Imagine navigating a rapidly changing landscape, where technology seems to evolve at the speed of light and the pressure to keep up is relentless — this is the reality for today’s CIO. CIOs face the daunting challenge of driving innovation while managing costs and ensuring practical implementation in a rapidly advancing digital landscape. Future proofing technology investments has become a critical imperative for organizations seeking to maintain their competitive edge. This article presents essential strategies for CIOs to strike the optimal balance among innovation, value, cost, and practicality in tech investments.

Embrace the future-proofing imperative

Eighty-three percent of IT leaders and 88% of LOB leaders expect full-year spending in 2024 to be higher or in line with original 2024 budgets despite inflation and potential recession concerns, according to IDC’s Future Enterprise Resiliency and Spending Survey, Wave 3 (March 2024). This highlights the need for a structured approach to future-proof technology investments in tough economic times.

Future proofing requires balancing new opportunities with optimizing existing solutions. IDC’s Future Enterprise Resiliency and Spending Survey, Wave 4 (April 2024) shows that to fund new investments in generative AI, companies will use a mix of maneuvers, including increasing IT budgets (53%), shifting budgets from digital transformation (30%), from infrastructure modernization (25%), and from application modernization (14%). Future proofing ensures organizations adapt to market changes while maximizing resources.

Master the quartet: Balancing innovation, value, cost, and practicality

A leading bank embarked on a cloud transformation journey in 2021, focusing on innovation by shifting critical operations to the cloud to enable AI-driven services. In terms of value, this move was designed to enhance customer service, mitigate risks, and boost efficiency, showing substantial benefits to stakeholders. To manage costs, the bank selected a hybrid cloud model, optimizing expenses and data control. Addressing practicality, the bank tackled the challenges of data migration and compliance by collaborating with secure cloud providers, creating a detailed strategy for a smooth transition that integrated with existing infrastructure without disrupting operations. This example shows how this balancing act may transcend the trade-offs and create synergies.

Build understanding by asking the right questions

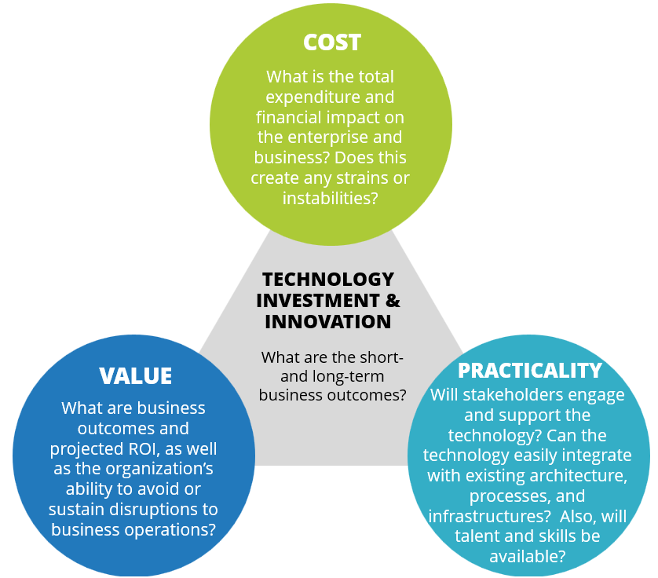

The figure below summarizes the most typical questions that help build the whole picture of the challenge.

IDC, 2024

However, CIOs must delve deeper into each dimension of this quartet.

Fuel competitive advantage through strategic innovation

Innovation — critical for reshaping business models with emerging tech — succeeds by fostering a discipline of pragmatic exploration balanced with real-world business constraints.

Deliver tangible business outcomes: The value proposition

Value represents the benefits that future-proofing activities bring the company, considering current and projected economic health, revenue, and assumed business outcomes. It’s crucial to ensure that these activities align with the organization’s overall technology strategy and accelerate plans rather than conflict with them.

Evaluate true costs: Look beyond the price tag

Cost encompasses not just the initial investment but the total expenditure over the entire technology life cycle. This includes direct costs like purchase price and licensing fees, as well as direct costs such as training, maintenance, and opportunity costs associated with transition periods.

Ensure practicality: Assess real-world feasibility

Practicality refers to the feasibility of effectively and efficiently applying a solution within an operational setting. A practical solution delivers clear value, is user-friendly, integrates easily with existing systems, and does not require disproportionate resources to deploy and maintain.

Balancing innovation with practicality is especially challenging. Having a superior solution doesn’t guarantee business acceptance. Technology adoption depends on timing and maturity. While crucial, innovation should be practical. For example, Netflix’s 2009 $1 million algorithm contest succeeded but the algorithm wasn’t used due to integration issues and business model changes.

CIOs must consider various factors when evaluating the practicality of a technology investment:

- Technical feasibility

- Implementation resources availability

- Staff ability

- Degree of disruption

- Legal, regulatory, and compliance considerations

- Executive sponsorship

Implement these strategies for effective future proofing

- Build cross-functional teams for comprehensive decision-making. Successful future proofing requires collaboration across the organization. CIOs should assemble teams combining IT, business units, and finance expertise to ensure well-rounded decision-making.

- Launch proof-of-concept pilots to minimize risk. Before full-scale deployment, test high-priority use cases through proof-of-concept pilots. This approach allows for learning and adaptation with minimal risk.

- Prioritize flexibility and integration for long-term success. Invest in modular, interoperable solutions that can easily adapt and extend as requirements evolve. This strategy helps avoid technical debt and ensures new technologies can integrate seamlessly with existing systems.

- Execute a phased implementation approach. Start small, learn from initial implementations, and adapt based on results. This phased approach allows for course corrections and minimizes the impact of potential setbacks.

- Continuously monitor and rebalance your technology portfolio. Regularly review your technology portfolio. Track both current and predicted impacts of investments on business outcomes. Be ready to shift priorities to ensure optimal performance.

- Optimize your technology portfolio relentlessly. Often overlooked, trimming the technology portfolio is crucial for maintaining an agile and resilient organization. High-performance organizations continuously seek to reduce system complexity, freeing resources for new initiatives. They can innovate faster, cheaper, and more frequently by simplifying their technology landscape.

- Foster a culture of pragmatic innovation. CIOs must foster a culture that balances innovation with pragmatism. This involves:

- Encouraging measured exploration balanced with business realities

- Experimenting voraciously but validating relentlessly

- Adopting an agile, data-driven operating model

- Ruthlessly optimizing and simplifying the technology portfolio

Act: Future proof your technology investments now

Future proofing technology investments is an ongoing process that requires continuous evaluation and adjustment. By embracing this approach, CIOs can drive sustainable enterprise growth through technology transformation while optimizing value, mitigating risks, and managing costs. As guardians of technology strategy, CIOs must create adaptive, resilient IT portfolios that drive business value.

By institutionalizing future proofing as a core organizational capability, CIOs can ensure their technology investments deliver lasting value, drive innovation, and contribute to the organization’s competitive advantage. It’s time to act: Implement these strategies to position your organization at the forefront of innovation, ready to seize new opportunities.

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the technology markets. IDC is a wholly owned subsidiary of International Data Group (IDG Inc.), the world’s leading tech media, data, and marketing services company. Recently voted Analyst Firm of the Year for the third consecutive time, IDC’s Technology Leader Solutions provide you with expert guidance backed by our industry-leading research and advisory services, robust leadership and development programs, and best-in-class benchmarking and sourcing intelligence data from the industry’s most experienced advisors. Contact us today to learn more.

Learn more about future proofing technology investments in this report from IDC:

IDC PlanScape: Technology Investments Future Proofing to Balance Innovation with Cost, Value, and Practicality.

Dr. Serge Findling is a senior IT and business executive and a CIO, CEO, and C-suite advisor. As an adjunct research advisor and former vice president of research with IDC’s IT Executive Programs (IEP) and the CIO and Technology Professionals Agenda program, Serge focuses on digital transformation leadership for business and technology executives. He also helps organizations thrive with AI, data excellence, and strategic architecture in today’s digital landscape. He is a frequent speaker, presenter, and moderator at industry conferences and provides analysis for multiple media outlets.