, the S&P 500 was up 1%, the Euro Stoxx 50 edged ahead 0.2%, the Nikkei 225 gained another 2.2%, and the Shanghai Composite was up 1.7%.

Our trades in the Japanese market in our Venturesome models three weeks ago have paid off so far, as those stocks have risen due to several supporting factors. DLS invests in dividend-paying, small-cap stocks in the industrialized world outside the US and Canada. DFJ focuses on dividend-paying small cap companies in Japan.

Finally, despite a cooling labor market, the US economy remains resilient. August retail sales — which were above expectations — are a good indication that the consumer remains mostly healthy. Easing by the Fed adds some important support. Maintain your current asset allocations.

Recommended Action: Buy DLS and DFJ.