This is the first of a two-part guide to art investment presented by Artelier, a UK-based art consultancy that specializes in curating art for luxury residences, yachts, aircraft, hotels and corporations.

Art holds a unique place in the world of investments. Financially, art is an excellent way to diversify your portfolio—a practice that can help protect against downturns in any particular sector. Art is also one of few asset classes that consistently increases in value over time, has a tangible value and typically isn’t subject to the same market volatilities—making it a stable investment. The UBS Global Art Market 2023 report showed how the market grew strongly in 2021. Despite the far-reaching impacts of the pandemic on global markets, aggregate sales of art were estimated at $65.9 billion, representing a 31 percent increase on the previous year. Additionally, the art market itself is diverse, offering opportunities for both high-end and speculative investments.

The attractive aspect of art investment, however, is that art holds a cultural and personal value. Collecting important work contributes to the passage of art history. Collectors are positioned among museums and institutions for key acquisitions, allowing them to impact the cultural landscape at national and international levels. Building a personal collection is also emotionally fulfilling in a way few other assets provide. Many choose never to sell, preferring to leave their collection to institutions as part of their legacy, or to be inherited by future generations. Most art investors are therefore truly committed to learning and engaging with art—if you collect what you are passionate about, there is always a return on investment.

Understanding the Art Market

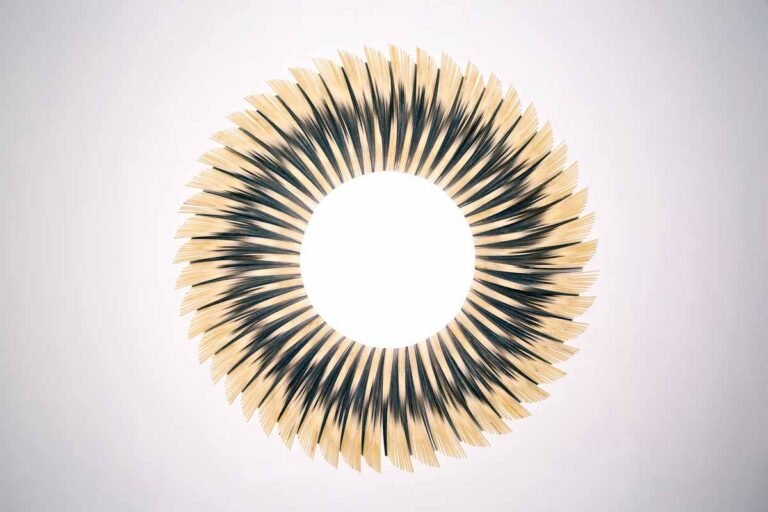

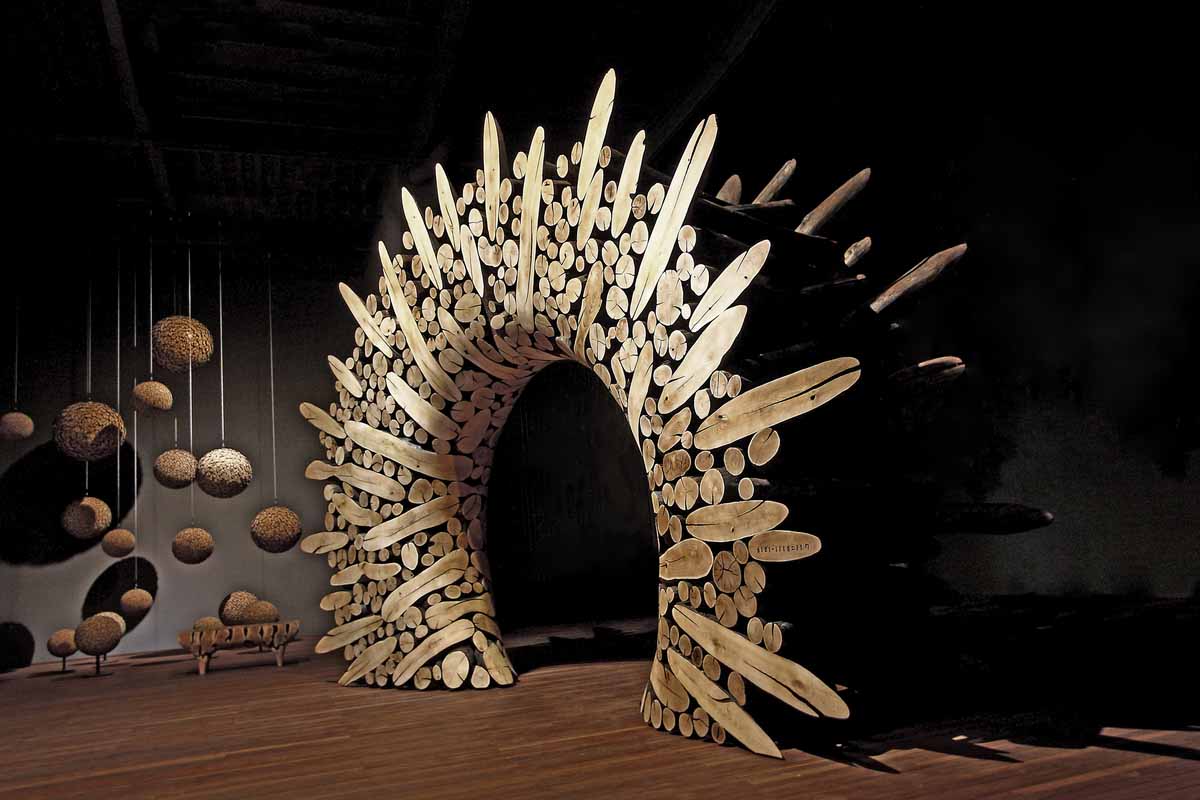

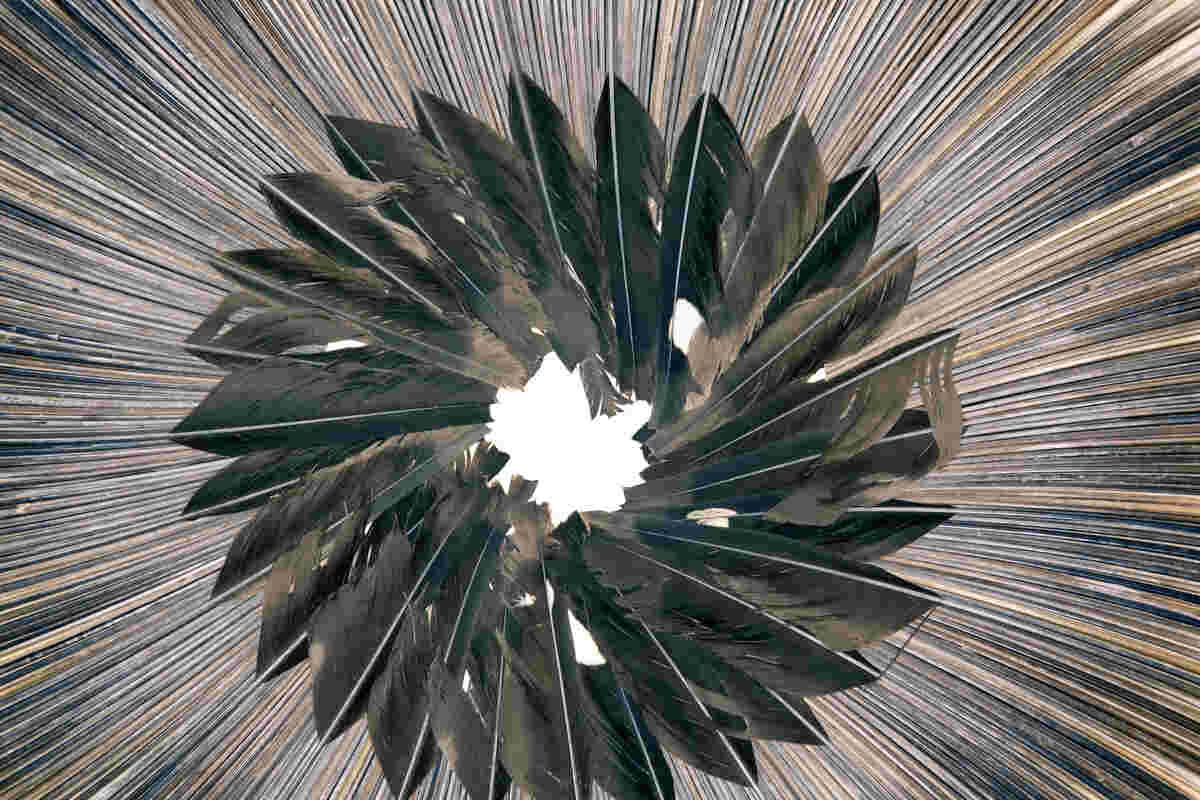

Saatchi by Christoph Schrein

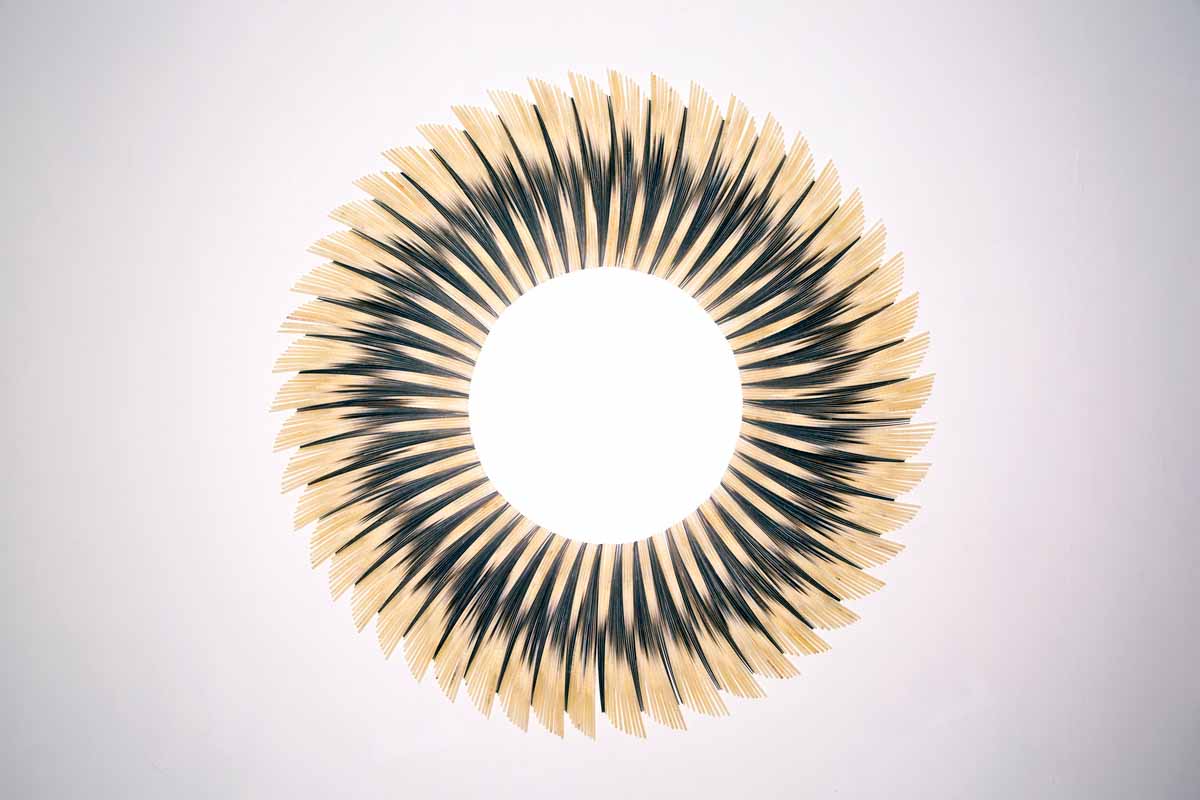

Piece by Lee Jae Hyo

If you’re ready to invest, the place to start is by understanding how the art market functions through a primary and secondary market. The former refers to the initial sale of the artwork by the artist or their representative. Any sales made afterwards by the likes of dealers and auction houses are secondary market sales. What does this mean for aspiring collectors? The primary market is spearheaded by galleries and is essential for artists to gain exposure and become established; buying on the primary market typically benefits from more stable and lower prices. The secondary market, however, gives the opportunity to buy rarer pieces and those by historic artists, although caution needs to be applied to not pay an inflated price beyond typical market value. Works sold on the secondary market are more sensitive to market demand and recent developments in the artist’s career—this is where record-breaking auction prices take place, and where publicity can have a huge impact on the price achieved. Each channel has its own benefits, and, ultimately, they’re interdependent in their influence on long-term growth. Here are the top considerations to keep in mind:

Buying from artists directly

Going to the source allows the collector to interact with the artist and learn about their creative process. Purchasing directly from the artist also eliminates the gallery’s commission, making the work more affordable. Beneficially, there’s no question of authenticity, which makes the acquisition more valuable long-term. However, buying from the artist may lack the reassurance of specialist appraisal or market forces.

Traditional art galleries

Art galleries represent artists and sell their works on their behalf, ensuring a fair price for the artwork and professional management of the sale. Galleries work to publicize the artists they represent, increasing the artist’s market value. However, buying from galleries can be exclusive, and many galleries prefer to sell to reputable collectors or long-standing clients.

Art fairs

Art fairs bridge primary and secondary markets, as exhibitors may be selling new work or re-selling. As galleries worldwide exhibit at the likes of Frieze or Art Basel, it provides an unparalleled opportunity to discover new galleries or artists, and collectors can see the work first-hand rather than online. However, it can be tempting to make impulsive choices, so inquiring with the gallery and then seeking independent advice from a specialist is advisable.

Dealers

Dealers are knowledgeable in their field and are often highly specialized, allowing access to rare pieces and niche interests. They provide authentication documents, condition reports with details of any restoration, and documentation of the artwork’s provenance. However, finding a reputable dealer is paramount. Ensure they are members of professional organizations such as the Art Dealers Association of America or the British Antique Dealers Association to give confidence that they have a proven track record of offering high-quality, authentic works of art.

Auctions

Auctions are highly accessible since sales and lots are publicized, giving wider access to collectable modern masters. Auction houses such as Sotheby’s and Christie’s ensure accurate provenance, and extensive condition reports and forensic analysis can authenticate and date a work. Prices, however, can skyrocket beyond even experts’ expectations—which is positive for an artist’s overall reputation and market value, but can limit your returns if buying for investment. Setting a reasonable limit on bids is crucial for buyers seeking to re-sell at a later date.

Off Market Deals

Many art pieces are sold privately, away from the public eye, and these exclusive sales can offer unique and unexpected finds by world-renowned artists. Gaining access to this network depends on your own reputation as a collector and relies heavily on word of mouth through connections. Working with art advisors can help gain entry to this elusive market.

Developing an Art Strategy

Strategy is paramount when beginning to invest in art. David Knowles, the director of Artelier, an art advisory that specializes in investment, gives guidance for investment collectors: “Investing in art requires a long-term view, as the market can be unpredictable and not transparent. It is generally advisable to hold onto artworks for over five years before re-selling, giving the artist’s career and reputation time to grow, which increases the return on investments. A diverse art portfolio is the best complement to time. Collectors need to consider diversifying their art investments among various types of works that complement one another in terms of initial cost, risk/return profiles and capital preservation characteristics.”

A sound approach is to buy at different price points from varied artists who are at different stages in their career. Advisors consider four key categories of artists when choosing investments: emerging artists, established artists, contemporary blue-chip artists and modern masters. Emerging artists are defined as artists who are beginning to receive recognition for their work, while established artists have been active in their field for at least 10 years and have a solid track record of exhibitions and sales. Contemporary blue-chip artists are those whose work has been consistently sought after by collectors and commands high prices in the market, while modern masters are historical artists from the 19th and 20th centuries whose distinguished oeuvre has confirmed their significant role within art history. Each category comes with different benefits and risks, and who to choose depends on your identity as a collector.

Investing in a modern master like Pablo Picasso or a blue-chip artist like Yayoi Kusama is reserved for the most exclusive collectors due to the high entry price point. Yet, since their work’s value is well-established in the secondary market, they are considered stable and reliable. If budget is a concern, investing in artworks by blue-chip artists is still possible through limited-edition prints and multiples.

Established artists are attractive for investment as they are more affordable than blue-chip, but the trajectory of their careers is clearly defined compared to emerging artists, and therefore easier to predict. However, an existing active market for their work can present a barrier to access compared to emerging art, as there may be more competition and higher prices.

Meanwhile, investing in an emerging artist often means direct access to their primary market and a significantly lower price. They therefore have a great potential to yield high ROI, but with fewer guarantees. Looking at the trajectory of Banksy’s sales at auction since 2000, for example, both the number sold, and the prices achieved, saw an exponential growth that worked in the favor of early investors. The challenge is identifying similar opportunities in the current art market, while being realistic that many emerging artists will not have such dramatic increases in demand. If you are not as concerned with returns, however, emerging artists often present fantastic value for money, can be highly innovative and bring something original to your collection, and are most likely to be open to bespoke commissions.

Receiving specialist advice on rising names, market forces and fair valuation of particular artworks gives buyers greater confidence. It is also essential to assess your personal, financial and social goals, and integrate them with which artists to buy, and from whom. Artelier have introduced a new concept to the world of art investment, the role of a personal “Art Concierge,” a specialist who develops bespoke strategies based on independent advice, acts as a representative with galleries and dealers to confidently acquire pieces and provides turnkey installation and curation services as part of collections management. Each collector receives tailored support, whether acquiring a standout piece, commissioning new talent, looking for portfolio appraisals or ongoing management of existing collections.

In the next issue of Jetset, we will introduce Part 2 of this guide, where we look more closely at a step-by-by criteria one can apply to investing in the art market. We will also look at collections management—how to keep your investment safe while maximizing enjoyment.