Humanoid robots have gone from theory to reality thanks to advances in AI and falls in component costs — and corporate investors are interested.

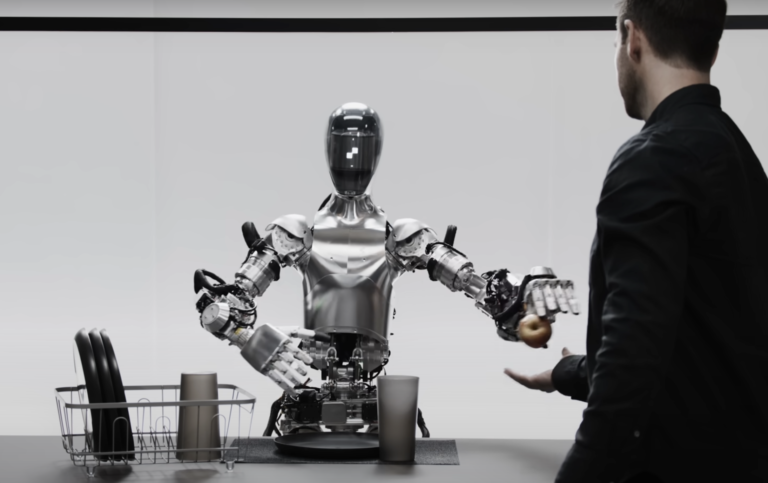

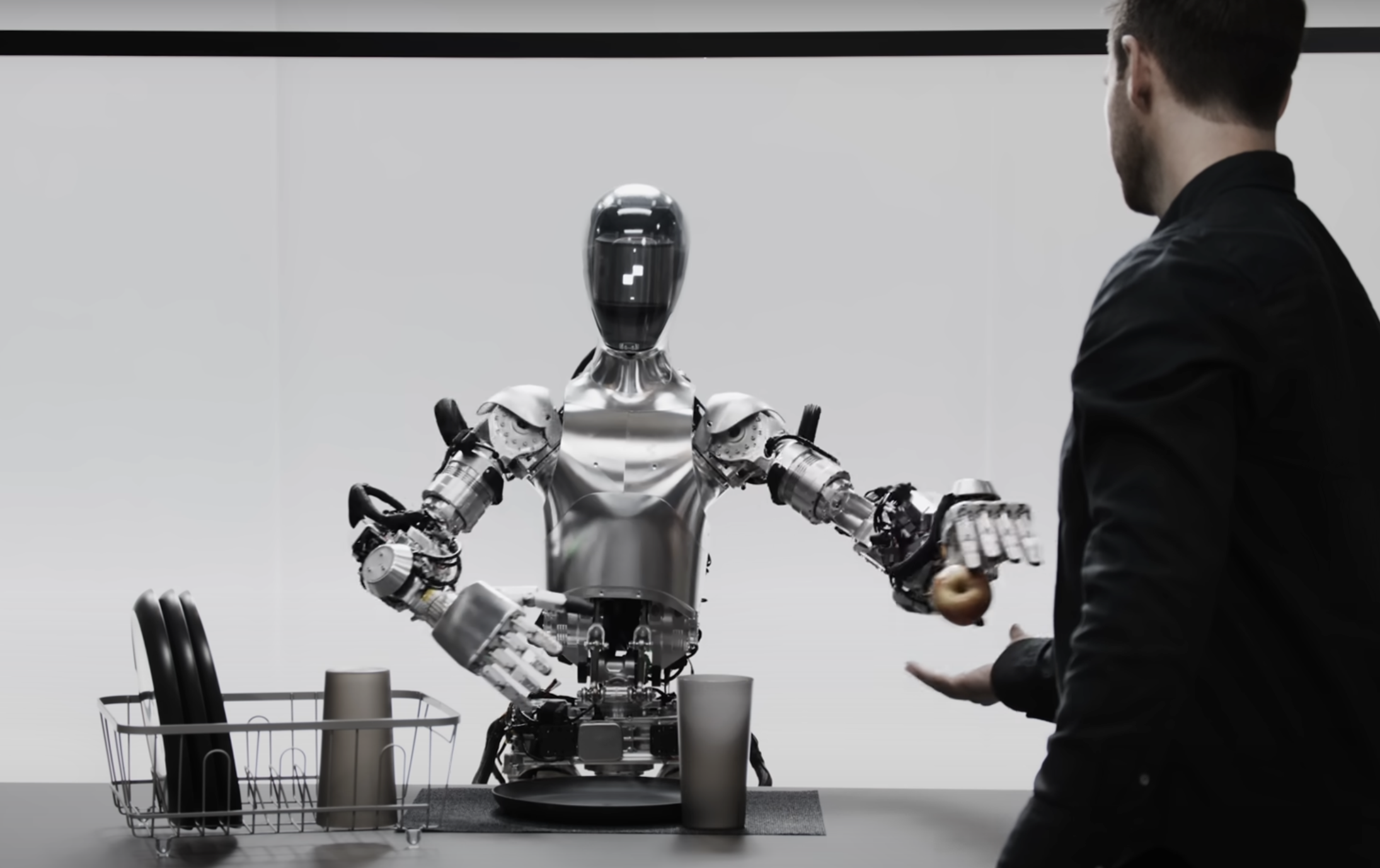

In a memorable moment for AI technology, OpenAI’s ChatGPT stepped out of the virtual world into the form of a humanoid robot made by Figure AI. The video, which went viral a few months back, captured an impressive debut of AI in a human-like form. It gave a human the only edible item in front of it, picked up trash and properly arranged dishes on a drying rack with fluid movements, while maintaining a coherent conversation with the person testing it.

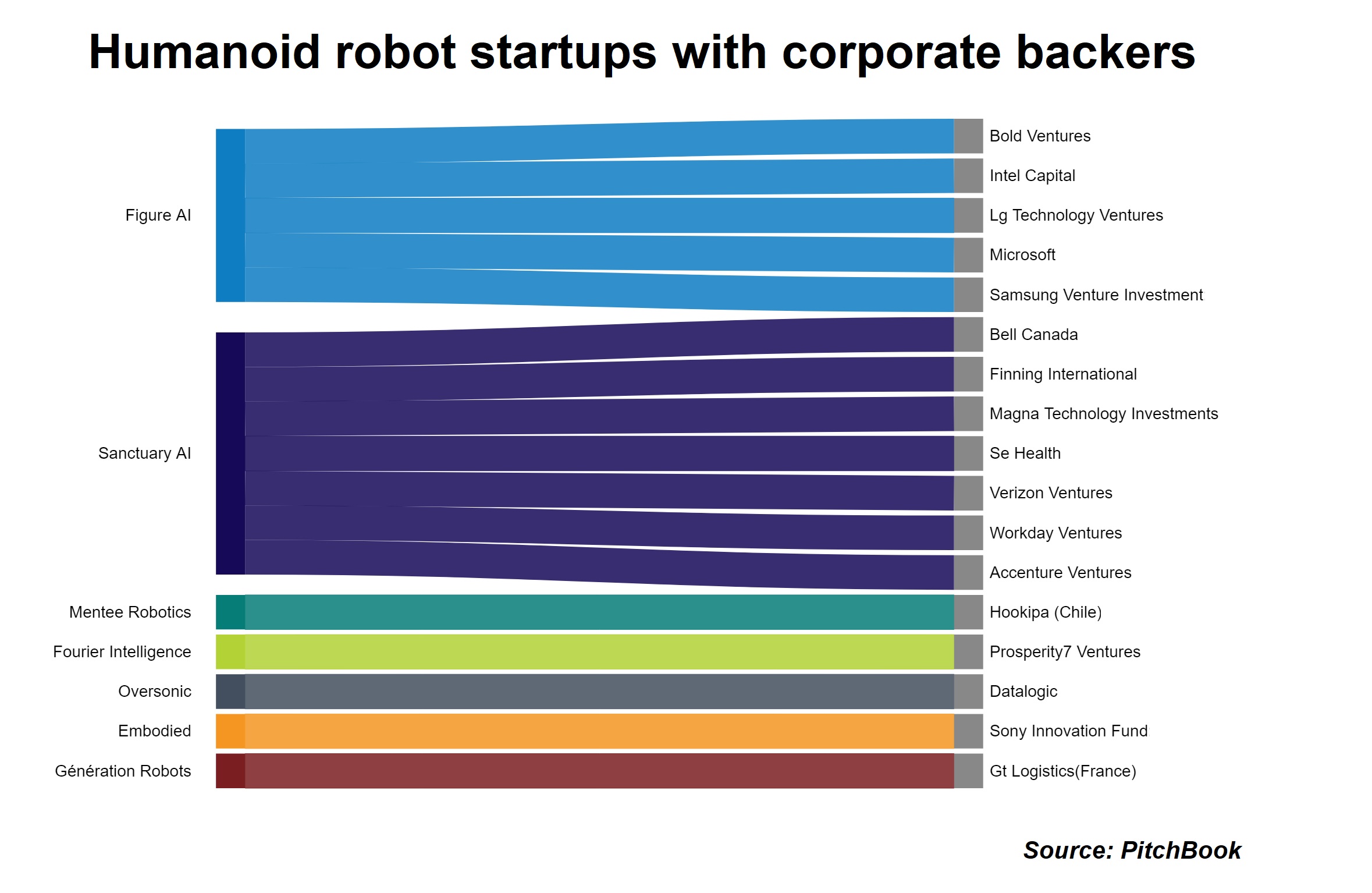

After decades of being theoretical, it seems that humanoid robots have arrived — and they are capturing the imagination of corporate investors. Many corporate investments in this area have clustered around two companies: Figure AI and Sanctuary AI.

California-based Figure AI secured $675m in a series B round in February this year, featuring tech giants LG, Samsung, Microsoft and Nvidia at reported pre-money valuation of $2bn. Other backers of the startup include semiconductor maker Intel (via Intel Capital) and OpenAI. LG and Samsung participated through their LG Technology Ventures Samsung NEXT Ventures units. The substantial capital injection is expected to accelerate Figure AI’s development of advanced humanoid robots.

Sanctuary AI, based in Vancouver, is developing general purpose humanoid robots to offer a cost-effective solution for autonomous labour, addressing the growing challenge of labour shortages as well as workplace safety concerns.

Most recently, Sanctuary AI raised an a round of undisclosed size from Accenture Ventures. Other corporate investors in its cap table include automotive parts maker Magna, telecoms companies Verizon and Bell Canada, software developer Workday, care provider SE Health and industrial equipment maker Finning International.

A handful of other humanoid robot developers have also secured corporate investment, usually from a single company. Saudi Aramco´s Prosperity7 Ventures, for example, has backed Shanghai-based Fourier Intelligence, which is developing a general-purpose robot dubbed GR-1, focused on healthcare and rehabilitation services. Another health and wellness humanoid robot developer, Embodied, has received backing from the Sony Innovation Fund.

Why humanoid robots now?

As with any other tech, costs and scalability are always top of mind for investors. In the case of humanoid robots, the convergence of several factors is favouring their rise.

Recent advances in AI have made it possible to have humanoid robots learn tasks rather than having to programme every single move separately.

Reductions in component costs have also helped. “Costs are always an issue but we have seen prices coming down. For instance, we see that camera modules now cost very little,” says Dong-Su Kim, head of LG Technology Ventures, whose LG Innotek Fund backed Figure AI.

With labour still in short supply in the post-pandemic era, there is a market need for robot substitutes.

Josh Berg, who leads Manga´s corporate venturing unit and has invested in Sanctury AI, believes that the use of humanoid robots makes sense for less desirable jobs: “The labour landscape has been significantly impacted by covid, leading to shortages in certain industries. In this context, humanoid robots can be seen as a potential solution to perform tasks that may be challenging to find willing human workers for. Ultimately, our intention is to embrace humanoid robots to help tackle jobs that are less desirable or difficult to fill.”

Humanoid robots are coming in to fill a very specific niche. We already have many robots — from home appliances to manufacturing assembly lines — that do not mimic the human form. But, says Kim of LG Technology Ventures, there are tasks where a humanoid shape is useful.

Most work spaces are designed for humans, he says, and it can be useful for robots to be similarly formed. “I don’t think humanoid robots will replace existing robots used in manufacturing. They will likely replace humans in some industrial jobs where spaces are designed specifically for humans, for example, warehouses,” he says.

Aside from hazardous tasks in industrial settings, Kim also sees great potential for general-purpose humanoid robots in healthcare: “Another field with big potential is elderly care. People tend to be more comfortable with something human-like,” pointing out that such robots have already been used for some time in Asian countries like South Korea and Japan.

What corporate investors are looking for

Corporate investors backing humanoid robot startups all look for the same basics – a good team and a solid investor base. But there is one specific thing they look for as well.

As humanoid robots startups are raising significant amounts of capital, they fall into the temptation of trying to do everything by themselves. “You need to have willingness on part of the founders to work and partner with others who have know-how, including corporations like LG. Some companies could be, at times, overly protective which makes them hard to work with. I have seen this in varying degrees,” says Kim of LG Technology Ventures.

Though some companies like Tesla have been successful in making (nearly) all parts themselves, in general it is more efficient to partner with a whole ecosystem.

“Just because you have raised enough money to be able to do it in-house, it doesn’t necessarily mean that you should,” says Berg of Magna. Sanctuary AI is case in point, he says: “Sanctuary AI takes a similar approach to an OEM, recognising the benefits of outsourcing certain components or services.”

“They understand that even though they have the capability to produce the humanoid robots themselves, it may be more cost-effective to work with a supplier that can also produce at scale. This mindset requires organisational and technical understanding, as well as humility, that sometimes you have to rely on expertise of others around you,” he says.