Black Monday, 5 August, was a rude awakening for investors as a confluence of risk-off factors roiled the markets.

The recovery has been remarkable. One thing the sell-off did was to expose investors’ risk comfort.

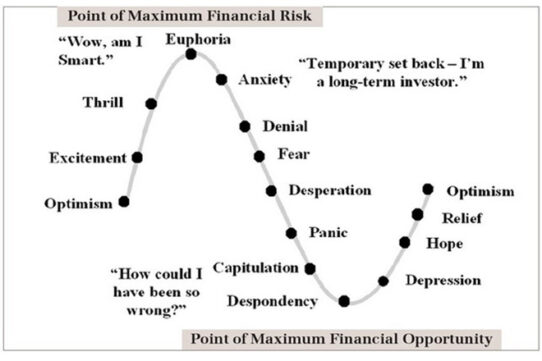

It reminds me of Barry Ritholtz, whose graphic about investor sentiment is so very true. Often, we as investors reach the point where we think, “Wow, am I smart”. We have FOMO (fear of missing out), syndrome, chase tech stocks and get caught up in the hype about AI. Ah yes, euphoria.

Source: Barry Ritholtz, The Big Picture

Although the recent sell-off caused some anxiety, the typical comment from investors and financial advisers was it was a “temporary set-back – I’m a long-term investor”. Fortunately, the Black Monday sell-off was short-lived and the markets, specifically growth stocks and tech stocks, recovered most of their losses. However, nobody knows when, where, or how the euphoria will end, but the signs are we are near Ritholtz’s point of maximum financial risk.

Sometimes it is appropriate to take on higher risks, and the pay-off could be massively rewarding. Yes, risk higher than your risk budget provides for.

Check your sentiment

As disciplined investor, you should regularly check your sentiment towards individual assets and sub-asset classes to get a feel whether the composition of your aggregate investment portfolio is still within your risk budget. If you are uncomfortable and red lights flash, take appropriate action by rebalancing the risks and therefore your investment portfolio so that it falls in line with your risk budget or comfort zone.

The sticking point for any investor or adviser is to let go of investments that shot the lights out. Many justify holding onto an investment to defer capital gains tax, only to see the price drop sharply afterwards. Perhaps you have made enough profit to pay tax.

But how do I reduce risk and stay fully invested in stocks?

Any stock portfolio consists of growth and value components. For illustrative purposes, I used US growth stocks, measured by the Russell 1000 Growth Index ETF, and US value stocks, measured by the Russell 1000 Value Index ETF.

I think the margin of earnings disappointment in growth stocks is significantly higher than in value stocks.

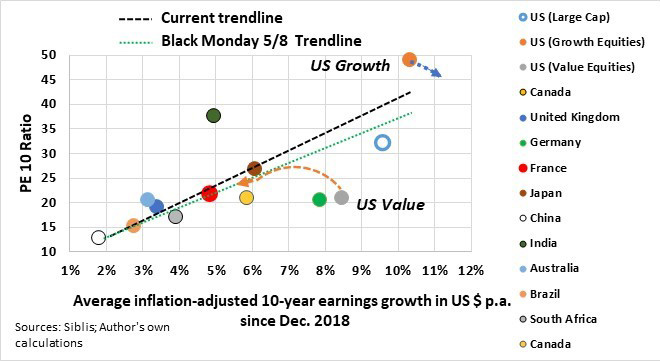

After the global stock market’s resurgence after the Black Monday crash, it appears that the current PE10 of US growth stocks is pricing in inflation-adjusted earnings growth of more than 10% a year over the next 10 years. Considering the average inflation-adjusted 10-year earnings growth in US dollars of selected global equity markets since December 2018, it appears that US value stocks are pricing in comparative earnings growth of about 5% a year.

Optimum stock portfolio

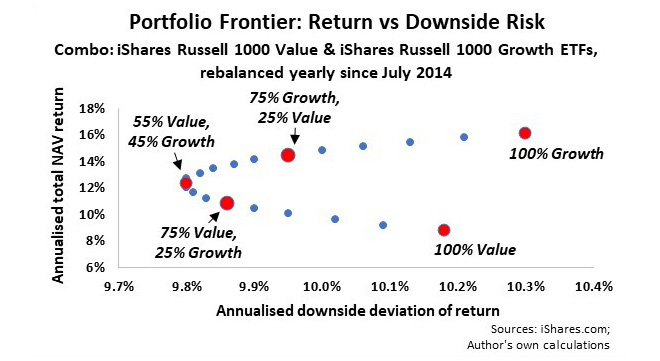

My calculations of the optimum structure of a portfolio consisting of a combination of US value and growth stocks are based on the returns and downside risk of iShares Russell 1000 Value and Russell 1000 Growth ETFs, where downside risk is the downside deviation of returns: therefore, only focusing on bad volatility (Investopedia) over the past 10 years.

The annualised total return of growth was about 16% over the past 10 years, with an annualised average downside risk of 10.3%. The average 12-month momentum of growth since the momentum turned positive in April last year was about 29%, roughly 1.8 times the total annualised return. Furthermore, from my calculations, it is evident the 12-month momentum has peaked, and investors are therefore facing diminishing 12-month returns in due course.

In comparison, the annualised total return of value was about 9% over the past 10 years, with an annualised average downside risk of 10.2%. The average 12-month momentum of growth since the momentum turned positive in April last year was about 10%, roughly equal to the total annualised return. The 12-month momentum has peaked, and investors are also therefore facing diminishing 12-month returns in due course but less so than with growth.

Considering the possibility of a higher margin of earnings disappointments in growth stocks relative to value stocks and the significant gap in valuation metrics between the two asset classes, I am inclined to add value stocks to my investment portfolio at the expense of growth stocks.

My calculated optimum portfolio frontier points to a ratio of 55% value and 45% growth stocks, where I am likely to get the highest return given a level of risk. The reward-risk equation can be enhanced by adding defensive high-yield consumer stocks, such as tobacco, and steering clear of so-called “value opportunities”, such as the ex-growth Mainland China.

That is not to say I won’t lose money with this risk-reducing strategy, but my investment stress level, or comfort, is much better than it would be if I held 100% growth stocks. It could enable me to capitalise on the next “point of maximum financial opportunity” (Ritholtz).

Yes, “Wow, am I smart” could be the most expensive phrase in managing investments.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.