The stock market is making a comeback after taking a serious tumble earlier this month, but many investors are still feeling nervous about what’s coming.

According to the most recent weekly survey from the American Association of Individual Investors, around 29% of U.S. investors are feeling pessimistic about the market’s future over the next six months. That’s down from 38% the week prior but still up from 25% in late July.

For some investors, all these ups and downs make it tempting to get out of the market altogether in case prices fall again. While that can sound like a good idea in theory, selling your investments right now is one of the riskiest moves you could make. Here’s why.

Holding your investments is key to long-term success

Trying to time the market and buy or sell stocks at just the right moment may seem like a smart strategy on the surface. If you can sell your investments when prices peak, you can make a hefty profit while avoiding the ugly aftermath of a downturn.

However, effectively timing the market is next to impossible, as nobody knows what stock prices will do in the short term. Case in point: Many investors were not expecting the market to bounce back as quickly as it has over the last week. If you try to time the market and your timing is off, it could cost you.

For example, say you decided to sell your stocks in February 2022. At that point, the market had already been falling for about a month and still had quite a bit further to fall. Even its rebound was shaky, as it experienced some significant ups and downs throughout most of 2023.

However, between February 2022 and today, the S&P 500 has still soared by nearly 22%. By selling your investments in early 2022, you’d have missed out on some serious potential earnings.

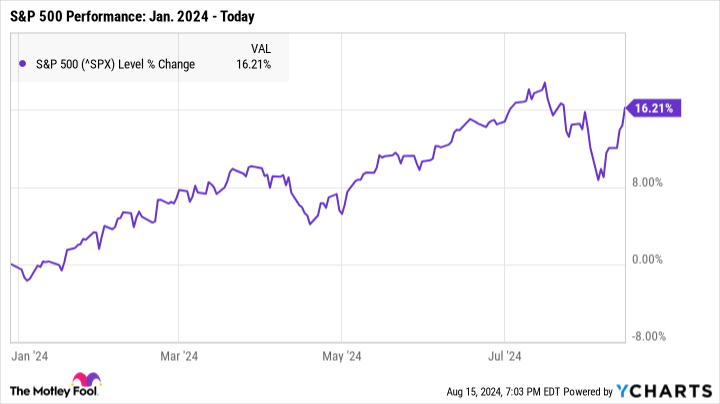

Even if you’d reinvested later, it could still be costly. Say, for example, you decided to reinvest in January 2024. The market was surging by then, with several more months of gains on the horizon.

That may have seemed like a much safer time to invest, as the worst of the rollercoaster was already behind us. Yet, between then and now, the S&P 500 has only earned total returns of around 16%.

While it can seem counterintuitive, staying in the market rather than selling your stocks can actually keep your money much safer over time. Your portfolio may take a hit in the short term, but you won’t need to worry about selling at the wrong moment and missing out on potential gains.

Also, selling your stocks after prices have dropped is one of the most common ways to lose money in the market. If you simply hold your investments until the market recovers, your portfolio should rebound, and your stocks will regain their value. But if you sell your stocks for less than you paid for them, you’ll lock in those losses.

The right stocks will protect your portfolio

The market’s short-term future may be uncertain, but if you have a portfolio full of robust stocks, it’s extremely likely that your investments will recover no matter what’s on the horizon.

Strong stocks have a far better chance of surviving tough economic times. That doesn’t mean these stocks are immune to volatility, as most will still drop in price during a downturn — perhaps substantially. But a company with healthy foundations is much more likely to bounce back.

Right now can actually be a fantastic time to consider buying more. If stock prices plummet once again, that can be a smart opportunity to load up on quality stocks at a fraction of the cost. Then, when the market inevitably rebounds, you could see significant gains.

Feeling nervous about market volatility is normal, and staying invested can be tough. But by sticking it out and holding your stocks for the long haul, you can maximize your earnings while protecting your investments as much as possible.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,001!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,511!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $357,669!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of August 12, 2024

The Motley Fool has a disclosure policy.

S&P 500 Sell-Off: This Is One of the Worst Investing Moves You Could Make Right Now was originally published by The Motley Fool